Newsletter 105: Pitching Investors in Southeast Asia: Practical Advice for First-Time Founders

A bonus edition on best practices when pitching investors in Southeast Asia.

Since relocating to Southeast Asia, I have been working towards supporting the local startup ecosystem in any way I can. Over time, I got to know many regional accelerators and invested my evenings and weekends in supporting their portfolios. One such cooperation is my role as an Entrepreneur in Residence at BigBang Angels (a VC and accelerator in South Korea). Through my work with BigBang, I have had the privilege of supporting over 100 founders with their fundraising efforts. Most of those founders were first-time entrepreneurs seeking early-stage capital. Through a series of workshops and 1:1 mentoring sessions, I have seen firsthand the challenges they face when navigating the fundraising process. Whether crafting a compelling pitch, designing an easy-to-understand deck, identifying the right investors, or navigating the legal and financial considerations of fundraising, first-time founders face various obstacles as they work to bring their vision to life.

In this article, I want to share what I have learned so far. Common mistakes alongside offering tips for first-time entrepreneurs seeking to raise capital in Southeast Asia (SEA).

Pitching Investors in Southeast Asia: Common Mistakes and How to Avoid Them

It's easy to overlook that investors actively seek opportunities to invest their capital. However, the challenge arises because investors meet with numerous entrepreneurs constantly, whereas founders only have one chance to impress each investor. Therefore, as founders, our task is simple:

First, clearly articulate what you are building and why.

Second, derisk the investor’s decision.

To accomplish this, founders create a "pitch deck," a presentation about their business. Unfortunately, many first-time founders struggle to design compelling pitch decks. As a result, a wealth of advice is available online on developing effective pitch decks, but not much has been written about the process in Southeast Asia and Korea. So my objective is to highlight common pitfalls in this region.

1. Cluttering your slides

Most early-stage founders often make their decks way too complicated and lengthy. In my view, that’s driven by their goal to persuade potential investors to fund their company.

The founders may feel that including more details and data will demonstrate the thoroughness of their research and the business idea's potential. However, this can have the opposite effect. Making the deck overwhelming and challenging to digest. This is especially true in highly technical fields such as life science, biotech, and hardware which require deep domain expertise.

In my experience, the founder must prioritize highlighting the most essential information. Then, work towards presenting it clearly and concisely.

As a rule of thumb, communicate only one idea per slide. This will make it easier for investors to understand your startup and whether it aligns with their investment thesis.

Here you go a few tips on what to avoid:

Overloading the slides with text.

Adding too much branding on each slide.

Including excessive explanations and caveats.

Using unnecessary animations and transitions.

Inserting photos without proper titles or captions.

Usin,g words you wouldn't use in everyday conversation.

Including memes that might distract from the core message.

Using subtle or accidental humor that may not resonate with the audience.

If you feel that certain information has not been shared in your pitch deck yet is somehow important, add it to the appendix.1

2. Not highlighting indirect and direct competitors

Many founders do not include competitors in their decks for various reasons.

One reason might be that they are unaware of their competitors or may not consider certain companies a threat.

Another reason may be that they do not want to draw attention to the competition. Perhaps, the founder feels that it could make their business appear less unique and thus potentially undermine their positioning in the market.

However, it is essential to include information about competitors, as investors will likely want to know about the competitive landscape and how the company plans to differentiate itself. By having information about competitors, founders can demonstrate their understanding of the market and, thus, the strategy for competing within it. This can help to build confidence in the business and its potential for success.

Additionally, some investors would be actually happy to see recently funded competitors. Therefore, such information may serve you well because it would validate the opportunity you are going after.

In fact, Southeast Asia has a lot more appetite for proven business models in comparison to many other tech ecosystems.

A word of caution, though, when presenting such updates, make sure to highlight how you are differentiating.

Throughout my career, I have never encountered a company with no competitors. Every organization competes in some way to solve a problem or address a specific need. Even if your company is the only one offering a particular solution, it still competes with alternative solutions to win over customers. Read my essay on alternatives to dive deep into this topic.

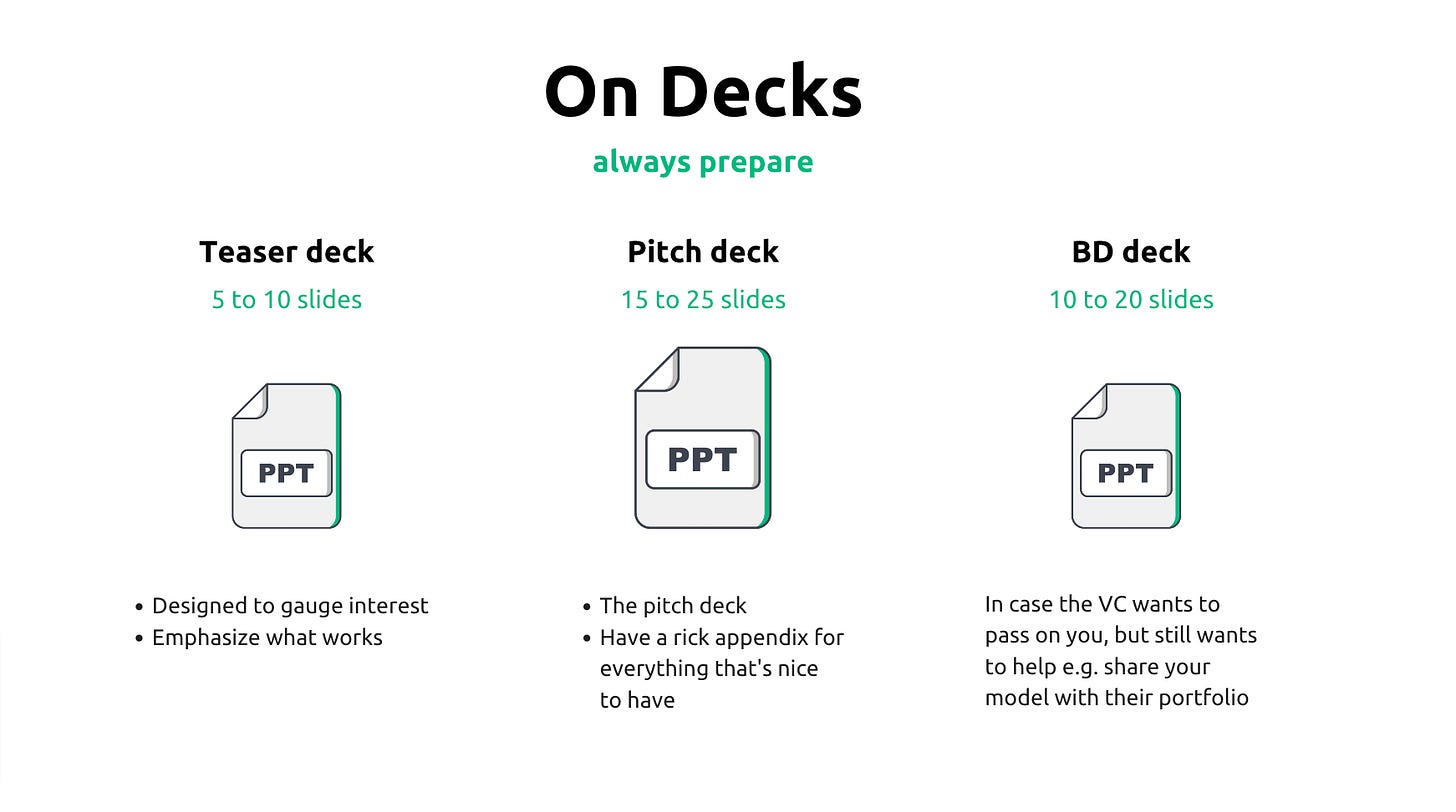

3. Building only one (lengthy) deck

Most founders build one lengthy deck and then drop absolutely everything in there. Instead of doing that, I recommend you build three decks:

Teaser deck

Pitch decks

Business Development / Partnerships deck

Developing three decks when raising capital can be an effective strategy because it allows founders to tailor their pitch to different audiences and stages of the fundraising process.

A teaser deck, also known as an executive summary, is a shortened version of the pitch deck. This deck introduces the business and its key points to potential investors. It is typically sent to investors before a meeting to give them a general overview of the company and to gauge their interest. A teaser deck should be brief and focused, highlighting the most critical information about the business. The core objective here is to get a meeting with your target investors.

The pitch deck is a more extended version of the teaser and is used to present the business in more detail to potential investors. It includes information about the company's product or service, target market, competitive landscape, financial projections, and team. The pitch deck should be well-organized and visually appealing, with clear and concise language.

Last but not least, a business development/partnerships deck is a presentation used to outline the company's plans for growth and expansion. It may include information about the company's go-to-market strategy, products/services, current traction, and significant partnerships. This deck is typically used under one of the following scenarios:

The VC cannot invest in your business but still wants to support you by introducing you to relevant portfolio companies or other people in their network.

When you meet a potential partner or client during your fundraising efforts.

4. Not specifying what you are looking for

I have seen so many decks lacking a clear ask from the investor. That’s especially true for early-stage startups still figuring out their financial needs. However, not specifying what you are looking for can be a mistake because you want investors to leave the conversation with no remaining questions about your startup.

A clear understanding of what you are looking for helps demonstrate how you think about the short- and long-term future. For example, how do you plan to allocate resources given today’s market conditions? What is your depth of thinking and preparation regarding this fundraise?

Including a slide in the pitch deck called "use of proceeds" is a helpful way for founders to specify what they are looking for and how they plan to use the investment. This slide should outline the specific areas where the funding will be used, such as product development, marketing, or hiring. But, again, be as specific as possible.

Last, prepare to back the numbers with arguments of why a particular part of the business will consume more than others.

“Tell the investor how much money you need, and what it gets you. If you can lay out where you’ll be inside of a year, which should make you Series A ready, that’s powerful.”

Aaron Harris, YCombinator

5. Adding unnecessary slides

That’s perhaps the most direct advice I will offer today. Do not include slides about your organizational chart and history as an early-stage startup.

First, investors are typically more interested in the business and its growth potential than the company's specific org. structure. While founders need to be able to articulate their roles and responsibilities, an organizational chart may not be the most effective way to do this. Instead, it may be more beneficial to focus on the team's key functions and responsibilities and highlight a proven history of success.

Second, an organizational chart can be too detailed and unnecessary for an early-stage presentation. Investors may not need to know about every single person on the team or their specific roles to understand the business. By including too much detail about the organizational chart, founders may risk overwhelming investors and taking focus away from the more important aspects of the company.

I have noticed that South Korean startups love to add an organizational chart, while Japanese founders tend to have a slide about the company’s history. That probably stems from the high degree of power distance in South Korean culture and the past orientation of Japanese society. Yet, the harsh reality is that such slides bring zero value when your team size is 1-10 pax.

6. Not following a coherent storyline

This is particularly evident in biotech and hardware verticals. Highly technical founders tend to over-fixate on the complex products they build without consideration for the overall narrative. That results in presentations that feel messy and difficult to follow. The founder is bouncing back between different topics without a consistent flow.

To avoid this problem, it can be helpful for founders to use guidelines created by companies like Sequoia Capital and YCombinator, which provide recommendations for developing effective pitch decks.

These guidelines can help founders prepare a well-balanced narrative, shedding equal light on all major topics.

Some tips for creating a clear and compelling story in a pitch deck include:

First, identify the main points you want to convey and order them logically.

Use clear and concise language to explain your ideas and avoid jargon, abbreviations, or technical terms that may confuse investors.

Use visual aids like charts and graphs to help illustrate your complex information and make the deck more engaging.

Practice your pitch and rehearse the delivery to ensure it flows smoothly and makes sense to the audience.

Remember, no one would invest if no one gets what you are building.

7. Not investing in great design

Simple slides = Simple ideas = Easy to understand.

Clean design and attention to grammar are essential in fundraising decks because they can help to create a professional and polished presentation that reflects well on the company. In addition, a well-designed deck can help to build trust and confidence in the business and its potential for success.

Since you only have a handful of ideas you want to get across, invest time in building a deck that makes you proud. Always remember that investors are pretty easily distracted because they are impatient. If you do not drive your point immediately, they might lose focus and start checking their phone.

Also, avoid grammar mistakes and inconsistent formatting at all costs. Such silly mistakes make you appear sloppy and unprofessional.

Investors do not make investment decisions based on how your deck looks and feels, BUT if you cannot build a great deck, how can they expect you to be capable of building a great product?

To avoid these mistakes, it is important to proofread your decks carefully, to ensure all the information is accurate and error-free. It is also helpful to use a clean and consistent design that is easy on the eyes and helps to organize the information logically. Here you go a few great resources that can help:

Having said all that, consider this quote by Naval that illustrates well how pitching is secondary to building a great business.

Pitching skills are overrated.

Find the right co-founder.

Attack the right market.

Craft the right product.

Investors will pitch you.

Friends Across SEA: Money Abroad

Get smarter with money 💰 You know at The Ascending World we believe strongly in being well informed. Well, our friends are publishing a weekly newsletter Money Abroad, which is an excellent resource for expat tech professionals to learn about building wealth while living abroad.

Money Abroad shares fresh tips about money & wealth that you can learn in under 10 minutes. Plus, it’s free. Sign up here!

Bonus: Fundraising resources

Active investors

OpenVC — a platform that allows tech founders to connect with investors.

Finta — fundraising software.

Founder Suite — another fundraising software with an active database of investors.

The startup fundraising playbook by Docsend

An appendix is a document section containing additional or supporting information that is not essential to the main text but may be helpful for reference.