Newsletter 104: Successful Business Models for Tech Startups in Southeast Asia: A Look at What's Working

The key levers behind successful business models in Southeast Asia.

My fascination with what leads to the success of startups across various regions dates back to my Master's studies in Denmark. During that time, I was lucky enough to receive a scholarship for a field trip to Hong Kong where I studied startup success factors in Asia.

The scholarship took me to Hong Kong Polytechnic University, where I interviewed many local founders on what it takes to be successful in Asia.

After a few weeks of collecting data, I relocated to Bali, Indonesia, where I stayed until my Master’s thesis was complete. Bali felt like a great place to research, write, and simply enjoy life.

At the time, I thought my stay in Southeast Asia (SEA) would be brief and I would return to Denmark once done. Yet, seven years later, I am writing this essay out of Singapore.

Over the years, I have learned much and changed my perspective on various topics. Still, one thing remains the same — my view that specific business models and products are particularly well-suited for Southeast Asia.

The region's distinctiveness gives rise to specific challenges and opportunities, which must be considered when launching a new venture or entering the market.

For example, OpenAI and its groundbreaking work in the field of artificial intelligence could never have originated in Southeast Asia. Unfortunately, the region lacks the engineering talent to develop such complex AI research.

On the other hand, a successful Southeast Asian startup like GoJek might not find the same level of success in, say, Denmark. The European markets are vastly different. The average user would likely feel overwhelmed by the million options of services offered by GoJek. Western audiences prefer minimalistic and clean user interfaces that solve one problem at a time. In Asia, people are comfortable with an overload of information, features, banners, instant communication, and notifications. Perhaps most importantly, the high standard of living in most western countries would not be able to sustain Gojek’s unit economics.

To top it all, founders and investors in Southeast Asia prefer proven business models. The market is hard enough the way it is. Finding technical talent is a challenge. The internet connection is not always stable outside of big cities. Many regulations are vague and frequently changed. Even the cost of starting a company continues to be high in countries like Indonesia, the Philippines, and Vietnam. The purchasing power of the average user is considerably lower than in Europe and North America. Each country speaks a different language, making localization a challenge. While there are many significant similarities between Southeast Asian cultures, there are also quite a few differences, increasing the complexity of localizing products and business models. I can keep on going about the challenging nature of the region, but you got the point, building a startup here is really hard.

“This is a particularly challenging market for founders to get started,”

Abheek Anand, Managing Director of Sequoia Southeast Asia

With all of this in mind, I thought it would be valuable to dive into what strategies increase the probability of success in SEA.

Critical factors for building a successful business in Southeast Asia

Throughout the past seven years, I have seen several strategies again and again when talking to founders across the startup ecosystem of SEA. So I thought, why not summarize my findings and share them with the broader community?

The levers I have noticed to work are:

Leverage a tested business model

Adopt low-pricing

Align incentives

Expand regionally

Localize

Let's explore each lever in detail.

Leverage a proven business model

It’s not a secret that investors and founders in SEA have an appetite for proven business models.

What do I mean by that?

In plain language, copying business models and products that have been widely successful in developed markets.

Perhaps the best example of this approach is Rocket Internet. The company entered Southeast Asia in 201,2, aiming to launch one new venture per quarter. Although keeping track of all the companies Rocket launched in the region is challenging, some well-known ones include Zen Rooms, Zalora, Lazada, Food Panda, Lamudi, and Lyke. Although many of those ventures failed, some were quite successful, i.e., Lazada and Zalora. The one common thing amongst all those startups was that Rocket attempted to replicate a proven business model and tailor it for the Southeast Asian market.

A proven business model helps you raise capital faster. In turn, your one goal as a founder is to focus purely on execution; the playbook has been written,n and the money is in the bank. Not to mention, it’s a lot easier to find great ops and business development talent in Southeast Asia as opposed to product and engineering.

Adopt low-pricing strategies

When I first arrived in Southeast Asia, I immediately noticed the price sensitivity. Even in B2B capacity, and regardless of how well-funded or successful your counterparty is, negotiating heavily is a common practice.

Let’s take a few examples, highlighting LinkedIn and Slack.

Not too long ago, I met a few people from LinkedIn who mentioned that Indonesia and India are the only markets where the company offers discounts globally. Many large technology companies are adopting this trend of highly localized pricing.

Another example that comes to mind is Slack. While negotiating with their APAC team, I learned that the headquarters location of a company could result in a 60% reduction in pricing (i.e., India VS Singapore).

That’s not surprising, given the lower standard of life across SEA. Let's take the average monthly salary in the region excluding Singapore (being an outlier), which comes to about $1360. With a large and youthful population of over 685 million, many business owners prefer to hire more staff rather than pay for expensive software or hardware that has a promise of “productivity” or “saving time.”

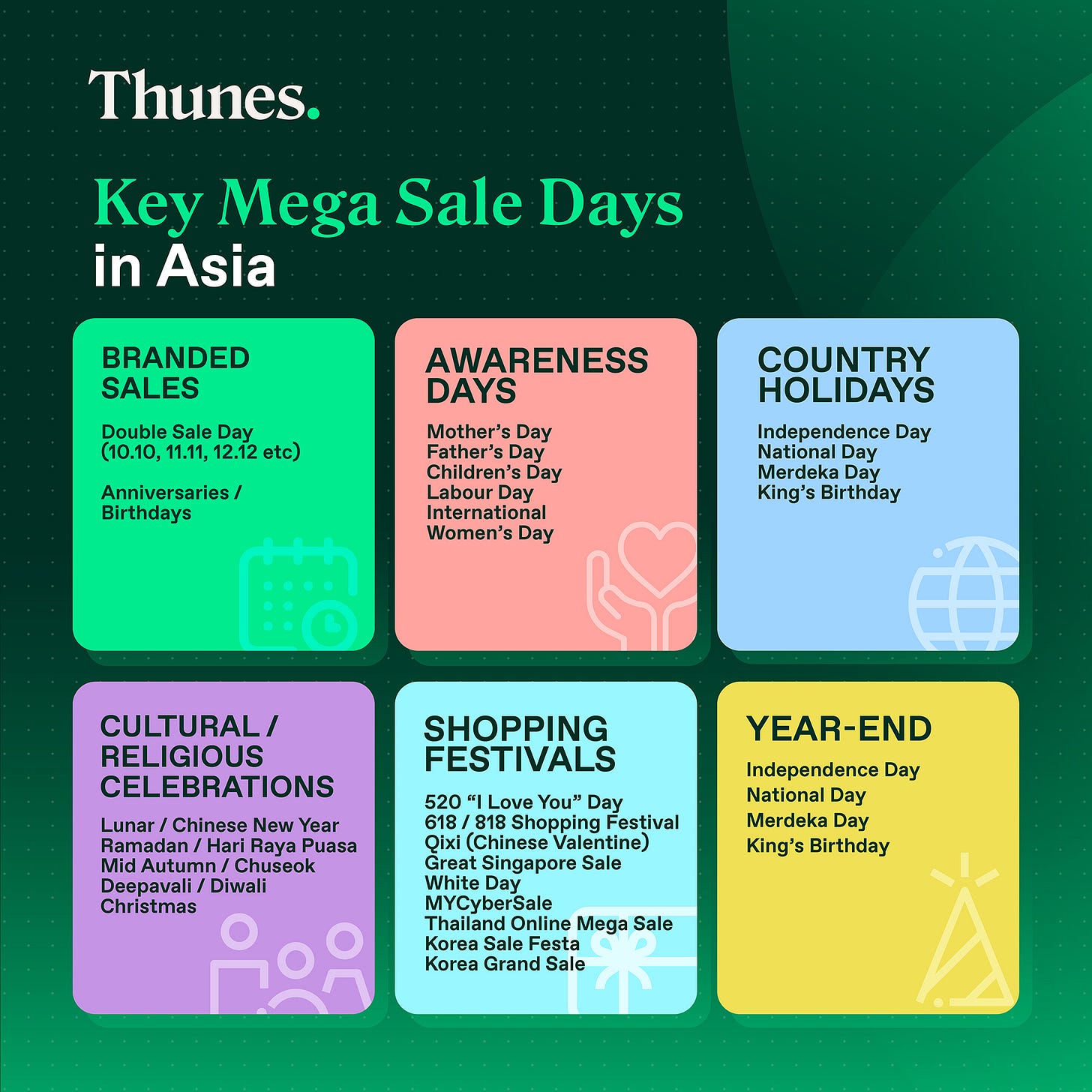

When it comes to B2C, that dynamic is amplified quite a bit. For example, e-commerce platforms have been having a frenzy of shopping events to lure in consumers.

This is also evident in the hotel and travel industry. My first job in Indonesia was as the Head of Marketing for a travel startup. Back then, we faced intense competition from heavily discounted online travel agents, ultimately leading to the company's closure. I vividly recall an experiment where we listed several free rooms on our website. We promoted the campaign as a treasure hunt and let people explore our listings to find the free rooms, which caused the entire site to crash due to the massive influx of traffic.

Aligning incentives

In a market where salaries are relatively low, anything that can boost your income is appreciated and grows virally. To illustrate, I will provide two examples, one in ride-hailing and the other in mobile games.

Gojek

GoJek started as a ride-hailing app but has since expanded to offer various services beyond transportation. The company addresses a significant issue as most markets in SEA lack a reliable public transportation system. Additionally, Gojek provides a means for drivers to earn a livelihood without specialized education. Currently, GoJek “employs” over 2 million drivers who rely on the platform for their income and appreciate the flexible employment opportunities it provides.

In developed markets, ride-hailing drivers often use apps like Uber and Lyft to earn extra money. In contrast, many Gojek drivers rely entirely on the company to make a living in Indonesia.

The local government also benefits from increased employment rates and support in solving significant problems in the transportation system.

Not too long ago GoJek aligned incentives even further by rewarding ~600,000 drivers with 4,000 shares each (equivalent to ~94 USD) following its IPO. In the process, they are creating a win-win-win strategy across all major stakeholders.

Axie Infinity

Axie Infinity is a play-to-earn blockchain game that has seen impressive growth since its launch several years ago. At its peak in 2021, the Vietnamese startup had 730,000 unique active wallets and processed a volume of ~$78M. According to their website, Axie Infinity is the most-played NFT game of all time. In its latest round, the company raised $150M and is valued at $3B.

The easiest way to understand how the game works is to imagine CryptoKittes and Pokemon having a baby. The gameplay involves collecting and battling digital creatures called Axies, which are tokenized as NFTs. Players earn valuable NFTs by playing well and can sell their characters for profits that can be used to purchase game tokens or converted into cash.

Axie is especially popular in emerging markets, such as the Philippines, Cuba, and Venezuela. It provides livelihood opportunities for people who play it full-time and earn around $800 per month. To onboard financially vulnerable players, the game developers have created "scholarship" programs that loan out Axies in exchange for sharing tokens earned from wins. There are about 40 Axie scholarships that I know of, which have created a brilliant way to onboard people who cannot afford the onboarding fees.

Axie took off in the Philippines, where many people are playing to supplement or entirely replace their income source. People who play full-time can earn about 200 SLP tokens daily at a rate of $0.2 which comes to $800 per month. That’s not impressive income for developed markets, but in developing markets is a no-brainer and many people rushed to play during the pandemic.

In both examples, we see startups that have found ways to share revenues with people using the platform. In markets where the living standard is low, and many people do not have access to a great education system, such platforms thrive.

Expanding regionally from the offset

Expanding early is a common strategy in Southeast Asia. Despite the large size and population, your target market might be small. As a result, many entrepreneurs expand their market by venturing into other Southeast Asian countries early on. While some companies have found success by focusing on one country, such as Tokopedia, many prefer to venture out early.

Here I will offer the example of Docquity, where I am currently working. The founders have been quite successful in expanding very early in their journey.

You can think of Docquity as a professional network for doctors with a strong focus on education. Currently, the platform has over 350,000 doctor users in Indonesia, Thailand, Malaysia, Vietnam, the Philippines, and Taiwan. Unlike many startups in developed markets who wait until they reach Series C or D to expand internationally, Docquity entered multiple markets across SEA early on. The founders were successful thanks to two strategies. First, they cracked the playbook of quickly finding the right people on the ground who can kickstart a community of doctors in each market. Second, we aligned our growth with our clients. We often worked together to conquer new markets whenever they needed our help. This kept costs low and revenues high.

I now oversee engagement across all countries and have noticed the success of each call is driven by high localization. It's uncommon to find campaigns that work well regionally. In most cases, we work closely with local teams to run highly localized initiatives. This leads me to my final point — localization.

Business localization

Localization is another crucial strategy for success across SEA, yet it is often overlooked. While I might have briefly covered the topic under the previous sections on “low pricing” and “regional expansion,” I believe it deserves separate consideration.

Even well-established startups in Southeast Asia struggle with localization. A deep understanding of the local culture is essential, but easier said than done. In my experience, this includes adapting the brand to fit the new market through local campaigns incorporating local slang and cultural nuances.

“Almost everyone in the leadership team has at least lived here for some number of years… So you need to be multi-local, not regional.”

Lim Kell Jay, Head of Grab Singapore

In addition, it is important to modify products to comply with regulations and cater to unique use cases. Simply translating the website and product is not enough. A notable example of a company that has successfully localized in Asia is Spotify. The company used a variety of strategies and tactics, which I covered in an article sometime back.

Similarly, at Docquity, we have adopted a multi-site structure for our website. We use specific plugins and widgets for each market to ensure that our message and product resonate with the local audience. While the effort is more significant, it allows us to achieve a level of localization that many other companies cannot.

Another example is Sea Group's solution to the problem of unbanked individuals in the region. They introduced the "AirPlay" product in Indonesia to address the largely rural population a reverse ATM that offers digital cash distribution in remote areas. These counters also provide internet services in areas with limited infrastructure. This product is highly localized and specific to just some markets and thus offers a great example of the thinking one needs to succeed.

The five essential levers for conquering the SEA Market — Southeast Asia Mechanics Framework

By now we covered five different levers that might help you grow your business across the region: leverage a proven business model, align incentives, expand regionally early on, adopt low pricing, and localize.

It's important to note that these levers are interdependent but work best in conjunction. As described above, the region is difficult enough. Founders need to reverse engineer what’s working and build products that cater to that. The following model shows how the levers should be approached and integrated for maximum success.

You could focus on one strategy in isolation, but the probability of success increases as you start layering different levers, one on top of another. This is hard because you do not know how all parts of your system should fit together. What would be effective early on? When to introduce another lever? And the level of magnitude you need to consider. Yet, it does give you a mental framework that guides you toward what is essential and how much effort you want to allocate.

So these are the five levers I came up with. The idea of the Southeast Asia Mechanics Framework was three years in the making. I first wrote an article on “winning fast-growth markets” a few years back. At the time, my view was that some business models and products experience tail other headwinds, but I could not pinpoint the levers at play. After advising nearly a hundred founders on their go-to-market for Southeast Asia, I started seeing patterns. With this framework, you can avoid the same mistakes I made when relocating to SEA.

Lastly, I want to address the elephant in the room. This article is informed by the time I spent working in and exploring Southeast Asia’s startup ecosystem over the past several years. I have not conducted any academic studies and thus you need to take it with a grain of salt. Every rule is bound to have edge cases. We can all think of examples of companies that are successful without following any of the methods described in this article. I guess that’s the challenge of running a business. There is no one recipe that works 100% of the time. Life is unpredictable, and even the most well-intentioned frameworks can backfire or prove ineffective. But that does not mean we should not study what works and what might be contributing to the success. Each founder decides how to run their business and I hope this framework proves helpful.

great information, thank you for this

Anna of Property Access

https://propertyaccess.ph/