Newsletter #23: Winning fast-growth markets

16 minutes reading time. Thoughts on startups, growth, and technology 🚀

Hey there,

Today, I am preparing for two events where I will be sharing my views on what it takes to "win fast-growth markets." The first one is a webinar we are running together with HubSpot and the second is a conference on the Future of Work in Asia. So I decided to write my thoughts, and clear my mind.

Fast-growth markets are typically countries, which by definition are riskier and less stable but have economies and populations of a certain size that display strong growth potential and are, or could be, strategically important for business. Taken together, the fast-growth markets have grown by 5.8% per year over the last decade, more than three times as fast as the advanced economies.

Running a business like Greenhouse, where we help foreign companies to expand to Southeast Asia, gives me an interesting perspective of what it takes to be successful in fast-growth markets. Founders eyeing the region often seek our advice on how they can be successful. Going through many such discussions, it is obvious that many of entrepreneurs are concerned.

Concerned if they will be successful and how that will impact their runaway or other plans.

A valid concern, breaking into a foreign market where everything you have learned may not work, is hard. Yet, people do it all the time. In fact, in 2018, more than 250,000 businesses incorporated across Southeast Asia alone.

The reasons for expansion vary depending on the business, its scale, current needs, and emerging opportunities abroad. To narrow down the main reasons, I looked into a recent study where Velocity Global asked about 500 companies from the US and the UK to rank the main reasons why businesses look to new markets.

Source: Velocity Global The State of Global Expansion 2020

Then I narrowed down further and looked into what the study found out about Asia where Greenhouse, and some of the world's most exciting fast-growth markets like Vietnam, Indonesia, the Philippines, etc. are located.

Source: Velocity Global The State of Global Expansion 2020

It turns out; western companies are considering Asia mainly to access tech talent. Or perhaps, the right terminology here would be a more affordable tech talent.

In my experience, the results must be reversed as most companies we have encountered are interested in revenue growth.

Since my experience covers mainly businesses interested in revenue growth, I have prepared my presentations accordingly.

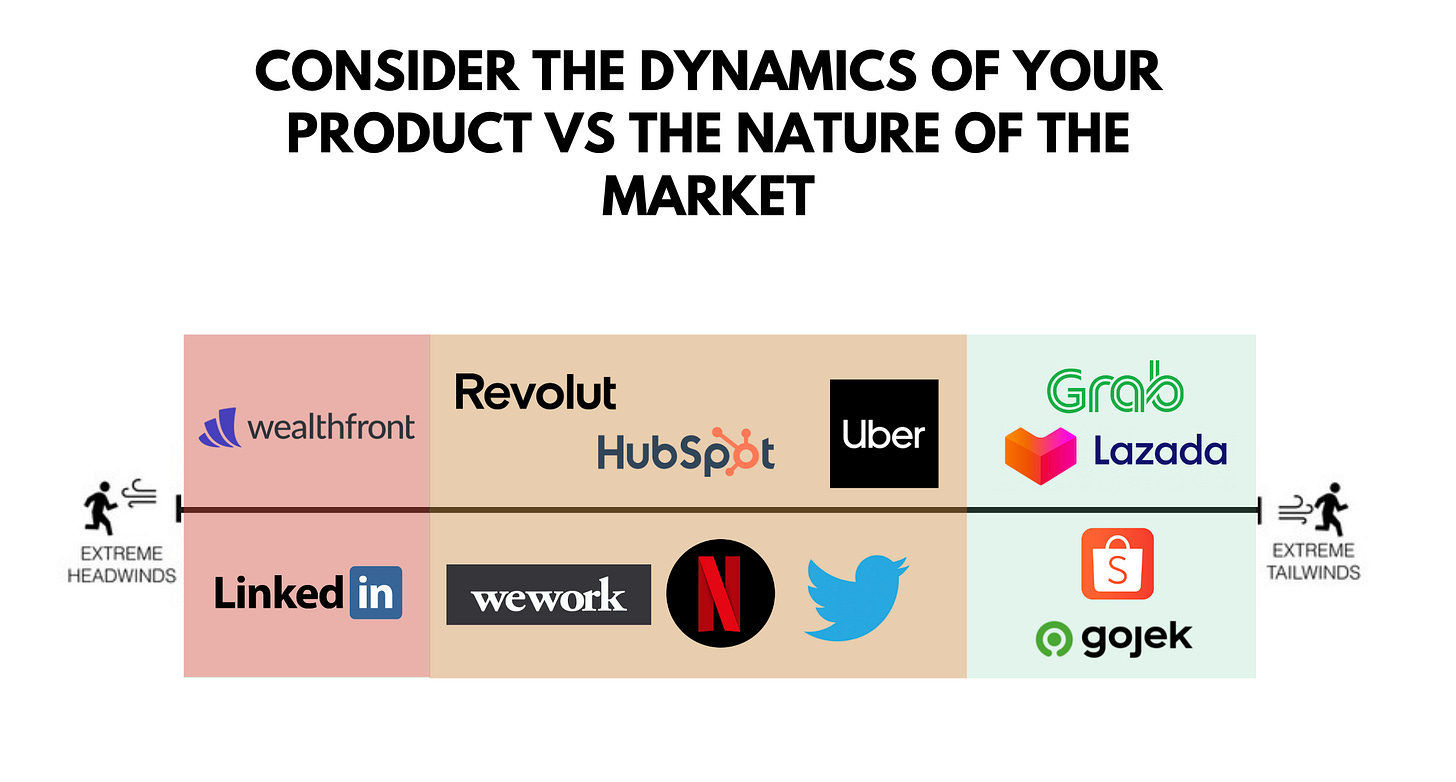

When entering a fast-growth market, the very first thing you need to consider is how suitable your product is for fast-growth markets. To illustrate that, I developed the following image.

Before I dive into my thoughts here, I would like to clarify that this is not based on any research and it reflects mainly my personal observations and experience. I am focusing primarily on the "fit" of fast-growth-markets (Indonesia, Thailand, Vietnam, the Philippines, etc.) and well-known products to make the examples easy to understand.

In a nutshell, there are products experiencing extreme headwinds or tailwinds, and others experiencing something in between.

Extreme Headwinds

The majority of your customers' habits in the market where you started are completely different in the fast-growth-market you are approaching. Here I have chosen two examples.

LinkedIn - here I am referring to their recruitment solutions. LinkedIn recruiter is such an expensive product that the company has prioritized developed markets like Singapore over larger markets in close proximity. Rumor has it that Indonesia and India are the only markets where they offer significant discounts.

Wealthfront - Weahlthfront's ideal customer profile is 25 - 35 years old engineers at startups that are about to be acquired/go through an IPO. Such a niche segment works very well for markets like the US, where we see a lot of startup exits and a very mature startup eco-systems. In turn, if you look at Indonesia or Vietnam, the number of exits is low, and most engineers do not receive stock options.

Source: HubSpot's Elevate Accelerator

Hence, the questions such companies need to ask themselves is:

Are we willing to adapt our product significantly to serve a much more price-sensitive and fundamentally different market?

Extreme Tailwinds

The majority of your target customers' habits in the new market are similar or even better suited.

Here I am giving examples of e-commerce and ride-hailing companies because:

E-commerce brings prices down, which goes hand in hand with the price-sensitive behavior, which is common in fast-growth markets.

Ride-hailing - replaces the lack of the transportation infrastructure, creates jobs for a large working class that requires little or no knowledge and investment on their end i.e., there is no need to have a university degree to be a Grab driver, you only need to buy a scooter.

In-Between

Some of your products work well, others need tweaking. Here I have listed a bunch of well-known companies because they operate with a different degree of success across the region.

Companies like WeWork, Netflix, Hubspot, and Uber, have premium products that are marginally better than local competitors, but they face a lot of pressure to offer discounts.

In other cases, like Twitter, some markets' behavior clicks well with the product (e.g., Indonesia), in other, the platform struggles to overcome other established players (e.g., Facebook in the Philippines).

When it comes to FinTech solutions like Revolut, such companies are facing a lot of resistance and regulations from local governments. When it comes to financial services, local governments prefer locally grown startups, over foreign businesses.

By now, you may be curious why Uber is on that list since their product is the inspiration behind Grab and Go-Jek, companies listed under the "extreme tailwinds" spectrum, which leads me to my next point.

What else plays a role in one's success when expanding?

Here, I have summarized some of my most painful lessons. As with all things, the list looks pretty obvious in retrospect, but it was not when I moved to Southeast Asia.

Mobile-First VS Mobile Only - People do not talk enough about the importance of mobile-only solutions. Let me give a few examples:

In Indonesia, most people do not own a laptop. At the same time, pretty much everyone owns a smartphone. That became obvious when the COVID lockdown was initiated; companies quickly realized how few employees own a laptop and how dependent they are on company laptops.

Most people grew up without a laptop; as a result, they are incredibly fast when operating with their smartphones, but do not know how to take full advantage of a more powerful, yet larger machine.

To drive the point home, I used a website grader developed by HubSpot to showcase you how we at Greenhouse have optimized our website to be Mobile Only:

Source: Website Grader by HubSpot a test of Greenhouse.co

Not a homogenous market - most fast-growth markets have populations in the hundreds of millions e.g., Indonesia, Philippines, Vietnam, etc. In some cases, that population is dispersed across thousands of islands, cultures, languages, income levels, etc. Many foreign businesses look at the major business hubs and expect that to be representative of the entire country, which is wrong.

Source: Joe Wadakethalakal wrote a great post on the topic that illustrates my point here.

Local competition - Uber is a great study case here. Their product was superior to Grab and Go-Jek on every level. Yet, local players understand the local customer behavior much better, managed to fundraise a lot of cash, and worked hard to localizing their brand in every geography where they operate, think Go-Jek rebranding to Go-Viet (Vietnam) and Go-Get (Thailand).

Be flexible - I am guilty of making multiple mistakes here. Mostly, I am referring to trying to run a business in a western way when it's evidently not working. To name an example, Greenhouse operates a workspace in Jakarta, in the early days of our business it took us three quarters of tests and failures until we figured a way to run highly engaging community activities for our members. We assumed that intellectual talks, videos, and events would drive high attendance and NPS. It turned out that nothing could be further from the truth, the thing that worked out was creating events around food, where people come simply to eat together and chat. It took me way too long to see through all that as I had a different experience of running intellectual events in Denmark and wanted to replicate it here in Indonesia.

Localization - I touched on that with the Uber example, but let me provide a different case study. In my previous startup, we were running a marketplace for budget hotels in Indonesia. The entire product was translated to Bahasa Indonesia (local Indonesian language), other than one page - the payment gateway check out. Literally, the page where people need to add their name, CC, and address. We assumed that words like "name," "credit card number" are kind of universal. It turns out they aren't. It took us way too long to realize how much of a bottleneck that was.

Recruitment - that's the most painful lesson amongst all. While there are plenty of smart and ambitious people in every fast-growth market, finding such folks and getting them on board is hard. There are a ton of headhunters that, in my experience, do an okay job in helping you. Yet, you cannot outsource the headhunting of your entire team; it will be costly. This leads me to my next point, even in emerging markets, good people know their value and will cost you similar rates to what developed markets charge.

Last but not least, while recruiting on your own is possible, it’s pretty hard, we at Greenhouse hire up to 3 people for every 1000 applications.

Time VS Money - in most developed markets, "time" is people's most valuable resource, but that's not the case in fast-growth markets. The results of that are a) people are not punctual, b) products that save time rather than money are not as successful.

Now that I painted a picture illustrating the main challenges, I would like to share some of my best practices:

Build relationships - you know how people say "cash is king," well in fast-growth markets, relationships are king. Unlike some western markets, business leaders in Southeast Asia do business with people they know and trust. If you are considering entering a fast-growth market, make sure you start investing efforts in building relationships via networking events, LinkedIn, speaking at local events, asking for introductions, and doing what you can to deliver value long before you enter the market.

Experiment with different channels - whatever channels have proven to work for you, may not work at all in fast-growth markets. Test out relevant channels and see what clicks best.

Customer experience (CX) - most local companies offer pretty bad CX, which gives you opportunities to stand out, drive word of mouth and encourage loyalty.

Automation - most businesses in fast-growth markets are pretty conventional when it comes to their tech stack (if any). Automating your processes will provide you with a quick edge, and most people won't notice the automation if done well. Up until today, I get replies on my automated reminders for upcoming meetings in 9 out of 10 cases.

Focus on execution - execution is your #1 priority. In fast-growth markets, everything will slow you down, your company formation (so call us to help there), recruitment, sales, partnerships, getting an office, etc., all that will be much harder than what you are used to. You need to hire a street smart, T-shaped team focused on execution.

If you are keen to find out more about the topic drop me a message or attend:

A quote worth remembering:

💬 James Clear, the author of Atomic Habits shares his thoughts on the paradox of freedom:

"The Paradox of Freedom:

The way to expand your freedom is to narrow your focus.

Stay focused on saving to achieve financial freedom.

Stay focused on training to achieve physical freedom.

Stay focused on learning to achieve intellectual freedom."

A book recommendation:

📖 The 7 Habits of Highly Effective People Personal Workbook by Stephen R. Covey

I typically avoid books with cheesy titles on self-improvement but this one is an excellent book. It helped me to re-evaluate my current approach in planning personal and work activities and most importantly approach to living. At some point, we used the 7 habits to run training at Greenhouse that was highly appreciated.

Positive news worth sharing:

Millennials and Generation Z have grown up with globalization, open borders and diverse communities. They tend to be more open-minded about the benefits of diversity. It’s helping to make the world more inclusive.

Check out the source here.

The Road to 500

One of my resolutions this year is to grow this publication to 500 subscribers 🚀

The best way to spread the word is to hit the share button and say nice things about why you enjoy reading this every week and what you learn.

Thanks for reading,

Viktor