Newsletter #33: Winning Asia like Spotify

11 minutes reading time. Thoughts on startups, growth, and technology 🚀

Welcome to another edition of the Struggle.

The Struggle is a weekly newsletter where I share my thoughts and learnings from running a fast-growing startup in Southeast Asia.

*I am experimenting with longer and better-researched articles, let me know how do you feel about this format.

In September, I will speak at three events on the topic of doing business in the Asia Pacific (APAC). As part of my preparation, I will release a few articles on foreign companies that have expanded successfully to APAC with a focus on Southeast Asia (SEA).

Many countries in APAC are considered as fast-growth markets, or also known as emerging economies.

Such countries have lower liquidity levels, less established markets, and lower levels of per-capita income than developed markets. Yet, fast-growth markets are called 'fast-growth' for a reason. These economies will grow larger and have a significant impact on global trade and economics. A few notable examples are Indonesia, Thailand, the Philippines, and Vietnam.

Think of China, it was not a long ago when we used to refer to China as an emerging market, but nowadays, China is the world's second-largest economy (measured by GDP).

In my opinion, many of these markets are doing a remarkable job in transitioning from commodity and manufacturing to technology and higher value-add production-driven economies.

For example, companies in SEA have moved straight to e-commerce and e-banking models, bypassing the establishment of brick-and-mortar outlets. Leapfrogging what happened in developed countries and thus introducing a lot of investment opportunities.

However, expanding operations into emerging markets can be risky and presents high costs in terms of time and capital spent.

Going through several companies that managed to win such markets, I stumbled on the example of Spotify.

Spotify

Four years ago, Spotify's Managing Director for Asia - Sunita Kaur shared a bold vision:

“We want to be everywhere in Asia.”

Spotify's growth in Asia started back in 2013 - 2014 when the company expanded to Singapore, Hong Kong, and Malaysia. At the time, they were just 15 people overseeing three markets while preparing for the next expansion to Taiwan, the Philippines, Japan, and Indonesia.

Success across so many new and unique markets can be tricky. From cultural and language barriers to bureaucratic jurisdictions, lack of payment infrastructure, local copy cats, piracy, and different consumer habits are just some of the challenges Spotify faced.

"The one main takeaway was understanding how different Asia is from the rest of the world... Whereas in the US you’ve got 50 states but it is essentially the same culture and language, you come to Asia and even in just one country like India, for example, it’s almost like having 28 different countries within one because you have such different cultures, such different languages, everything."

Sunita Kaur - Spotify's Managing Director for Asia

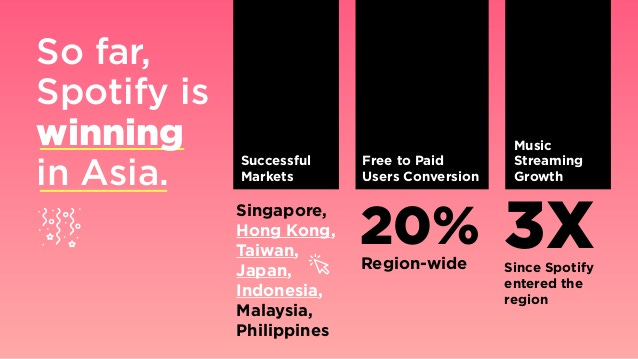

Despite all that, it seems like Spotify is consistently winning Asian markets. The data below illustrates their growth in 2017, shortly after they expanded to Singapore, Hong Kong, and Malaysia.

Next, I looked at Spotify's quarterly results in 2020 to evaluate their current performance in APAC. Unfortunately, Spotify does not separate Asia in their reporting, so it's challenging to determine with precision their growth in the region. Having said that, Spotify's monthly active users are growing 58% year over year, in what they refer to as 'Rest of World' where they park the data for Asia.

When it comes to subscribers, Asia represents less than 11% in comparison to Europe 39% (their core market), North America 29%, and Latin America 21%. Meaning, there is still a lot of room for growth in Asia on the monetization side.

We do need to acknowledge that the company has been in a rapid expansion mode, currently boasting a presence across 92 countries, suggesting a focus on growth over profitability.

How is Spotify doing all this?

Three core strategies have helped the company to be successful in Asia.

Mobile-first approach

"It’s mobile first, and a mobile first strategy was very important to us here in Asia. It made sense for us because everybody here lives on their mobiles. So when we launched this new feature people were talking about it in social media. Our best marketeers are Spotify users. Everybody was telling their friends about the fact that you can get Spotify free."

Sunita Kaur - Spotify's Managing Director for Asia

Tactics

Before even setting up a local office, Spotify Japan partnered with Japan's top messaging app LINE to enable sharing Spotify tracks over LINE's mobile app.

At the time, LINE had 218,4M+ monthly active users, and 70% of them located in Japan, Taiwan, Thailand, and Indonesia.

To gain traction as outsiders, Spotify partnered with local telecom companies in the region for deals on their paid subscription.

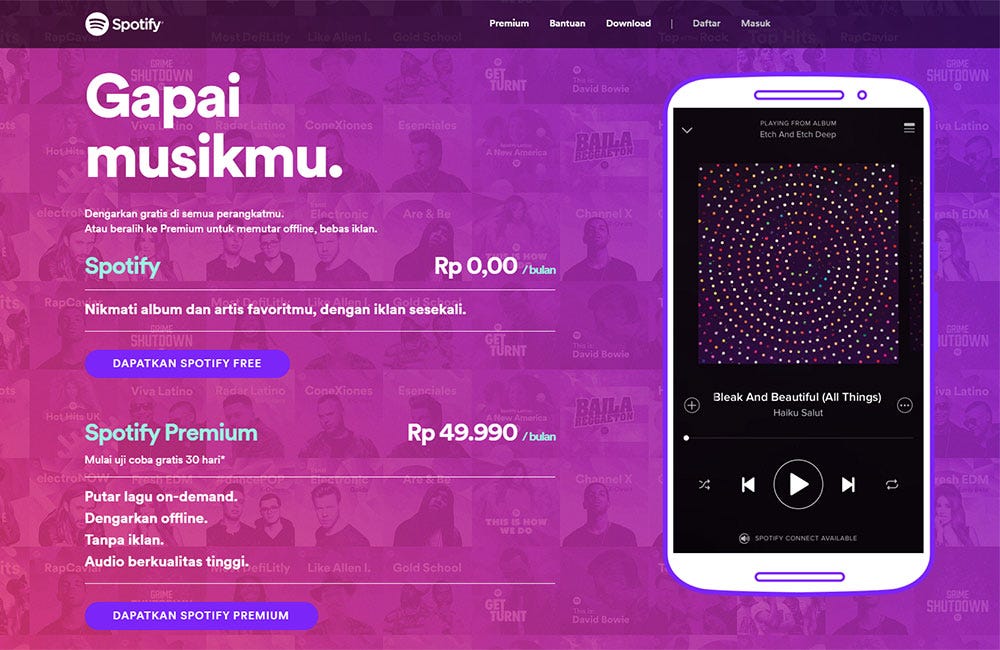

Bank account penetration is not significant in countries like Indonesia and the Philippines, so in the beginning, Spotify offered cash payments for the very first time in their history. In the meantime, they worked with local partners to provide other popular options such as bank transfers, ATMs, e-wallets, and even convenience store payments.

Partnering with local telecom companies like Indosat (Indonesia) and Singtel (Singapore) helped them to launch unlimited mobile data streaming for Spotify Premium users.

Yes, it goes back to marketing 101--the more people you can get to try your product the more people will convert. Then we thought about Asia and the fact the only way to try our product was on desktop and yet in Asia the desktop experience is completely skipped. Spotify free on mobile was the best thing we ever did. I’m looking at the numbers and it is making really good sense. And yet before making that change, and for any startup, there is that risk, there are these big decision where you think – gosh, should I do it?Sunita Kaur - Spotify's Managing Director for Asia

Localization

Heavy focus on localization was their next move; after all, nobody likes feeling language or cultural barriers on their home turf. Users expect their experience to be localized, even if they are using an international company.

Tactics

Created local language advertising and adjusted pricing which is better aligned to the standard of living in each market.

Before launching in Japan, Spotify's team produced several TV and print ads to introduce local audiences to their platform and product. The videos were culturally on point and featured funny scenes from everyday life in Japan.

By investing in a good translation and local content.

“We tend not to launch a market until we have a very robust local music catalogue. Because we want to make sure that we have got very, very strong local music content.”Sunita Kaur - Spotify's Managing Director for Asia

For Asia, the approach has been to go local, with the music-streaming service actively reaching out to local artists/labels in each market, which has helped the company push its user update extensively. This is particularly so for markts such as the Philippines, Hong Kong and Taiwan." Elizabeth Low, Marketing Interactive

Stay relevant

Tactics

Build communities through localized social media channels.

“When we launched this new feature people were talking about it in social media. Our best marketers are Spotify users."Sunita Kaur - Spotify's Managing Director for Asia

Engage users through local news and trends.

When Singapore and Malaysia were impacted with smoke from neighboring Indonesia's forest fires, Spotify responded with a tailored playlist called '"Hazed and Confused," featuring 40 fiery tracks like Billy Joe's "We Didn't Start The Fire" and Maroon 5's "Harder to Breathe."

In a nutshell, Spotify implemented three things very well:

Targeted mobile channels in mobile-first markets.

Localized content and pricing.

Stay relevant and engage with the local community.

It all boils down to localizing and adapting to the new markets. In Sunita Kaur's words, she described Spotify's approach in the following way:

I think it’s not so much a challenge as it is quite a lot of fun. Not to have a cookie cutter strategy that we use across each market. With each country that we go into, for example Hong Kong, we work with the big artists here, whether it is Eason Chan or Jay Chou, who are trending on top of the list in Hong Kong. When we look at the music trends across all of the different countries, every country is very, very passionate about their local artists so it’s not just the big international stars that trend well across Asia. They’re also very passionate about their local music scene so what we always try and do is walk with as many local music artists or middle concept promoters to be able to build up a marketing story in that country. It is kind of starting from ground zero in every country.

this is very insighful, thanks!