Newsletter 91: two life skills not taught at school

This essay is about something that has been on my mind since forever: important things school does not teach us.

While schools are supposed to prepare us for adult life, it seems like the educational system knows little about this.

How to build a meaningful career?

It’s funny how for ~18 years of studies, I did not have a single session on how to think about building a meaningful career. It was always assumed that I would work on something related to my specialization. So each school attempted to push me in that direction. Looking back, no one indeed took the time to help me understand if that was the right path for me.

Society has designed an educational system that offers a well-defined path with a clear set of rules. You attend classes X hours a day. Studying for exams helps you to have good grades. Arriving on time and attending classes ensures you can continue to study. The list of such rules goes on and on.

Reflecting on all that, I can see that most rules are designed for the benefit of the system, not necessarily for the students.

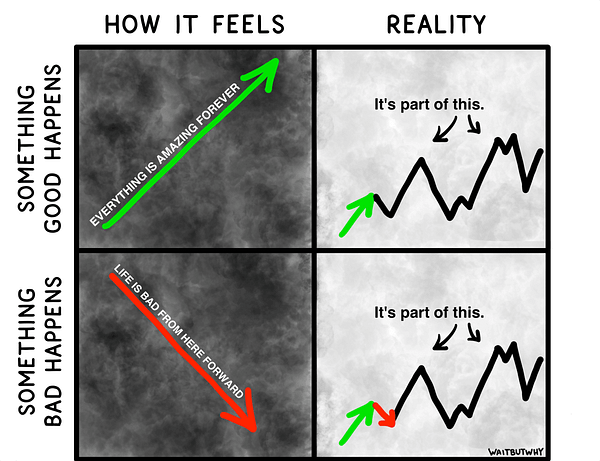

Think about it. Going through school is quite a predictable experience, but life is rarely so straightforward. As a result, when the time comes to leave school, many young people feel confused.

That’s not surprising. After all, the school environment has guided us for many years, and we got accustomed to that over time.

Then one day, all that is whisked away. We are finally done with studying just to realize that there was something comforting about a clearly defined path. About a life that’s predictable because it follows a clearly defined set of rules. Now all that is gone. We need to make all decisions on our own. Working hard does not always guarantee career progression. Arriving on time does not mean anything; you can still get fired. Preparing for important meetings would help, but thriving in your job requires so much more.

Unless you work in a highly controlled environment, you will experience many stressful events.

“Kids in school are kind of like employees of a company where someone else is the CEO. But no one is the CEO of your life in the real world, or of your career path—except you. And you’ve spent your whole life becoming a pro student, leaving you with zero experience as the CEO of anything.”

Tim Urban

To top it all, our parents are not super helpful either. After all, they started their careers some time back, when the world was a pretty different place.

Yet, throughout our life, our careers will eat up approximately 50,000 to 150,000 hours. That’s about 20% of our lives! And up to 60% of our meaningful adult time.1 Not to mention that the quality of our careers will directly impact our a) happiness, b) wealth, c) health, and d) identity.

And yes, there are the lucky ones—people who always knew what they wanted to do. But for most of us, deciding what to work on straight out of school is difficult. We are indecisive about which career path to take on. Society tells us things like follow your passion. But what if we are not sure what’s our passion? Or if our hobbies can actually generate decent income? To top it all, we are changing as we grow older, making the whole process even more confusing.

In my case, it took me a whole decade before I could understand what I wanted to do. What I was good at, and what would compensate me well (I wrote on the topic recently). So today, I wonder if there is a better way to prepare the next generation?

It is not surprising why people say that you need to spend your twenties figuring out what you want to do in life. It’s challenging. Some people never figure it out.

If you look at the biographies of people you look up to, you will find out that their paths are not terribly linear. Reding such books has been instrumental for my journey. Understanding how even some of the most successful people out there have periods when they feel lost has a calming effect. Especially when you are still figuring out your own path. So here you go, the biographies and memoirs of my heroes. Books that have been guiding me throughout my life.2

How to manage your money better?

Growing up in a blue-collar family, no one ever taught me how to manage money. Well, early in life, I did not have much money, so I did not see that as an issue.

Twenty years later, I can’t say that I have figured it all out, but I am in a job that challenges me, earning more money than I reasonably need. Once you reach a similar situation, the topic of preserving wealth becomes essential.

On the one hand, my business degrees taught me a lot about raising capital, accounting, and finance. On the other, it is somehow not sufficient. Especially when it comes to making important decisions about managing my own money. Yes, I can build beautiful and smart excel sheets that allow me to map and track everything happening in my life, but that’s half the battle. Once we have skin in the game, it becomes equally important to understand human psychology. That’s why it’s common to hear of highly educated people with great careers who end up losing most, if not all, of their wealth.

People struggle to be objective when it comes to managing their wealth. Having skin in the game changes everything. We become emotional, which leads to mistakes. After all, our behavior is unique and hard to measure. As we go through life, we naturally adapt and change. So even if we understand ourselves at the age of 20, our experiences will shape us differently a few years later. Therefore, teaching how to manage one’s money is pretty hard. Even when your audience consists of self-aware and intelligent students. While I have written in the past about my journey of wealth creation, and the lessons learned so far, there is so much more I have to learn.

As I grow older, I started hanging out with people who are wealthier than me. That was not the case during my childhood. As a kid growing up in the outskirts of Sofia, that was impossible. Everyone around me was equally poor. But as an adult living in Singapore, I have exposure to many successful people. So naturally, the topic of growing my wealth became a priority. I find it fascinating to observe and learn from other people who are more experienced in managing money than me.

“Rich means you have cash to buy stuff. Wealth means you have unspent savings and investments that provide some level of intangible and lasting pleasure – independence, autonomy, controlling your time, and doing what you want to do, when you want to do it, with whom you want to do it with, for as long as you want to do it for.”

Morgan Housel

Only now do I understand how little I know about a) building and b) preserving wealth. Concepts like the importance of compounding without interruptions. How no one can time the market. The implications of personal history bias. The danger of extrapolating the recent past into the near future. How we are frequently influenced by the wrong people, which causes us to make poor choices. The list goes on and on.

Those are just some of the lessons I learned the hard way. In fact, I am still studying best practices. Most probably, that would never stop. I wish the schools I attended put a bit more effort into helping us through that, but it is what it is. So once again, I sought the help of great books. Here you go, my favorite reads on building and preserving wealth.3

“At the moment, a long human life runs at about 750,000 hours. When you subtract childhood (~175,000 hours) and the portion of your adult life you’ll spend sleeping, eating, exercising, and otherwise taking care of the human pet you live in, along with errands and general life upkeep (~325,000 hours), you’re left with 250,000 “meaningful adult hours.”3 So a typical career will take up somewhere between 20% and 60% of your meaningful adult time—not something to be a cook about.”

Tim Urban

From left to right:

"Surely You're Joking, Mr. Feynman!": Adventures of a Curious Character, by Richard P. Feynman

Amazon Unbound: Jeff Bezos and the Invention of a Global Empire by Brad Stone

Will by Will Smith, Mark Manson

Dapper Dan: Made in Harlem by Daniel R. Day, Mikael Awake

Green Lights by Matthew McConaughey

The Ride of a Lifetime by Robert Iger, Joel Lovell

Steve Jobs by Walter Isaacson

Shoe Dog: A Memoir by the Creator of Nike by Phil Knight

The Innovators: How a Group of Hackers, Geniuses, and Geeks Created the Digital Revolution by Walter Isaacson

Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic Future by Ashlee Vance.

From left to right:

The Psychology of Money: Timeless lessons on wealth, greed, and happiness by Morgan Housel The Richest Man in Babylon by George S. Clason

Why It's OK to Want to Be Rich by Jason Brennan

The Almanack of Naval Ravikant: A Guide to Wealth and Happiness by Eric Jorgenson.