Newsletter 80: web3 and real estate, a happy marriage?

In 2013, Chris Dixon wrote an essay titled “What the smartest people do on the weekend is what everyone else will do during the week in ten years.”

The title says it all. A lot of cool projects tend to get started that way. Think of all the tech innovations that hobbyists originated in their garages and dorms, e.g., the PC, the web, blogs, and most open-source software.

When groups of intelligent people invest their precious free time to work on something new, we have to pay attention. Most likely, such projects will result in the next frontier.

Today’s essay covers:

Heirs vs. founders

Innovation unbound

Web3

Web3 meets the world of atoms

Heirs vs. Founders

Another caveat I would like to highlight is that the world was all about inheritance. People used to inherit wealth, names, and institutions. Most of the value in the old world was inherited rather than built from the bottom up. For better or worse, technological progress has changed all that. Suddenly we have a generation of intellectuals who are becoming software CEOs. The typical path for “normal” people used to be studying hard and climbing the corporate ladder. That’s changing as technology has gradually decreased the cost of starting a company ( i.e., ~$200,000 in 2006 to ~$1250 in 2020).

Additionally, the internet has made content creation permissionless. Meaning if you are great at something, most probably, your content will reach like-minded folks. People who may end up supporting you. Support in the form of a close-knit community, investment, or talent for your new venture.

That has led to a world where the wealthiest people are actually self-made. The past 30 years of innovation and wealth creation have removed many barriers to starting a business. The risks have decreased while the potential upside has increased. The more successful cases we have, the more we understand what it takes to create value. Over time, best practices start circulating. Innovation hubs like Silicon Valley and Singapore are popping up. Capital becomes more accessible. To top it all, we are learning how entrepreneurs do not need a ton of money to create value with software. In reality, all they need is to be great on (at least) one dimension, have a unique insight and attract other like-minded people who see the world the same way they do. As we rinse and repeat the formula, the number of ecosystems that have produced billion-dollar startups is on the rise.

Innovation unbound

More new ventures equal more innovation. The past several decades have been a relentless march of value creation. Today, our smartphones are more powerful than the technology that took us to the moon in 1969. Software has been eating the world. In biotech, the two new mRNA COVID vaccines are game-changers. Now we can program our cells to make whatever proteins we want. On the energy side, we are observing a great decline in the costs of wind and solar. Space is another sector that has experienced excellent cost reduction. The payload cost to low-Earth orbit in 1981 used to be $65,400/kg. Today, SpaceX can get it done for $2,600/kg. The list of innovations goes on and on.*

My point here is that we are having a great run of value creation. It is interesting to note that much of that value comes from the private sector. For example, NASA struggled to decrease the cost per low-Earth orbit flight for decades. Until SpaceX figured that out. Although governments and cities play an important role, one can argue that the world is becoming more decentralized. Today, you do not need to be in Silicon Valley to start a successful tech company. The pandemic has accelerated a transition to a remote and digital world.

At the same time, many governments have had a hard time dealing with COVID. As a result, the pandemic has damaged the already fragile relationship of citizens and institutions.

“Over the course of 2020, public health failed, public schools failed, fire departments failed, and police departments failed. National, state, and local governments failed. Media corporations failed and even the US military failed.”

Balaji Srinivasan

When you put all that together, I see the following narrative:

Wealth creation through founding companies overtakes inheritance.

The cost of starting a business is decreasing.

Virtually all sectors across biotech, hardware, software, energy, and space have been on a relentless march of innovation and value creation.

Venture capital has fueled a ton of innovation across all sectors. All that results in significant returns. The better the return, the more money will be channeled back into startups.

The pandemic has accelerated a shift to a more decentralized world. Today, you can work or start a business from anywhere.

The mishandling of the COVID situation is eroding the already fragile trust in institutions.

Web3

All that leads me to think about how we are at the threshold of another tectonic shift: in my opinion, Web3 is the next frontier. Everyone I know (and their sister) is tinkering about opportunities in web3. Whenever I catch up with friends, we end up talking about crypto.

More and more people are pivoting careers. VCs are shoveling capital at web3 companies. Every day we hear about companies that started just a few years back but managed to raise massive rounds of capital (e.g., Polygon, Alchemy, FTX, Fireblocks, OpenSea, etc.).

Chris Dixon’s thesis on smart people working on weekends is coming to life again. Not too long ago, all those fast-growing companies were just side projects.

“Name a 3 year old company worth $20B… (I’ll wait)

OK here’s mine: Polygon.

Yep, Polygon ($20B) is now worth more than Pinterest ($17B). Why? Because it solves some of the biggest problems with Ethereum - fees & scaling.”

Shaan Puri

Yet, it is still not apparent to most people how crypto will become a big part of their every day. People remain skeptical, and I cannot blame them. Even some of the most respected investors like Warren Buffett have called Bitcoin “rat poison.”

In turn, that has amplified a new wave of criticism. Comments like crypto “is just a speculation,” “there are not fundamentals,” “it resembles multi-level-marketing schemes,” and the list goes on and on.

Perhaps all those people are correct, and crypto is one large Ponzi scheme.

Or maybe not.

On a long horizon, I believe that crypto is unstoppable. But it’s hard to predict how things will play out in the short term. There will likely be some market crashes as we are still figuring things out. But it’s hard to imagine a future where a user-owned economy won’t be able to thrive.

I particularly like this video of Gary Vaynerchuk. He calmly articulates how it’s up to the market to decide what holds value and what does not.

Observing all that from the sidelines made me reflect. What needs to happen, so people become less skeptical?

Web3 meets the world of atoms

A few weeks back, I wrote an essay on the state of web3 in 2022. In that article, I argued how we are currently going through a period of exploration and sophistication.

Exploration represents the hunt for native use cases in crypto—projects where web3 offers a 10x better solution than the current alternative.

Sophistication because the most significant challenge right now is the ease of use of web3. Most web3 applications are technically challenging to use. The UI/UX cannot compare to what big tech (web2) achieved in the past ten years.

In my opinion, another puzzle piece needs to fall in its place, so people understand the value of crypto - tangible benefits in the real world.

Many people used to be skeptical of why tech companies are valued ten times more than any other sector until Uber and Airbnb solved massive problems across transportation and accommodation. All that in less than a decade while generating considerable value for their users.

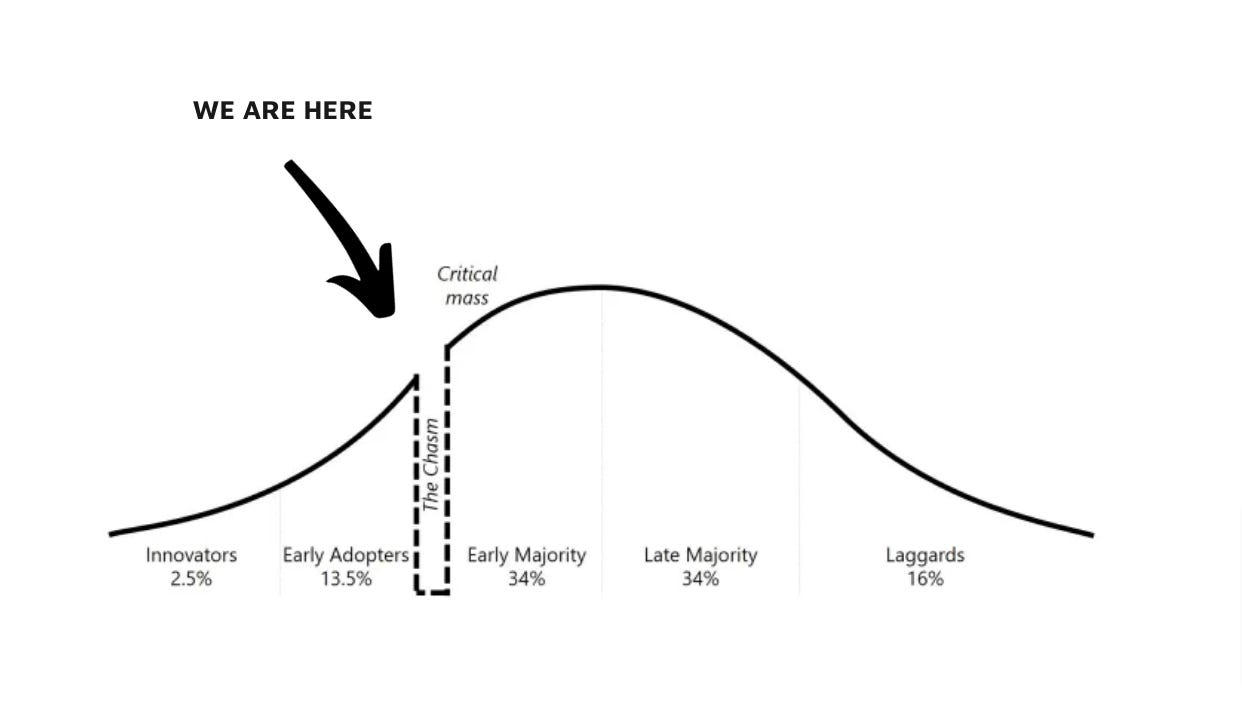

To transition from early adopters to early majority, we need to experience substantial benefits in the world of atoms.

So I am thinking, is there a way to find a use case grounded in the world of atoms that brings the benefits of web3?

For example, let’s take something diametrically opposed to crypto, like real estate. Most people think of investing in properties as the safest form of wealth creation and preservation. It’s a tangible product with obvious benefits. Moreover, the value creation is easy to understand, even for people with little to zero experience in investing. So this begs the question, is there an opportunity to amplify value creation in real estate? Can we marry web3 and commercial property development to increase the value of each project?

Here you go a few ideas of how web3 can enable value creation in real estate:

Royalties - assuming you are using NFTs, they could be programmed so that the investor gets a cut of future sales. That brings extra value to the initial owner. But not necessarily to the prospective investors, though.

Decentralized Finance - if the tokens are compatible with DeFi, you can use them as collateral to borrow against. It’s a lot faster and on better terms than going through the same process with a legacy system like banks.

Brand - you can potentially build a solid online community. Like-minded people who share similar interests. Examples of such interests include location, sustainable construction, aesthetics, etc. Ownership of similar NFTs can help groups of people identify each other. Moreover, if executed well, those people will start organizing many activities around the property. Similar to what’s happening with Bored Ape Yacht Club.

Liquidity - buying the token on a blockchain guarantees transparency. If you purchase a token for, e.g., 5000 USD, everyone can see that. Assuming you can build a good brand around the project, it will be easier to liquidate the NFT and thus exit. That's not comparable to traditional investing, where the process may take a very long time. You can sell the token to the highest bidder without any bureaucracy with crypto. Therefore, it might be a more attractive form of investment than what legacy systems offer.

Marketing - one of the biggest hurdles of building a property as an investment is how competitive the market is. Virtually everyone invests at some point in real estate. But tokens can make the users owners. In the process, reducing the customer acquisition costs to near zero. Crypto as a whole has grown to over a trillion dollars in market cap with barely any marketing spend. In fact, many countries have banned crypto advertising, yet the market has gotten bigger. The inherited value of ownership incentivizes word-of-mouth. In turn, this helps you stand out in a commoditized space.

I have been reflecting on that quite a bit. At the moment, I am thinking about testing a new concept—a project at the intersection of web3 and real estate. Drop me a message if you have any ideas of how the two concepts can be married.

“It’s a good bet these present-day hobbies will seed future industries. What the smartest people do on the weekends is what everyone else will do during the week in ten years.”

Chris Dixon

* If you want to dig further, I recommend an excellent book by Peter Diamandis called Abundance.