Newsletter 78: the state of web3 in (early) 2022

Major developments, key trends, NFTs, DAOs, companies, and projects to pay attention to in 2022.

Hi friends!

What a crazy two months it’s been since my previous web3 post. After two years of closed borders, I finally traveled to Bulgaria. One of the many lessons I learned during the holiday is that we travel to appreciate what we have.

I returned to Singapore feeling grateful for my roots in Europe. In just 30 days, I experienced a lot of history, culture, and sightseeing while connecting with family and friends. During the holiday, we took a ~1200km road trip and were blown away by the beauty of my home country.

Now, I am back in Singapore. I am continuing my entrepreneurial journey with a strong sense of appreciation. Southeast Asia might have taken away some comfort but has paid dividends in growth.

Anyway, enough about me, let’s kick off the year with some thoughts on what’s happening in crypto today.

In today’s newsletter:

Complimentary opposites

The great rebranding

Exploration

Sophistication

State of crypto in (early) 2022

Web3 funding

OpenSea

Helium

DeFi

NFTs

Play-to-earn

DAOs

WAGMI

Complimentary opposites

My time in Europe allowed me to talk to many people across Bulgaria about crypto. While most people seem interested, a few have a basic understanding of web3 or how crypto works. All in all, I met just a couple of experts.

The more people I talked to, the more I realized how early we are. Add a lot of reading on the topic, and you can guess that my perspective started evolving. While I am still convinced that web3 will be the next major shift in tech, I also came to appreciate the current state of things.

Most web3 proponents tend to demonstrate strong dualities. To name a few, decentralization is good, centralization is bad. Bitcoin is good; fiat is doomed. Such dualities paint concepts as good or evil. That line of thinking never resonated with me. Instead, I started to think about such concepts as complementary opposites.

Having the ability to appreciate two ideas that seem opposite brings a lot of humility. That’s especially true when thinking of web2 and web3. Lack of certainty makes us more humble. Avoiding dualities gives a better perspective about everything in between.

Think about it. Realistically, no one knows the future. So we cannot be certain about the effect of our actions. Especially how whole industries will evolve, i.e., web3 taking over web2.

Whatever happens, there will always be tradeoffs. Humility allows us to keep an acute awareness. Which in turn enables us to navigate an ever-complex world. We need to embrace complementary opposites to nurture humility and thus become antifragile.

“The critical idea here is that thinking consciously about trade-offs, and developing the ability to hold many different probabilities in mind simultaneously without allowing personal bias to obscure your view of all possible futures, allows you to pick The Middle Way more often than not.”

KERNEL, the Play of Pattern

Any person who ever tried to change the world learned to navigate complexity. Even some of the most successful people of our times, like Steve Jobs and Elon Musk, learned that you cannot impose your own will on the world at all times. Determination does not equal foresight. Change is inevitable. But changing the status quo requires an understanding of the complementary opposites.

The great rebranding

All those reflections led me to think, where exactly is the web3 ecosystem today?

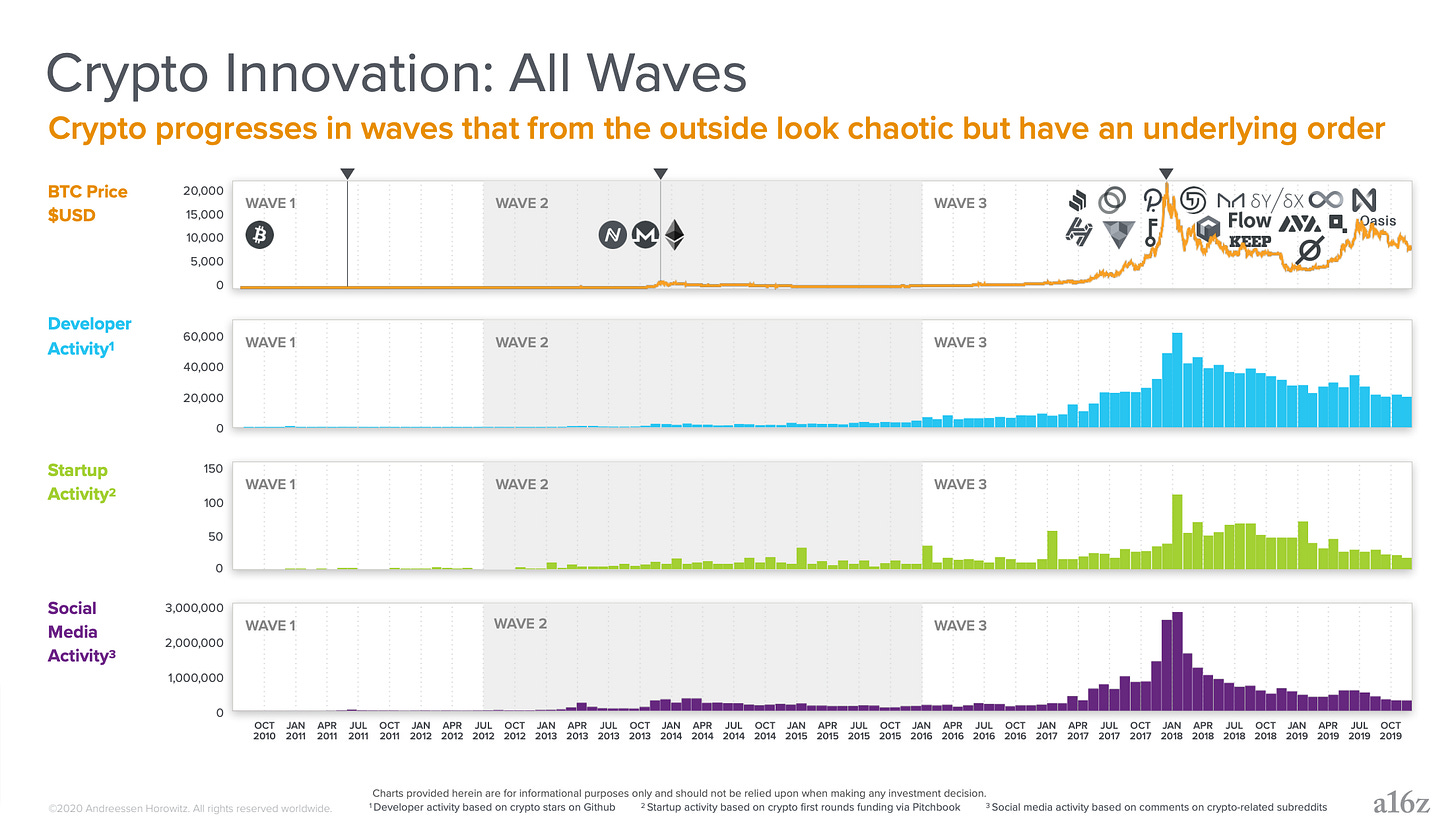

We certainly see a lot of activity in the space. Especially across social media, funding, new startups, developer activity, and the price of major coins like BTC/ETH.

Additionally, in the last few years, crypto has gone through a significant rebrand. Moving from crypto to web3 enabled us to leave behind bad experiences like the ICO boom in 2017 and market crashes.

The rebrand seems to be working. The brightest minds are pivoting careers and joining the decentralized movement. Although crypto has been around for more than a decade, we are still in the early days.

Web3 today is in a period of exploration and sophistication.

Exploration

Under exploration, I refer to working towards identifying and building use cases. Projects that leverage blockchain while delivering consistent value. Unfortunately, while DeFi, NFTs, and DAOs have emerged as innovation streams, many remain skeptical. As with every innovation in its early days, we are experiencing a phase of skeuomorphism.

“Skeuomorphism is a term most often used in graphical user interface design to describe interface objects that mimic their real-world counterparts in how they appear and/or how the user can interact with them. A well-known example is the recycle bin icon used for discarding files. Skeuomorphism makes interface objects familiar to users by using concepts they recognize.”

Interaction Design Foundation on Skeumorphism

During this phase, founders and designers are largely adapting existing use cases. Think of Letter writing > Emails and Books/Magazines > Read-only blogs during web1. It took a long time to get native web2 applications. Tools that enabled read and write functionality. Only then did we see an explosion of success cases. I am referring to social media (Facebook), productivity (Notion), and crowdfunding (AngelList).

One of the famous examples of skeuomorphism in crypto is Bitclout. The platform resembles a decentralized Twitter. Yet, the difference is that everyone gets a token. You can support your favorite influencer by buying her token. Of course, the price goes up as more people buy.

On the one hand, that’s a unique use case. A solution that directly rewards influencers without the intervention of third parties. On the other, it looks and feels exactly like Twitter. Perhaps that’s why it did not get popular outside crypto circles.

“A lot of today’s NFTs are adaptations from the offline world of art and collectibles. This leads people to think that NFTs are limited to those domains, in the same way people once thought the web was limited to brochures and magazines.”

Tokens: A New Digital Primitive by Chris Dixon

To be honest, I do not have anything against such platforms. On the contrary, I think they play an essential role. But the real value will be unlocked by web3 native use cases, not adaptations of web2 platforms.

Think of PoolTogether. That’s a native use case. Once you log in with your wallet, you can deposit money for a chance to win. Each week the smart contract picks one winner. Even if that’s not you, you end up keeping all of your money. A lottery where you can either win or save your money.

Sophistication

The second biggest challenge with web3 today is the poor UI/UX. Most projects tend to be highly technical. Hence, difficult to understand and act on. In my opinion, that holds back a lot of people from embracing web3 and experimenting in the space.

The challenge stems from how blockchain-enabled apps present an entirely new functionality. Use cases that were unseen in web2.

During the past 10+ years, we got really good at designing applications for third-party organizations. Think of apps that help us to manage our finance (banks), identity (governments and social media), transportation (Uber), and accommodation (Airbnb). Suddenly, we have a new paradigm shift. With web3, we manage our wealth without the need for a third party to interfere. In turn, designers struggle to address that complexity. After all, we cannot copy-paste proven best practices from successful organizations.

The same pattern played in both web1 and web2. The first web pages were ugly and hard to use. Likewise, the first versions of Uber/Airbnb/Instagram/Facebook were not great. It takes time to iron out the complexity and develop great UI/UX.

Having said that, we are seeing significant progress. If you compare any dAPPS from a few years back and now, you would see considerable improvement.

Meaning, web3 is going through a period of increasing exploration and sophistication. Extreme ideologists speaking of decentralization at all costs start meeting gravity. The promise of blockchain is appealing. But it will take time before we build dAPPS ordinary people can understand and use.

State of crypto in (early) 2022

So yes, it is true that there is a lot of room for improvement concerning UI/UX and native use cases. Additionally, crypto is still a relatively small portion of the global economy, even in some of the most popular use cases like “store of value,” i.e., Bitcoin.

Despite all that, we need to give web3 credit for the incredible growth it has achieved in just a decade.

Web3 funding

Intelligent people and explosive traction typically attract a lot of capital. That’s precisely what we experienced in 2021. As a result, dedicated crypto funds are reaching new records of assets under management (AUM).

OpenSea

The increasing venture capital has fueled incredible growth in web3 startups, especially NFT marketplaces. For example, in just a few years, OpenSea has achieved astonishing growth. From a seed-stage startup to a ~$13B valuation. Just look at OpenSea’s annual transaction volume:

2018: $474k

2019: $8 million

2020: $24 million

2021: $15 billion

For comparison, OpenSea did 80% of eBay's volume in Q4. All that while having less than a million users…

Helium

Web3 has touched even the world of atoms (i.e., hardware). Helium uses blockchain to create a scalable incentive and payment model for a public wireless network. As per their official website:

“Mining HNT is done by installing a simple device on your office window. That’s it. Seriously. Hotspots provide miles of wireless network coverage for millions of devices around you using Helium LongFi, and you are rewarded in HNT for doing this. And because of an innovative proof-of-work model (we call it “Proof-of-Coverage”), your Hotspot only uses 5W of energy.”

Helium’s official website

Often referred to as the People’s Network, Helium has reached more than 150,000 hotspots globally. In about two years! Meaning, Helium is the largest wireless network owned by its participants. Not any third-party company.

That’s quite a meaningful milestone. Moreover, it demonstrates how hardware businesses could be bootstrapped with the right incentives.

Decentralized finance (DeFi)

Moving away from single-use cases, let’s consider web3 verticals and DeFi in particular. The most popular protocols for exchanging tokens (i.e., Uniswap, PancakeSwap, and SushiSwap) make more than $100M in annualized revenue.

Non-fungible-tokens (NFTs)

NFT sales across platforms have seen exponential growth too. Q3 of last year alone resulted in $10.7B in sales. Thus, it is no surprise that crowdfunding solutions like PartyBid have started popping up. Such products enable groups of friends to bid on an NFT collectively. Pooling funds together is a smart way to trade high-value NFTs. In many cases, such NFTs can cost hundreds of thousands of dollars.

Play-to-earn

Perhaps, the most popular use case of NFTs today is collectibles. Collectibles are a set of assets. Some successful examples include CryptoPunks (lowest price $292K) and Bored Ape Yacht Club (lowest price $115K).

Yet, another use case is getting more popular by the day: play-to-earn. Examples of play-to-earn are Axie Infinity, Sandbox, CryptoBlades, and FarmersWorld. To deep-dive in this use case, I wrote about Axie Infinity growth in Southeast Asia (and beyond).

In August last year, Axie generated more than $342M, about 3000x year-over-year growth. The monster battling game has become the second most successful web3 project after Ethereum (revenue-wise). Ahead of OpenSea and Metamask wallet.

Decentralized autonomous organizations (DAOs)

Last but not least, I would like to highlight the fascinating growth in DAOs. While I have not written on the topic yet, it has been on my mind for a long time. This is because DAOs are such a simple yet important use case. Hence, some would argue, the most exciting innovation enabled by crypto.

A DAO is a community of people united by a mission. The governance of the community is handled entirely on the blockchain. Members of the DAO need to own a token issued by the community. That token is then used for voting rights. Meaning the community decides what and how to be built.

It’s still too early to speculate how things will develop in the DAO space. Yet, DAOs are a lot more transparent than traditional companies. As a result, risks of corruption or censorship are considerably reduced.

“Whereas most technologies tend to automate workers on the periphery doing menial tasks, blockchains automate away the center. Instead of putting the taxi driver out of a job, blockchain puts Uber out of a job and lets the taxi drivers work with the customer directly.”

Vitalik Buterin

Crypto Twitter argues that 2020 was all about DeFi, followed by NFTs in 2021, and now 2022 will be the year of DAOs. After all, more than 100 DAOs launched in the last year or so, collectively managing +$10B in assets.

A hundred DAOs may not seem like a lot, but that's because we lack the regulations to legalize them. Over time I expect all that to change. But, additionally, think about all the unique cases that will come out of that. We now have a special type of entity. An entity designed to enable communities to invest, buy businesses, support artists, develop new tools, and so much more.

WAGMI

I dislike making strong predictions because my experience has taught me better. Yet, I cannot imagine a future web3 is not part of.

Having said that, there will probably be several market crashes—an inevitable outcome given what has happened in the past and the pace of innovation.

It will take time to transition from exploration and sophistication to mainstream adoption. But in the long run, crypto is most likely an unstoppable force. Tailwinds remain strong. Capital is abundant. Talent is pivoting careers, and we have started seeing more and more successful use cases.

I will end today’s essay with Ryan Selkis’s predictions on what may happen next in web3:

“1) most likely, we experience a blow off top before the end of Q1 2022, followed by a shallower, but still painful multi-year bear market; 2) we rocket to a $20 trillion bubble that lasts all year, and sits on par with the dotcom boom in real dollars - unlikely, but possible given accommodative monetary policies worldwide, neverending government spending, and crypto’s accelerating narrative momentum; 3) we march slowly and steadily higher into perpetuity (the “supercycle” thesis). Ironically, the most bearish case here (Q1 blow-off top) may be the most bullish long-term and vice versa.”

Ryan Selkis, Founder of Messari