Welcome to another edition of the Struggle.

The Struggle is a bi-weekly newsletter where I share my thoughts and learnings from running a startup in Southeast Asia.

In a continuation of my previous two essays on Web3, I am covering the basics behind buzzwords in crypto.

Today, I am going down the rabbit hole on Bitcoin and Ethereum.

When I am excited about a new space, I try to follow Feynman’s technique for learning anything.

Richard Feynman is perhaps the most inspirational teacher I never had. His biography "Surely You're Joking, Mr. Feynman!": Adventures of a Curious Character is my 2021 favorite book.

In a nutshell, Richard Feynman observed how people mask a lack of understanding with complexity and jargon. In turn, if you can explain anything to a kid, you must have an excellent knowledge of that topic. So always strive to strip down needless complexity.

This and the following few essays are my attempt to simplify what I have learned about Web3 so far, starting with Bitcoin and Ethereum.

Bitcoin

Nothing illustrates a complex concept better than an analogy. So here you go, my favorite one.

“In a prison, there are no currencies. No one has access to money of any kind. But a prison, although small, is still a society. And a society needs to trade goods and services. Maybe someone is a barber. This person will cut people’s hair but wants something in return. Something that he can use to later go to his cellmate and give him in return for the book that he wants from him. The cellmate also needs something in return for the book to use for getting himself another book.

How do you do this without money?

Well, they use cigarettes as a currency. A hair cut is worth 20 packs. A chance to play basketball is worth 10 packs. A book is worth 5 packs and so on. There is a problem. There are not enough cigarettes inside the prison in each person’s hands to be able to do all the transactions. But everyone knows that once a week a new supply comes in. So instead of getting the packs from each other, they start “owing” each other some packs of cigarettes. Joey gets a haircut and he owes the barber 20 packs. The barber gets a book and owes John 5 packs. Once the new shipment comes in, everyone will settle their debts.

But how do we keep track of all this?

Well, everyone will have to carry a notebook with them. Whenever two people make a transaction, they both write it down in their books. Luke writes “I owe Johnny two packs” and Johnny writes “Luke owes me two packs”. This way we know who owes what to whom. But we all write everything in the same format. One transaction after another. So it becomes a long chain of transactions. If I know how many cigarettes I had at any point and go through the transactions after it, I can figure out how many cigarettes I will have.

Last problem: how do we know what people wrote in their books are correct and no one is faking transactions? I can go steal someones book and write a fake transaction in it.

Well, to overcome this we assign the wisest most trustworthy person in the prison as a witness. Whenever two people are making a transaction, he has to witness it and sign both books with his own signature. This way, we know that each transaction is witnessed by our trusted person and actually happened.

Cigarettes are bitcoin. Notebooks are ledgers. The agreed upon text format in the notebooks is blockchain. The wise persons are bitcoin miners.”

How would you explain to a layman what Bitcoin is? - Soroush Arghavan, Software engineer, independent thinker

Most people, who are not crypto fanatics, have some vague idea of what Bitcoin is. But a few people realize how in just 12 years, the cryptocurrency has become the best investment of all time as it has reached ~3,000,000x appreciation.

You can think of Bitcoin as a decentralized currency. Meaning it was not issued by a central bank like any other medium of exchange. Instead, it was issued by a computer program.

“The world ultimately will have a single currency, the internet will have a single currency. I personally believe that it will be Bitcoin.”

Jack Dorsey, Founder of Twitter and Square

Not too long ago, China, the world’s second-largest economy and the most populous country declared all cryptocurrencies illegal. Yet, today’s price of one Bitcoin is ~$61,095 (as of 17th of Oct 2021). Proving that it’s hard to devalue it by governments.

In simpler terms, it’s akin to gold. It leverages the scarce nature of gold, but it adds an element of digital transferability.

Every currency or store of value shares similar attributes. It must be scarce, portable, fungible, divisible, durable, and broadly accepted to be considered useful.

Bitcoin scores high on all that:

Scarcity - the supply of Bitcoin is only 21 million coins.

“There will only ever be 21 million Bitcoins. That property of saying there's only going to be 21 million is guaranteed by the blockchain. It is not guaranteed by the creators of Bitcoin. It's not guaranteed by the developers of Bitcoin, by Satoshi Nakamoto. It's guaranteed by the very network architecture. That never existed before.”

Chris Dixon - The Potential of Blockchain Technology

Portability - Bitcoin is a lot more portable than gold. It can be transferred digitally around the globe in seconds. Therefore, it’s cheaper to store and transfer. Not to mention, it’s instantly verifiable, whereas gold can require a slow and manual process.

Fungibility - similar to any other currency, any two Bitcoins are interchangeable.

Durability - a lot more durable than paper money and do not degrade over time.

Broad acceptability - while it has not reached the acceptability of gold and USD levels, Bitcoin has made impressive progress. That’s especially true in markets that are less stable politically.

“[Bitcoin] may not seem as compelling to some individuals who believe they live in stable monetary and financial settings, or under a government that respects property rights and the rule of law - but it becomes starkly relevant in their absence.”

— Nic Carter, Bitcoin Net Zero

No one knows what the future will bring. Bitcoin is up against gold and traditional mediums of exchange. Regular currencies have centuries of proven track records. Yet, looking at the loyalty of its community alongside the underlying innovation, it’s undeniable that Bitcoin offers an improvement over gold and fiat.

Additional resources

Matt Huang and Paradigm's "Bitcoin for the Open-Minded Skeptic"

Ethereum

Imagine Bitcoin as a valuable and defensible citadel that has proven to be a great place to store your gold in. Everyone races to store their gold in that impregnable castle because no one has ever successfully attacked it.

Ethereum is the city around that citadel. In fact, you can think of it as a network of cities that trade with each other using Ether (ETH). Then gas fees are paid to miners to ensure each transaction takes place as per the desired outcome.

Ethereum is the streets, land, buildings, pipes, electricity infrastructure, and everything else you need to have in order to build on. So now you can go to Ethereum and build your real estate or whatever else that’s important to you.

“This digital city is almost formed.

Ethereum is the foundation.

The ground on which buildings can be built.

Smart contracts are steel beams that hold the building together.

dApps are built buildings that all can see.

Solidity is the glue that holds each building together.”

Alex Lieberman, Executive Chairman at the Morning Brew

Ethereum is the second most valuable cryptocurrency in the world. Today, the market cap of Ethereum is about $420B.

Whereas Bitcoin is a combination of currency, a store of value, and a medium of exchange, Ethereum is a lot more. You can think of it as a vast distributed computer that exists around the world. Entirely decentralized.

It is one virtual machine that runs across many computers at the same time. As a result, some people argue that Ethereum is one of the most important inventions of the past decade despite current limitations.

“Ethereum is so many things at once, all of which feed off of each other. Ethereum, the blockchain, is a world computer, the backbone of a decentralized internet (web3), and the settlement layer for web3. Its cryptocurrency, Ether (ETH), is a bunch of things, too:

Internet money.

Ownership of the Ethereum network.

The most commonly-used token in the Great Online Game.

Yield-generating.

A Store of Value (SoV).

A bet on more on-chain activity, or the web3 future.”

Own the Internet by Packy McCormick

Developers can build applications on top of Ethereum using smart contracts. It is similar to how Excel works. In an Excel sheet, we can add a variety of formulas that are linked with one another. Smart contracts work similarly. Each contract can be linked to another one. In the process, creating opportunities to solve complex problems.

A popular analogy for smart contracts is vending machines. You insert money into a vending machine, and it delivers something back to you. In the same way, if you pay a fee to the smart contract, the smart contract will execute an action. The fees are paid in Ether (ETH), often referred to as “gas” fees.

Another simple example is designing a smart contract to reward your family on their birthdays. Imagine developing a tool that pays each member of your family $100 on their birthdays. Then, add the birth dates for each family member, assign the reward (e.g., $100/person), and the contract will handle the rest. Thus, annually on their birthdays, everyone in your family will receive the $100 without your intervention.

Currently, there are around 117M ETH. Like with everything else, the price is governed by supply and demand. More transactions and usage equals higher demand and thus higher costs. In simpler terms, that’s how a transaction on Ethereum looks like:

You send your friend John 1 ETH

You pay gas fees for that transaction. Let’s say .01 ETH

Your account balance goes down by 1.01 ETH. Your friend John’s account balance goes up by 1 ETH.

A distributed network of random miners on Ethereum gets compensated with 0.1 ETH to solve increasingly difficult cryptographic problems and thus facilitate the transaction.

“Owning ETH is like owning shares in the internet. Demand for ETH will go up with increased web3 adoption, while upcoming changes will decrease the supply of ETH and let more value accrue to holders. It’s like a tech stock, a bond, a ticket to web3, and money, rolled into one.”

Own the Internet by Packy McCormick"

Additional resources

Own the Internet by Packy McCormick

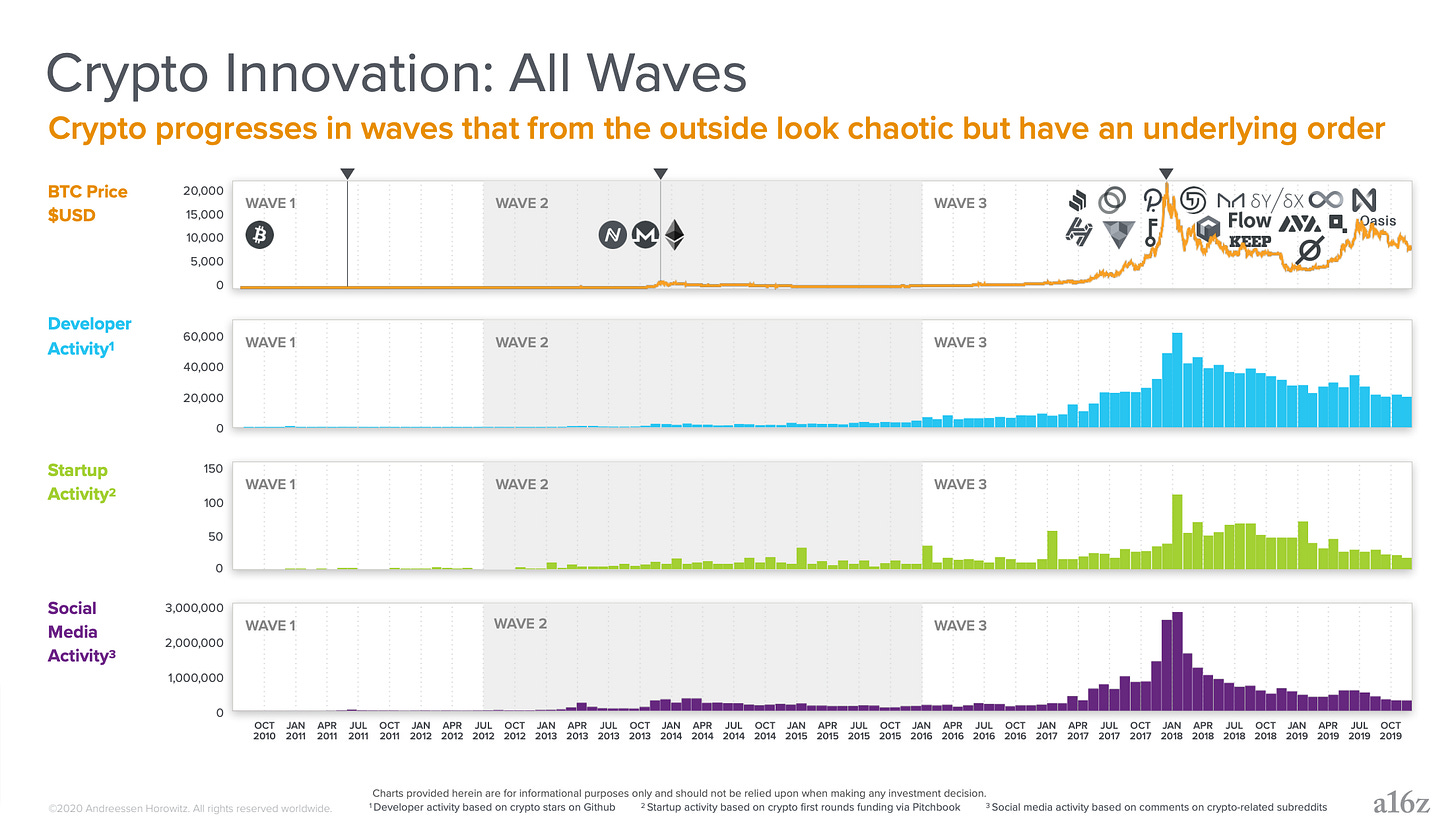

Lately, Ethereum has been in the epicenter of a lot of exciting innovations. Concepts like DeFi, DAOs, NFTs, Social Tokens have become all the hype around the world. Ethereum and other similar platforms are enabling people to cooperate like never before. The open, trustless, and permissionless internet finally has strong use cases. Cryptocurrencies like Ethereum and Bitcoin have shown us the potential behind Web3, and we are just getting started.

Unfortunately, current solutions are still slow and expensive. That was an intentional design; both Bitcoin and Ethereum are meant to be slow because of security reasons. Yet, the activity in web3 is attracting the smartest people from all walks of life. Strong financial incentives and incredible talent are usually a recipe for overcoming any obstacle. So I am sure that we will be able to have secure yet fast and affordable solutions in the near future. That’s why I am pretty excited about what’s coming next.

Stay tuned for the following newsletter, where I will cover DeFi, DAOs, NFTs, and Social Tokens.

References:

Own the Internet by Packy McCormick

The Acquired Podcast, Season 8, Episode 8, Ethereum (with Packy McCormick)

Matt Huang and Paradigm's "Bitcoin for the Open-Minded Skeptic"

Chris Dixon - The Potential of Blockchain Technology, Invest Like the Best with Patrick O'Shaughnessy