Newsletter #34: Winning fast-growth markets via Singapore 🇸🇬

9 minutes reading time. Thoughts on startups, growth, and technology 🚀

Welcome to another edition of the Struggle.

The Struggle is a weekly newsletter where I share my thoughts and learnings from running a fast-growing startup in Southeast Asia.

In a continuation of my previous newsletter, this month I am speaking at several events where I will talk on the topic of what it takes to be successful in fast-growth markets across Southeast Asia. Hence why, my essays are centered around that topic. As usual, any feedback is appreciated.

With a +600M population, an internet economy that has reached $100B, VC funding of more than $37B across more than 3000 startups, Southeast Asia (SEA) emerges as the third pillar of growth in Asia after China and India.

Source: International Monetary Fund

Founders eyeing the region from an expansion perspective often seek Greenhouse's advice on how they can be successful. Going through many such discussions, it is evident that entrepreneurs are concerned.

Concerned if they will be successful, how such an expansion will impact their runaway, growth, and profitability.

Breaking into a foreign market is hard. Breaking into an emerging economy is harder.

One of the most common strategies we have seen is entering the region through Singapore.

Why Singapore?

Competitiveness, Innovation, and Ease of Doing Business

Annually KPMG runs a survey addressing global tech leaders to find out which cities, outside Silicon Valley/ San Francisco, will be leading technology innovation hubs over the next four years. In 2020, Singapore ranked #1 as per the table below.

Source: KPMG Technology Industry Innovation Survey 2020

“Singapore, ranked seventh last year, took the top spot this year in the global rankings and offers and advanced IT infrastructure, strong government support and IP protection laws, and a deep pool of talent. As a start to economic transformation, the govrnment-sponsored Smart Nation program has been progressing since 2014, and the National Artificial Intelligence Strategy was announced in November 2019.”

KPMG Technology Innovation Hubs

To drive the point home, I researched four more global studies mapping all markets around the entire world in terms of competitiveness, innovation, and change readiness. All studies have ranked Singapore in the top 10, while three out of four positioned the wealthy city-state in the top five. The outcome being a robust external validation for Singapore's:

Modern infrastructure, including high-speed bandwidth

An urban locale that attracts young professionals

Available investment funding

A pipeline of skilled talent

Favorable regulatory environment

Positive demographic growth rate

Supporting eco-system (banks, accounting and law firms, etc.)

Generous tax and other government incentives

And here you go the reviewed studies:

The Global Competitiveness Report 2019 - Singapore ranked #1.

Bloomberg Innovation Index 2019 - Singapore ranked #6, and #3 in 2020.

Global Innovation Index 2019 & 2020 - Singapore ranked #8.

KPMG Change Readiness Index 2019 & 2020 - Singapore ranked #2.

Another important consideration is the ease of doing business in the target geography. The World Bank runs an annual study where they compare different countries on criteria like starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading across borders, enforcing contracts, and resolving insolvency.

As the graph illustrates, we are observing how each country in Southeast Asia is working hard to simplify their legal system to attract more FDI and domestic entrepreneurship, but no one beats Singapore.

Source: The World Bank

Internet Economy

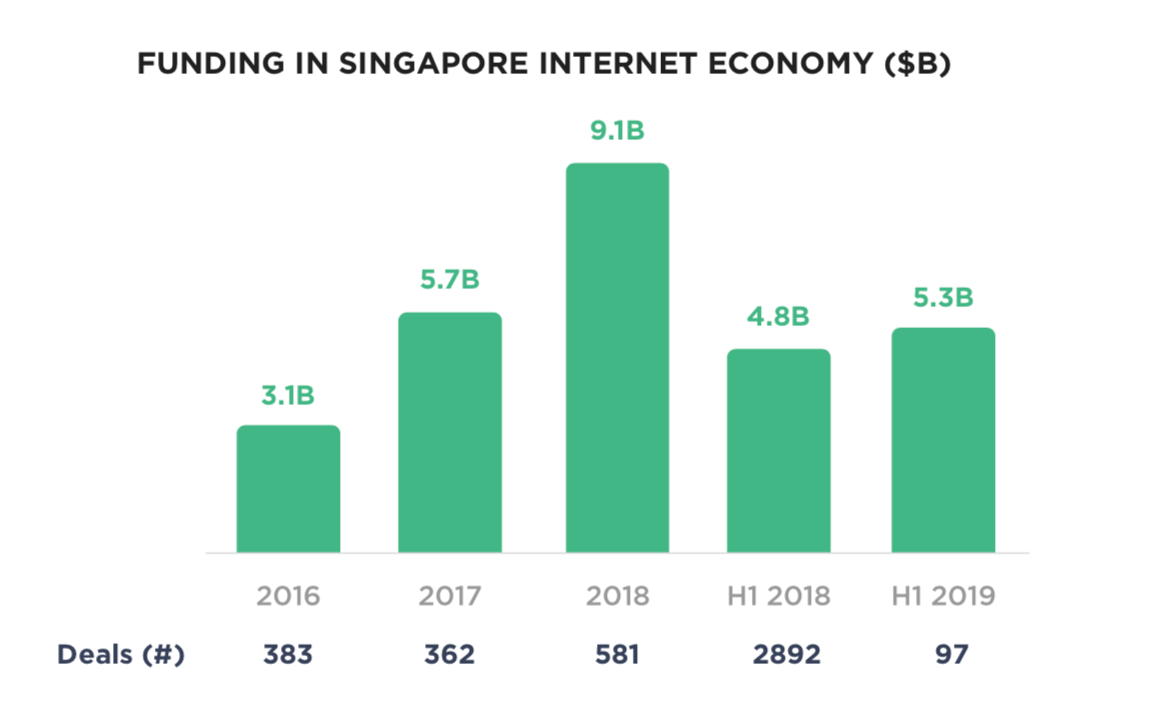

Since 2016, tech startups in Singapore have raised more than US$23B, resulting in unicorns like Grab, SEA Group, Carousell, GoBear, One Championship, PropertyGuru, ShopBack, and Zilingo.

Source: economy SEA 2019: Swipe up and to the right: Southeast Asia's $100 billion internet economy

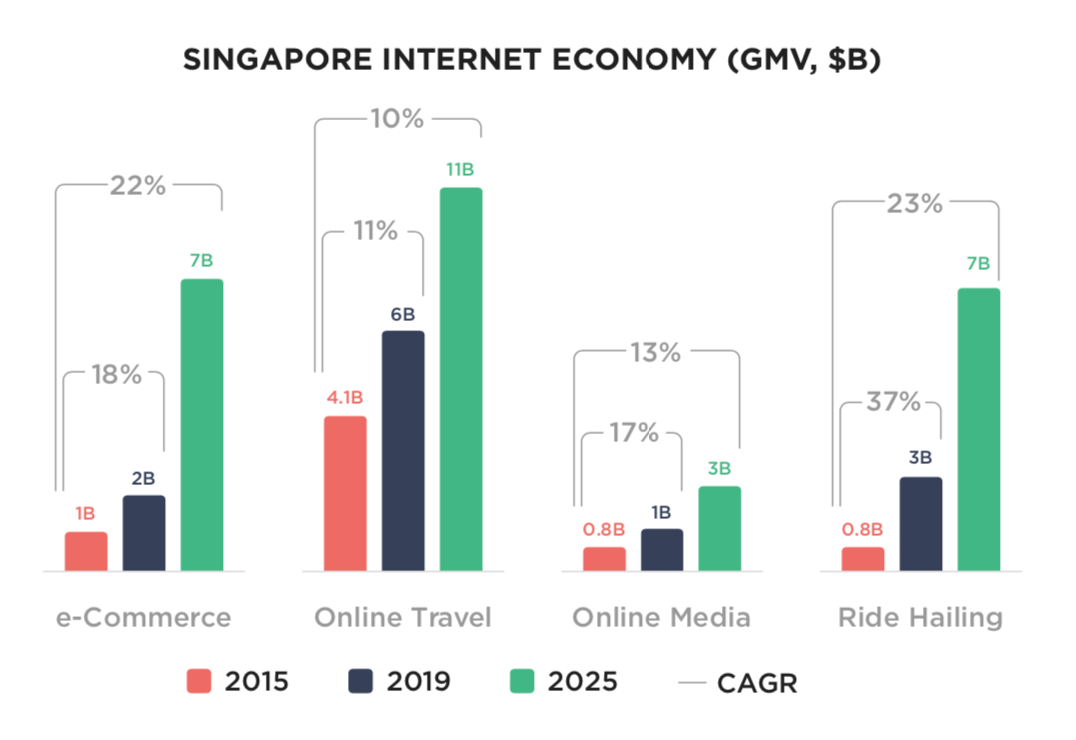

Because of the high income per capita, Singapore is often ahead on most metrics in comparison to other markets in SEA. For example, average order values in Singapore's e-Commerce sector are three to four times higher than those in the rest of the region. Although the population of Singapore is much lower than that of most countries in SEA, their internet economy was worth US$12B in 2019, which is comparable to many much larger neighboring markets.

Source: economy SEA 2019: Swipe up and to the right: Southeast Asia's $100 billion internet economy

Challenges

As with any other market, there are always pros and cons when it comes to expanding into a particular geography. In the case of Singapore, I have observed the following issues that stop companies from growing there:

Costs - Singapore is an expensive market. While starting a company can be pretty affordable, hiring people, getting an office space, and advertising can be costly.

Talent - While Singapore has some of the most qualified talent across Southeast Asia, the competition for good people is high. All large international and tech companies have their regional headquarters in the wealthy city-state, and all of them compete for more or less similar traits.

Market size - At the end of the day, the island state's population is just 5.8M people. Compare that to the 274M in Indonesia, and you can see why some companies question the need to have a presence in Singapore.

Opportunities

Here, I would like to list a few strategies we have observed foreign companies employ when expanding to Southeast Asia via Singapore.

Credibility - some startups incorporate in Singapore just so they can add the address on their websites or sales decks, thus convince prospective buyers that they have an office located in the world's leading tech hub outside Silicon Valley.

Research - in other cases, companies establish a small team in Singapore to build relationships and study the rest of Southeast Asia. In that way, they have time to nurture leads, validate the market, and close first sales without a massive investment in larger but more challenging markets like the Philippines and Indonesia. In fact, Singapore has some grants that support financially companies that have at least 30% local shareholding when expanding across Southeast Asia.

Market-Product fit - previously, I wrote an essay on how companies need to consider the market-product fit as some countries may naturally be a better fit for your model than others. If you are selling enterprise SaaS, Singapore might be a suitable market. In contrast, if you are in the business of eCommerce, Indonesia and Vietnam might be better positioned as the total addressable market is much more significant.

Tax purposes - we are currently helping a business that's expanding to China but considers incorporating in the Lion City as it will bring their taxes down considerably. Singapore has agreements with multiple countries, which allows for considerable savings in the long run.

Whatever reasons you have for expansion, it is rare to see companies regretting an expansion to Singapore.

What matters, though, is to be strategic and consider your market-product fit carefully, that will dictate what your options are. Take your time and invest in relationship-building early on. That's the only way to learn from people who have been through this experience.