Newsletter 100: economic growth and the ascending world

This is my 100th newsletter. To commemorate that, I picked a couple of topics that have been on my mind for a long time.

Economic growth.

The ascending world.

To build anything of value, it’s essential to understand how other things have been built in the first place. So I often turn to the domain of history for help. Up until now, the outcome has been both calming and reassuring. The more I study history, the more optimistic I become about our collective future.

“We study history not to know the future but to widen our horizons, to understand that our present situation is neither natural nor inevitable, and that we consequently have many more possibilities before us than we imagine.”

― Yuval Noah Harari, Sapiens: A Brief History of Humankind

One of the fascinating insights I stumbled upon was how economic growth happened. The story of how humanity shifted from no progress over a long period to accelerated growth. A development that reached unprecedented heights in just a few centuries.

To illustrate that, let’s take the UK as an example because it is amongst the first economies to achieve sustained economic growth.

From poverty to prosperity

A thousand years ago, the average British person was quite poor. There was barely any economic growth over many centuries. In fact, the average GDP in England between 1270 and 1650 was pretty similar and reached about ~£1,051 (measured in today’s prices).

Then things started changing. Most likely, thanks to the industrial revolution.

The average person's income suddenly skyrocketed from £1,051 to over £30,000.

A 29-fold increase in prosperity over a few centuries. Especially prominent throughout the past 100 years.

To truly grasp the incredible economic growth of the last ten to twenty generations, you need to zoom out further.

It’s truly a story of two worlds:

Several centuries of stagnation — People were relatively poor, and society could not achieve almost any economic growth.

Accelerated growth — A period of unseen prosperity.

Before the industrial revolution, the size of the population determined the size of the economy. The fewer people lived, the better the economy performed.

Today it may sound crazy, but life was indeed a zero-sum game back then.

Let me illustrate this with an example.

Think of the plague. The Black Death killed about half of the English population. Yet those who survived were better off. In the aftermath of the plague, farmers achieved higher output. As a result, more fertile land was available for fewer people.

Only after 1650, the world started transitioning from a zero-sum to a positive-sum mindset. At about that time, the English economy started growing despite the increasing population. Whereas before the growing population was associated with declining nutrition, health, and income, suddenly the opposite became true.

If you study the 1600s, you will notice that things started changing. Yet, it took another two centuries before the economic growth exploded.

The high economic growth of our recent history is predominantly attributed to two things: a) the industrial revolution and b) the knowledge economy.

In other words, technological progress.

It sounds unbelievable, but the last 10 to 20 generations grew their GDP per capita 15-times (roughly between 1820 and 2018).

To have sustained economic growth, we needed to continue increasing our productivity. By productivity, I mean the ratio of output to input.

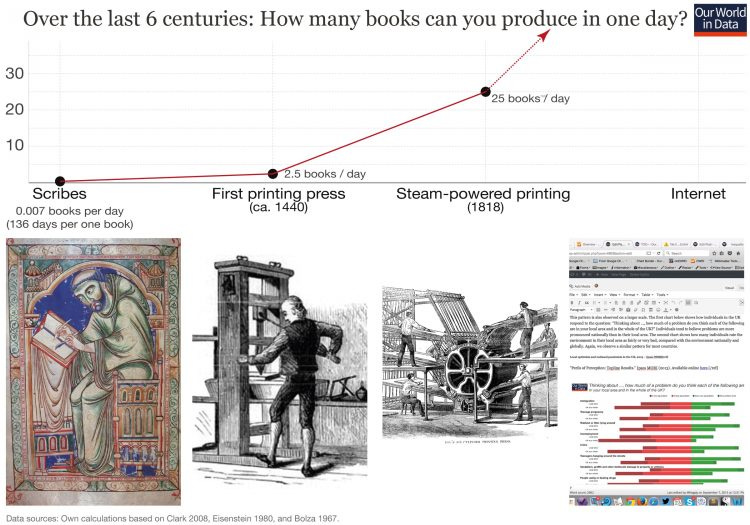

You might be wondering how that works, so let’s take the example of the production of books. Before the printing press, a scribe could copy a text like the Bible over 136 days. The invention of the printing press improved that considerably. Overnight, we could copy books at an incredible pace of ~2.5 books/day. Later, the invention of steam-powered printing increased the output to 25 books/per day!

And then the internet happened…

In layman's terms, technology allows us to do more with less. That drives incredible economic growth, correlated with various improvements in our lives.

That’s true across all sectors:

The increased productivity of all those industries led to an improved quality of life across the most critical metrics.1

Simply put, a higher living standard leads to better healthcare. Better healthcare leads to longer lives.

So people who earn more are healthier and happier.

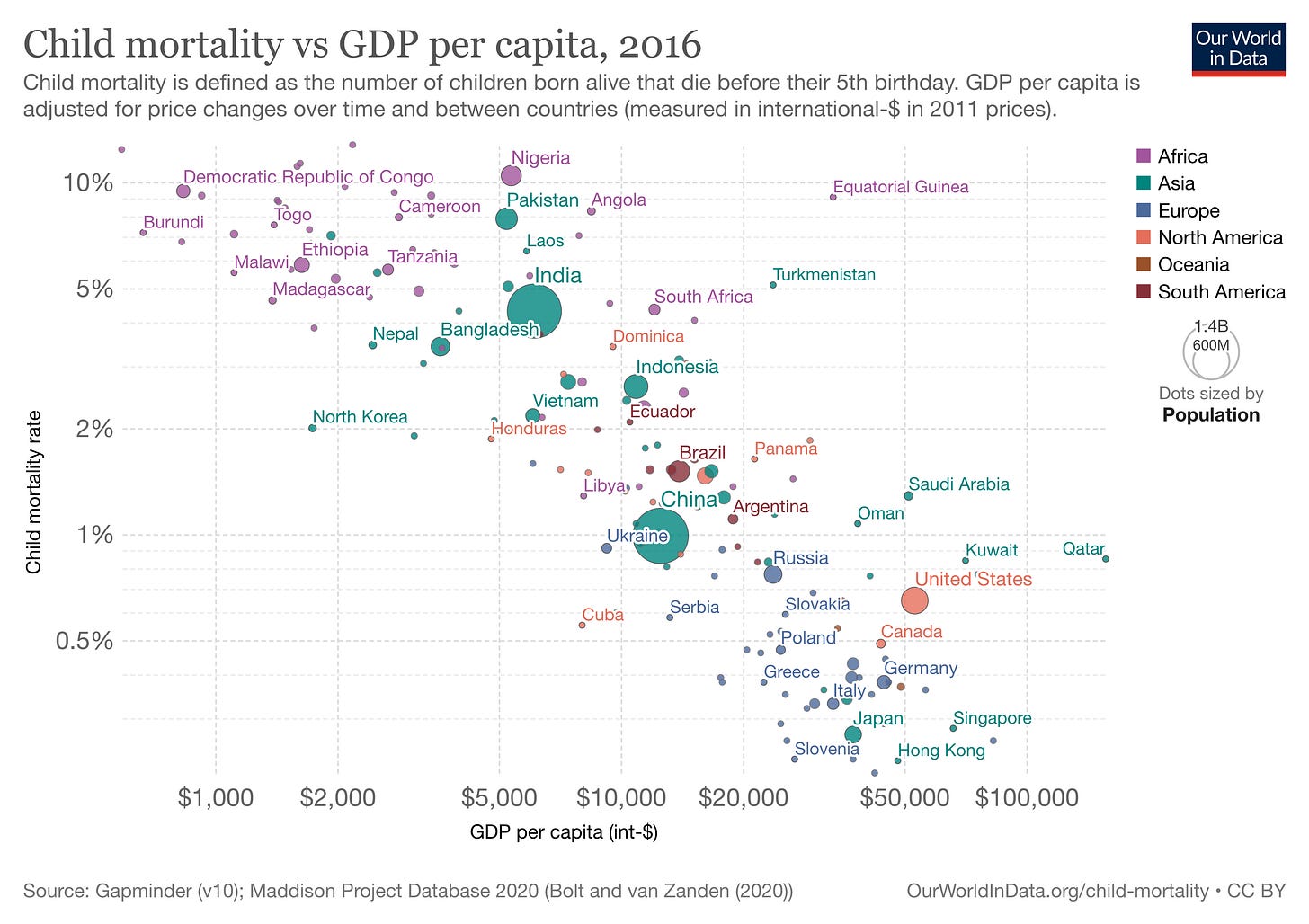

The same is valid for child mortality. As a country's GDP grows, fewer children die before their 5th birthday.

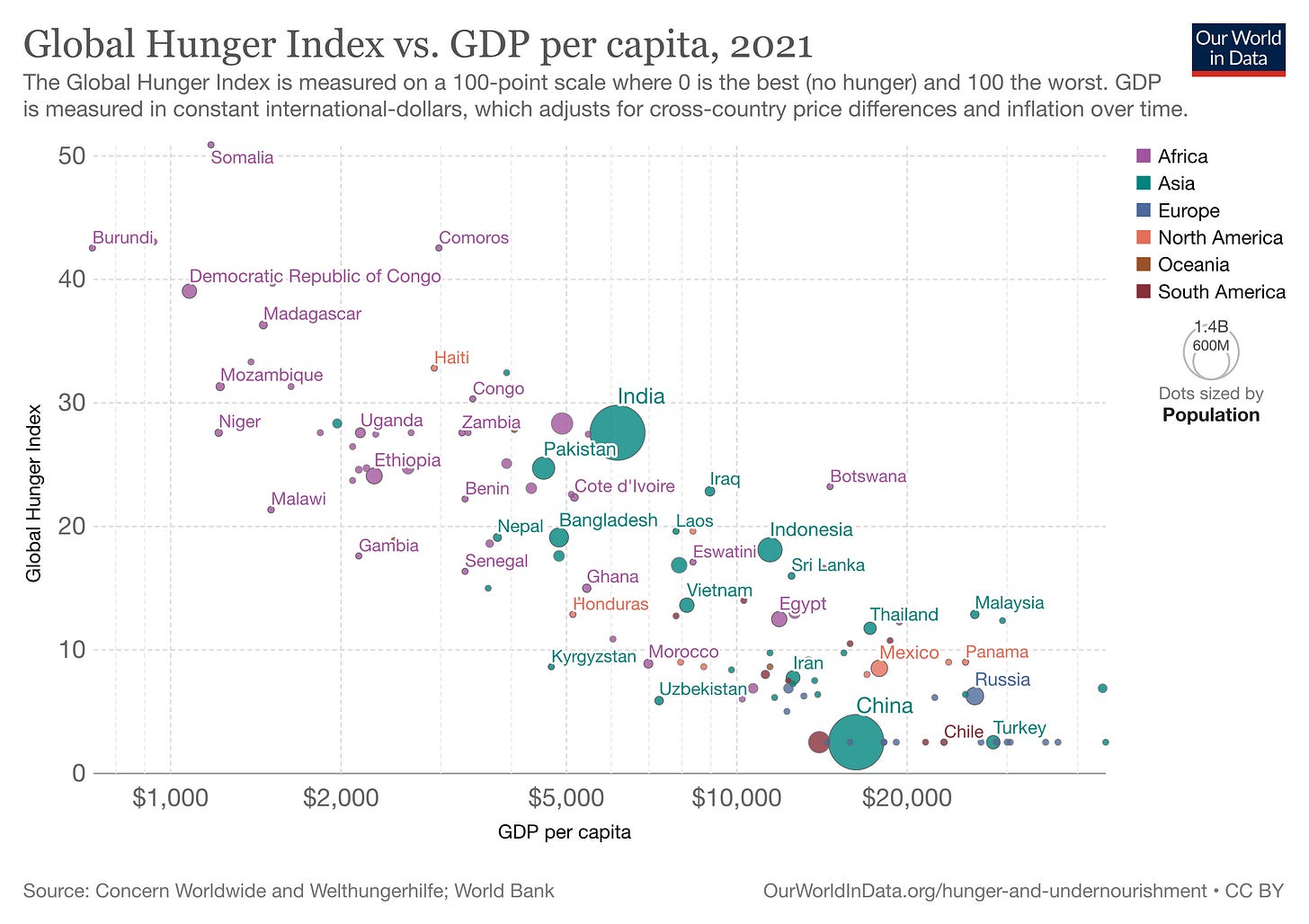

And global hunger.

While most of the world’s economy has been growing like never before, there are still a lot of challenges.

Incomes did not grow everywhere at the same pace. Even countries that were growing steadily started stagnating (think of Japan). Which begs the question, what will happen next? Are we going to continue having sustained economic growth? Is it possible to live in a world where we continuously get richer?

Predicting the future

Several possible futures come to mind. Each one is likely to happen and comes with different pros and cons.

The sovereign individual — also known as the fragmentation thesis. In short, the past favored centralization across all industries and governments. Think of radio, television, movies, etc., On the other hand, under this thesis, the future will be all about decentralization. Notable examples include personal computers, the internet, and crypto. To explore this thesis, I highly recommend you read the sovereign individual. Written in 1999, the book predicted many aspects of our current highly digital world. The most prominent example is the rise of Bitcoin.

“The empire, long divided, must unite; long united, must divide.”

The frontiers — this thesis argues that in the past, we have continuously sought the frontiers and will continue to do so. An example of the frontiers in motion is colonization. Venturing into the unknown to explore the world to discover more resources and economic gains. It can be argued that the “free” land the US found was crucial to its economic growth and current fortunes. Several possible frontiers come to mind. Opportunities that will likely drive our economic growth in the future:

The internet — Although we have had access to the internet for a few decades, there are still so many opportunities to create value. To solve problems and, in the process, connect the world even better.

Space — Think of Space X, Blue Origin, Virgin Galactic, and other similar companies’ progress. Then, couple it with the thesis on becoming a multi-planetary species. Space it’s definitely gaining more and more capital and attention.

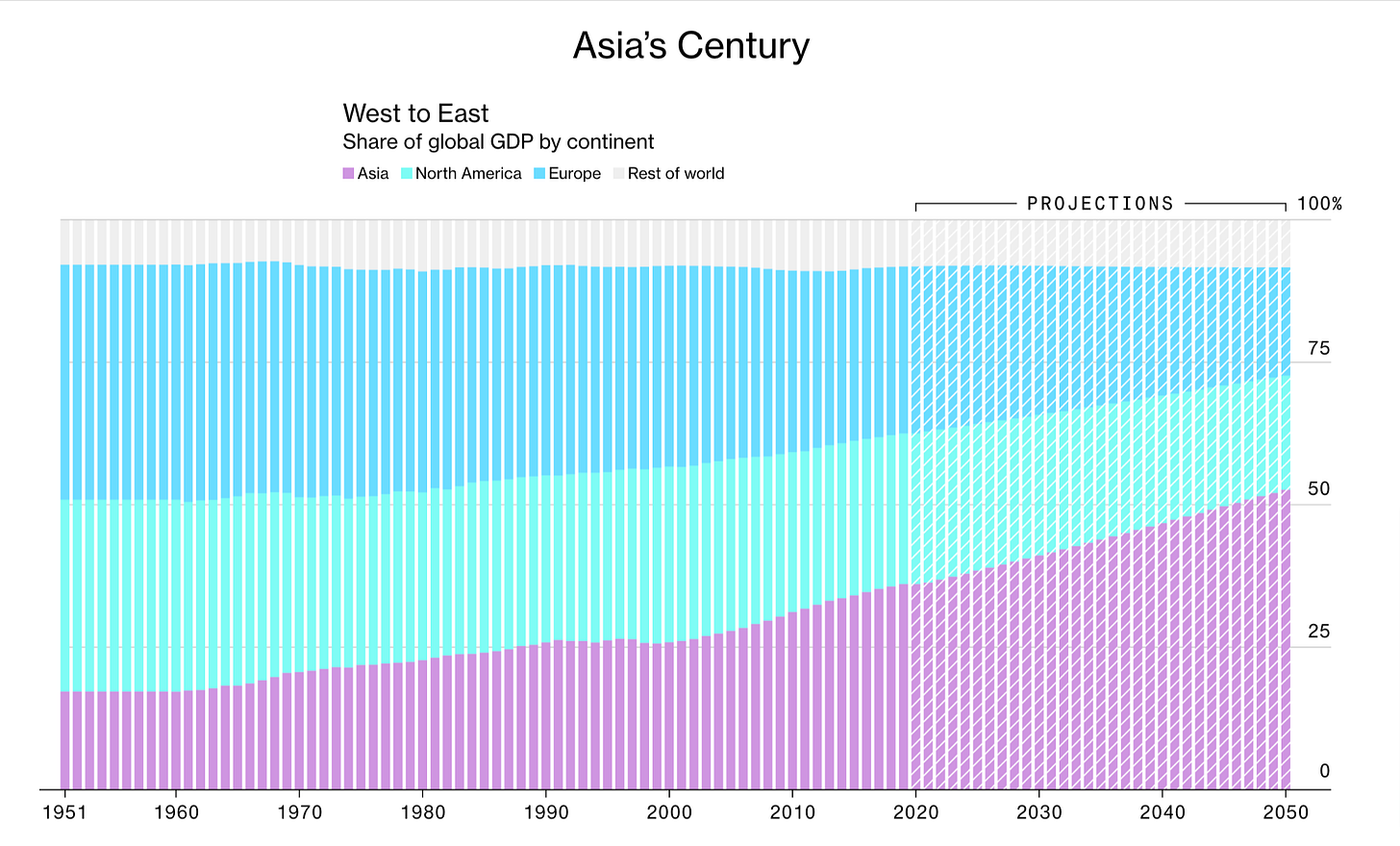

Ascending markets — Whereas some developed markets are showing signs of stagnation or declining growth, e.g., Japan, the European Union, and the USA, others keep on growing and surpassing all expectations, e.g., China, Vietnam, India, Indonesia, and Uganda. More on that later.

The fourth turning — supported by Ray Dalio, this thesis argues that we will experience events that did not happen in the course of our lives but did happen many times before. Under this thesis, conflicts erupt roughly every 75 years. That’s more or less the span of human life, so we tend to forget. Those who do not remember our history are doomed to repeat it, especially regarding monetary or military conflicts.

Most likely, the outcome would be a mix of all those predictions. I personally approach the topic as a rational optimist. Meaning embracing a positive sum mindset will solve our time’s most pressing problems.

The more we create for ourselves, the more we can give away to others. So we can grow the pie larger rather than fight over dividing it equally.

Furthermore, I am bullish on the ascending world while cautiously supporting a more decentralized future.

The ascending world

For many years, we have had the distinction of developed vs. developing world. People living in North America or Europe tend to think of their countries as the most advanced globally (with a few notable exceptions like Japan and Singapore). Yet, the more time I spend in the so-called developing part of the world, the more I am convinced how that’s not entirely true. I think Balaji’s tweet above is accurately calling the developing world ascending. The growth of those economies is just incredible to witness.

Perhaps, the most important benefit of living in the ascending world is how you can feel the opportunities. People seem to be a lot more positive about what is ahead.

Over the past decade, I have lived in or often visited Southeast Asian nations such as Indonesia, Malaysia, Thailand, the Philippines, Taiwan, China, and India. In all those countries, I experienced firsthand the economic growth and the impact on the locals.

There is an undeniable, tangible development. Roads are getting bigger and better. New highways are popping up frequently. The ever-improving infrastructure goes hand in hand with a thriving construction sector. The frantic construction leads to yearly changes in cities’ skylines. The quick pace of change is incredible to witness.

If you are skeptical, see how China built a skyscraper in 19 days, the construction of a train station in 9 hours, or how GoJek in Indonesia transformed so many industries while offering millions of jobs.

Moreover, as long as you speak English well and work hard, you can reach the top 1% of the wealthiest people in many growing economies. For example, earning $77,000 or $107,000 annual pretax income is not unreasonable in both India and China. Especially in the tech sector. I personally experienced a 420% growth in my income over six years in Southeast Asia.

The economy in all those countries is expected to continue growing. Especially in comparison to the western hemisphere.

For people residing in those countries, all their stuff has improved throughout one generation—technology, infrastructure, healthcare, living standards, access to housing, insurance, you name it.

Just take a look at the following images showcasing the capitals of Southeast Asian nations — from top left to right: Jakarta, Manila, Ho Chi Minh, Bangkok, and Kuala Lumpur.

Or the incredible growth Singapore has achieved in just 57 years. Despite its small size, Singapore has positioned itself as one of the top hubs for doing business worldwide.

While its strategic location plays an important role, the government’s proactive approach to research, innovation, workforce development, physical/digital infrastructure, governance, and policies is equally important.

The tiny nation seems to be coping fairly well in a world where western governments consistently disappoint their citizens.

In light of that distrust, Singapore’s approach to building a progressive country is a rather fresh breeze. After all, a lot of what makes the Lion City attractive could be credited to a consistent track record of great government initiatives throughout the past few decades.

Living in the ascending world makes you feel optimistic about what’s ahead. So I remain pretty bullish on two aspects a) fast-growing nations and b) a positive sum mindset.

I plan to continue writing about the promise of the ascending world in the upcoming months. Until then, onwards and upwards for a more positive-sum mindset.

The only areas that come to mind where economic growth has negative consequences are CO2 emissions and children per woman. Feel free to suggest more in the comments.