In a continuation of my previous three essays on Web3, I am covering the basics behind buzzwords in crypto.

Throughout my career, I’ve built several marketplace startups. Upon graduating with my Masters, a friend of mine and I started a lifestyle startup. We created a platform connecting photographers with people who need on-demand photography services.

In 2017, I joined another startup. We were connecting hotels with people who wanted to have an affordable yet standardized experience when traveling. As the Head of Marketing, I was responsible for attracting guests to more than 3500 rooms across 400 hotels.

A year later, I joined Greenhouse as a GM. While we started as a coworking space, we saw an opportunity to simplify finding reliable service providers in APAC early on. In turn, we launched a B2B marketplace for professional services. Today, we manage Asia Pacific’s largest curated network of service providers offering market entry services. We work with more than 200 service providers in 31 countries. So far, we've helped hundreds of startups to expand to Asia. Leveraging outsourced business development and corporate services through our network.

The journey of building three marketplaces has been invaluable. First, I had a chance to experience the good, the bad, and the ugly of running a marketplace business. Then, about one year ago, I wrote an essay, sharing my thoughts on what it takes to kickstart one.

Marketplaces are complex. Building one feels like you are running two to three businesses simultaneously. After all, you manage sellers (supply), buyers (demand), and everything in between. Yet, if successful, such models can be compelling because of the inherited network effects.

On the one hand, leveraging tech to connect supply and demand has helped us solve some of today's most significant problems. For example, think of Uber's impact on transportation or Airbnb on accommodation. But on the other hand, marketplaces are often ctizied because of:

High rake rates - think of Apple charging 30% for their AppStore and the uproar from companies like Epic and Spotify. The larger the marketplace, the more it tends to charge for each transaction.

No upside - If you are lucky enough to build a lot of liquidity and transactions, most probably you have raised a lot of capital. It isn’t easy to kickstart such a complex model without sufficient capital. Meaning, now it’s time to pay your investors back. That’s rightfully so because they took a risk on you. So in the event of an exit, investors, founders, and employees are sharing the upside. But what about the buyers and sellers of your marketplace? The people who you actually wanted to help in the first place?

Centralized control - yes, it is true that Uber drivers and Airbnb hosts have access to new revenue streams thanks to those startups. But they are at the mercy of the platform. The marketplace can delist them, increase its commission rate or dictate who gets more clients and who does not.

The outcome of high rake rates, no upside, and centralized control creates dramatically misaligned incentives.

Perhaps the most famous example of marketplaces gone wrong is food delivery networks (e.g., DoorDash, Grab, GoFood, etc.). If you speak to restaurant owners, you will quickly realize how they are not terribly pleased with such platforms. However, when a marketplace reaches critical mass, it starts having considerable power. To the extent that the platform can push the supply side into negative margins on its menu items. Not to mention abusing power. Think of how in 2019, DoorDash collected millions of dollars of tips and booked them as revenue. Pretty much stealing the money from its users.

Throughout the past decade, it has been challenging to build a model that satisfies all parties involved. While the world is a better place because of the success of companies like Airbnb, UpWork, and Uber, marketplaces receive a fair amount of criticism. To be honest, I have been as much a part of the problem here as anybody who built a marketplace business. So I started thinking, is there a better way to run one?

At about the same time, I started reading on web3. That helped me realize how there are ways to fix many of the problems mentioned above. So let’s illustrate how the decentralized web can solve many issues with web2 native marketplaces.

Traditional VS web3 enabled marketplaces

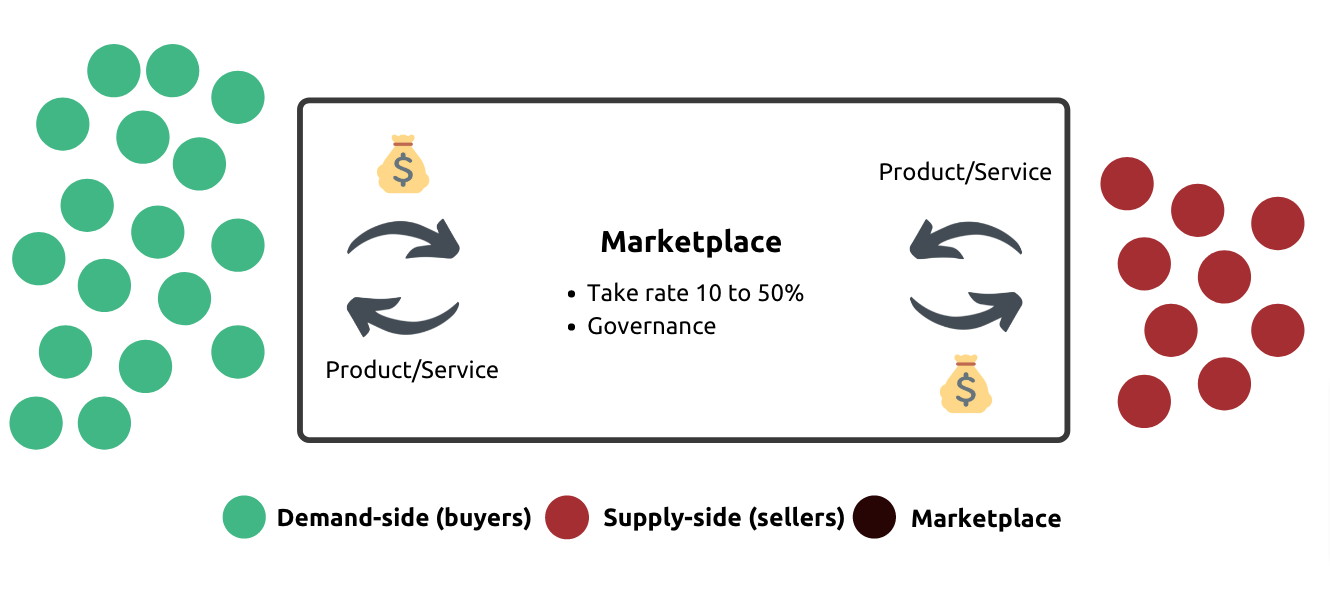

In a traditional marketplace, the dynamic is pretty straightforward. You have supply (sellers), demand (buyers), and the marketplace itself being in the middle. The platform charges commission to handle transactions and police the network.

In Web3 enabled marketplaces, things start getting a bit complicated. We still have supply (sellers), demand (buyers) but the marketplace itself is owned by all parties. Meaning, the users who make living thanks to the marketplace can “take control” of the platform through tokens.

Tokens are used to make payments, vote on important features, and manage overall governance. In traditional marketplace models, the users of the platform and the platform itself often become enemies over time. Whereas in web3 enabled marketplaces, that’s not possible. It’s all a result of well-aligned incentives.

To be fair, web2 marketplaces like Uber and Airbnb are not able to give ownership to millions of drivers/hosts around the world even if they want. It’s an incredibly complicated and regulated process. But, on the other hand, you can quickly spread control with blockchain-based tokens, no matter the location of each user. Platforms like Ethereum enable that. You can create tokens and program smart contracts that police the network the way you see fit, without human intervention.

Sounds impossible? Not quite. Let’s take a look at Braintrust.

Braintrust

If you are not familiar with Braintrust, here you go an excerpt from their website:

“Braintrust is the first decentralized talent network that connects highly skilled technical freelancers with the world’s most reputable brands like Nestle, Porsche, Atlassian, Goldman Sachs and Nike. Braintrust’s unique business model allows talent to retain 100% of their earnings and enables organizations to spin up flexible, skilled teams on-demand at a fraction of the cost of traditional staffing firms. This new business model that limits fee extraction and enables community ownership is uniquely enabled by a blockchain token.”

Braintrust’s official website

On the outside, it looks like any other marketplace for freelancers. But the mechanism that powers the platform is entirely different.

First of all, Braintrust is non-profit. Meaning, all revenues collected through the platform are distributed to the people who support the platform—either using their token BTRIST or in cash.

The thesis of Braintrust is to replace intermediaries that are extracting disproportionate value. For example, in the case of UpWork or Fiverr, the platform collects 25 to 40% of every transaction. On the other hand, Braintrust takes 0 from talent. Instead, the organization collects a 10% flat fee from clients, rewarding whoever brought the client onto the platform.

In fact, there is no Braintrust company, just a bunch of smart contracts on Ethereum.

The more you study their model, the more interesting it gets. In a recent interview with Acquired.fm, Adam Jackson, the CEO of Braintrust, mentioned how there are six different core teams behind Braintrust. Each team represents an independent entity. Those entities collectively employ about 30 people. Adam Jackson is, in fact, the CEO of one of those six entities called Freelance Labs. The other five entities operate independently.

“…our community does all the coding and that kind of stuff. So it's really like we kind of started it off decentralized, so we wouldn't have to like contort ourselves later.”

Adam Jackson, CEO of Freelance Labs

The objective of Braintrust is to ensure that all people who care about the rules of the network can earn control fairly. To achieve that, they distribute tokens, and each token represents one vote. The only way to get the brain trust token - BTRIST is to help build brand trust by supporting the network. That can be done in various forms. To name a few, bringing clients, developers, improving the software, etc.

Having said that, in the early days, Braintrust sold about 20% of all existing tokens to early backers and investors.

“we have 10s of 1000s of community contributors that contributed in some small way or some larger way. But outside of the small amount we sold (to early backers) the only way to get the token is to help build the network. And so that could mean dozens of things. It could mean like writing copy for us or building UI or committing code or writing a smart contract or auditing those smart contracts, all the things…”

Adam Jackson, CEO of Freelance Labs

Having said that, starting such network businesses is hard. That’s why in the early days, Braintrust raised about $30M and hired a few people to help with reaching sufficient traction. But once the network gains a critical mass of users, it gets self-sustained. To illustrate how it works, consider the following example.

Let’s assume that you are able to bring a new client to Braintrust. Not too long after you onboard them, that customer hires one of the developers listed on the platform. Since Braintrust is built on Ethereum (thus, it works with smart contracts), you will be automatically paid 10% of whatever the client pays for hiring that developer. No middle man fees. No platform charges. You get 10%.

Maybe someday the community will collectively decide that 5% is more appropriate and build a new smart contract to handle that, who knows. But the point remains. Braintrust is decentralized. The community has control of significant decisions. That was considered impossible up until recently. In web2 applications, we rely on a group of executives or product managers to make critical decisions. As Chris Dixon argues, "Instead of don't be evil (Google’s motto), it (web3) can't be evil. It cannot change the rules.”

And Braintrust is not the only marketplace experimenting with community ownership.

Audius

Audius is such an interesting case because of two reasons. One, it’s built predominantly on Solana (an Ethereum like blockchain). Two, because it has massive adoption with nearly 6M users.

In a nutshell, Audius is a digital streaming service that connects fans directly with artists and exclusive new music. The keyword here is direct because Audius is fully decentralized. A network of operators runs the platform. Meaning artists and fans have come together to manage Audius as a community.

The company was started in early 2018. By now, it has 6M monthly users and over 100,000 artists. While that number may not sound large compared to platforms like Spotify (+400M users), it’s one of the most used web3 platforms out there.

Music is such a fascinating industry. Pretty much everyone listens to music, yet, the music industry is worth only ~$25B globally. Compare that to the video gaming industry, which has an estimated size of ~$65B in the US alone.

Logically, that cannot be right. A lot more people listen to music than play video games. But the way the music industry has been controlled by intermediaries (i.e., music labels) makes it challenging to innovate. The music label model is not entirely bad, though. It is suited to a world where there are one hundred artists that matter. Music labels exist to discover and support the next big hit. In turn, it does work well for a certain caliber of artists.

Unfortunately, most artists are not fortunate enough to end up working with music labels. Audius gives an alternative to that path. The network enables artists to own rights to their music and share it with the world on their terms.

Perhaps by now, you are wondering how does decentralization helps this?

“What decentralization does here is, it removes any company or set of individuals from being in a position to make decisions like that. So they are not able to undermine both the integrity of the platform and the ability of users to get the same value from it as they have been previously.”

Roneil Rumberg, Audius CEO

Let’s illustrate the benefits of Audius’s decentralized model:

Security - the people who run the network buy and stake Audius tokens. In the event any of them misbehaves, that person can get penalized against the stake they hold. That provides a level of economic security around how the network runs.

Distribution - the token grants certain types of distribution features. As an artist, depending on how many $AUDIO tokens you stake, your distribution power within the network may grow.

Governance - on October 23rd, 2020 Audius network officially launched. From that moment onward, the company was incapable of changing the code that powers the platform. Decisions like how the music is uploaded, searched, curated, etc., were handed over to the community. To make such decisions, you need to make a governance proposal and convince the community why there is a need for a change. Then, you can initiate a vote, and only if you have a sufficient number of users supporting you, the new feature will be implemented.

“we actually aren't capable, I think of making some of those core decisions that many other platforms have have made previously, when they reached a certain level of scale, like pulling the rug out from under their API, for example.”

Roneil Rumberg, Audius CEO

The image below illustrates the total circulating supply of $AUDIO tokens alongside who owns what.

Let’s use a few practical examples to showcase how Audius has designed incentive programs to drive good behavior. One, as an artist, if your song crosses a certain threshold of listening/engagement on it, you get paid. Two, as a listener, if you curate a playlist that ends up being popular, you will get paid in $AUDIO too.

Over time, community ownership has spurred many exciting projects. In turn, third parties have built several cool apps. For example, if you make an account on Audius today, you won’t be using the core app but one of those third-party projects. Another community-led project is a music racing game where you steer your car around, and through obstacles in sync with the beat of the music you are listening to.

Having said that, the Spotify or Apple Music experience is far superior to Audius’s one. Yet, as the platform grows, I am sure that will change. We will see more unique features driven by a loyal audience. Skin in the game naturally increases loyalty and incentivizes word of mouth.

It’s fascinating to observe the evolution of marketplace models. Utility tokens enable governance directly by the community. That was not possible up until recently. Traditional marketplaces required a centralized body to police and grow the network. Web3 is changing all that as it enables internet-native economies.

“tokens are the fundamental unit of value in crypto economies. They are (as has been argued by others too) a breakthrough in open network design, because they are a mechanism for incentivizing open network participants, including users, developers, investors, and service providers.”

Patrick Rivera, Software engineer at Mirror.xyz

While everything sounds great, there are some issues I will need to highlight. One, although Audius is growing nicely, its UX and traction are nothing like Spotify’s. It will take a while before Web3 is able to create as intuitive a user experience as what we are used to. Two, despite all growth in the space, there is still a shortage of talent. Three, there is a risk of over financializing relationships. And fourth, high transaction (gas) fees.

To address all that, web3 enabled marketplaces will need to understand the interplay between supply and demand deeply. Building internet-native economies is not easy. But if successful such platforms will distribute wealth like never before in human history. Instead of relying on a centralized group to decide what’s good and evil, the community decides. Don’t be evil, becomes can’t be evil.

“To me, the goal of crypto was never to remove the need for all trust. Rather, the goal of crypto is to give people access to cryptographic and economic building blocks that give people more choice in whom to trust.”

Vitalik Buterin, Co-founder of Ethereum