Welcome to another edition of the Struggle.

The Struggle is a bi-weekly newsletter where I share my thoughts and learnings from running a startup in Southeast Asia.

As a thought experiment, I will be releasing a few articles breaking down problems I would be addressing if I am to start a new company tomorrow.

One of the things I regret not doing earlier in life is investing.

Growing up in Bulgaria, it was not common for most people to invest their savings, except when buying a property. At least in my circles, buying real estate was considered the safest thing you can do with your money. Whether that’s true or not, it’s up to you to decide. But it’s undeniable that buying real estate has considerable barriers to entry as it’s quite expensive for the average person. In turn, most people do it once or twice in their life.

Stock trading used to have similar barriers to entry. If you wanted to invest some of your savings, you would rely on a broker to advise and execute the transactions. Not to mention the high minimum investment requirements you may have to hold for thirty days and the complexity of the industry as a whole. If you get the wrong broker, you may get lost in translation given the industry jargon.

Luckily, the internet has unleashed a lot of innovation, and companies like Robinhood, Revolut, Acorns, and Wealthfront, to name a few, are changing all that.

''People used to have to call a broker and ask, 'What's up with my stock? Now this revolutionary information resource has popped up and liberated them.''

David Gardner, co-founder of the Motley Fool

Innovation in retail investment

Whereas before, we relied on brokers to guide each of our steps and needed to pay handsomely for that. Today, we have access to many well-designed solutions that cater to the needs of all sorts of people (that’s especially true if you are located in a developed market).

In my view, the following innovations have gradually eliminated friction, making the process of investing much faster and cheaper than ever before:

Communities - companies like Finimize, Seedly, and Robinhood Snacks, are doing a great job in providing credible information at scale. In the process, removing complex jargon and adding a community element to discuss your investment challenges and strategies with other people who have similar income and aspirations.

Free trades - Revolut, Robinhood, Acorns have eliminated the commission per trade, which was a massive pain point for most people.

“At a time when stock trades at other discount brokers like Schwab and E*Trade cost $5 or $10 per trade, Robinhood pioneered the concept of commission-free trades. It wouldn't be until 2019 that its largest competitors followed suit, but they eventually did, and today free trading is commonplace for individual investors.”

Robinhood's Bull Market, The Flywheel

Instant deposits: through traditional financial institutions, it can take several days to set up and fund a new account. In fact, at the moment, I am going through Saxo Markets’s KYC process, and it’s painful. If you do not have a ton of documents ready, it can take you quite a long time to set up an account. Once again, startups like Revolut make the process a lot faster.

Fractional shares: Most people cannot afford to buy one share of Google, Berkshire Hathaway, or Amazon, as the price is thousands of dollars per share. In turn, enabling users to trade with fractional shares as low as $1 has expanded the market considerably. Once again, Robinhood and Revolut come to mind when thinking of Fractional shares.

Cryptocurrencies: Given the rise of Bitcoin in the past 12 years to 3,000,000x appreciation, it is now the world’s best investment of all time. Whether you support crypto or not, it’s undeniable that more people than ever before have embraced bitcoin and other similar cryptos as a form of wealth storage. In addition, platforms like Coinbase, Binance, Robinhood, and Revolut have made the process of investing in crypto a lot more accessible, creating a lot of wealth in the process.

All that has led to a surge of demand from first time-investors. Consider the increase in brokerage accounts in Robinhood alone, illustrated below:

The result of eliminating all that friction is getting educated and investing at a meager cost. This leads to unlocking a ton of wealth as we now understand and have the tools to compound our wealth. Just a few clicks on your smartphone, and you can tap on relevant communities, ask questions, educate yourself, invest, diversify, and most probably have better returns than what your bank is currently offering.

The democratization of stocks and crypto investment has encouraged the digitalization of other adjacent verticals that are getting popular with first-time investors, too (I won’t cover index funds, ETFs, bonds, and other similar instruments as it’s quite common for platforms like Robinhood, Acorn, and Revolut to enable such trading).

Let me give a few examples of how other verticals are being disrupted, allowing regular people to trade art, games, real estate, and other equities like never before in human history:

Masterworks - is democratizing access to investments in blue-chip art. As a result, regular people can now invest as low as ~$2000 in multimillion-dollar paintings.

Fundrise - is doing something similar with real estate. Users of Fundrise can invest in a low-cost, diversified portfolio of institutional-quality real estate. You can start as low as $1000.

Rarible - non-fungible tokens (NFTs) were all the hype in the past several months as we have seen an explosion of digital art and media being converted to NFTs. As a result, marketplaces like Rarible, OpenSea, SuperRare, and other similar platforms are on the rise as they help you store, display, trade, and mint (create) NFTs.

Kickstarter - I see crowdfunding platforms more as a marketing channel rather than an investment instrument, even though I am sure there are plenty of cases of companies that raised capital solely through crowdfunding platforms.

Perhaps the most interesting ones are the crowdfunding marketplaces that offer equity in startups in exchange for cash (MicroVentures and Fundable), giving you a sense of what it takes to be an angel or work in VC.

Republic - crowdfunding games are not new. However, what Republic does differently here is that users can invest in the game's success in addition to rewards. Like buying stock in a company, you buy a stock whose returns will be based on the game's sales revenue.

The list goes on and on, from stocks to cryptocurrencies, games, real estate, and fine art. It seems like all verticals are now open for regular people to invest at low rates without feeling ripped off in the process, which begs the question, what’s next?

$1K angel checks

There is definitely a fair bit of innovation in the retail investing space, making the process of investing for regular people more accessible. But what are the remaining opportunities given everything I have shared so far?

As a person who spent the past six years running startups around the world, one thing I have noticed is that the processes of a) fundraising and b) reaching product-market-fit remain quite hard.

Having said that, there are more venture capital firms than ever before. In addition, more institutions and high-net-worth individuals are embracing the concept of investing in early-stage, high-risk companies because of the potential asymmetric upside.

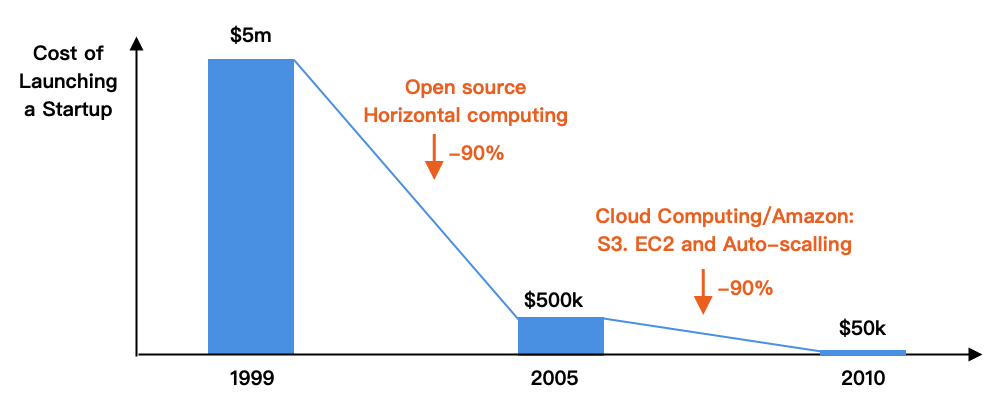

Additionally, the costs associated with starting a new business have decreased considerably in the past 20 years.

In turn, more people are starting tech businesses than ever before. The outcome is quite well illustrated by the following picture, which breaks down only SaaS startups focused on marketing 🤯.

The sudden increase in new startups brings a lot of innovation but also a lot of challenges for founders, to name a few:

Hiring good talent gets increasingly harder, especially for technical roles.

Customer acquisition costs are going through the roof. As a result, a lot of VC money is spent inefficiently on Google and Facebook.

It’s hard to raise capital because many startups are competing with you.

Although there are plenty of companies out there, it’s hard to invest in startups because the minimum threshold of becoming an accredited investor is quite steep at up to $1,000,000 in some markets.

I have faced each problem mentioned above myself. Unfortunately, it’s getting increasingly harder to compete for talent and attention in today’s environment.

Where am I going with all that?

What if you build a solution that allows founders to bring great people as investors for as low as $1000?

In my experience, when running a startup, you meet all sorts of incredible people. Often you try to bring them on board as employees, investors, or advisors, but sometimes the timing is not right. For example, some people have vesting shares; others receive a lot larger salary than what you can afford to pay; the third group of people wants to start something on their own. In turn, it’s hard to make the best out of such relationships when the timing is not great.

Yet, if you invite all amazing people you meet to invest in your business for as low as $1000, that will ensure the following:

They will pay close attention to your business and do everything possible to support you with advice, referrals, recruitment, and even bringing in customers.

Assuming that the business goes well, you will make them a lot of money, which in turn will strengthen your relationship with them.

It’s an incredible learning opportunity for every investor.

@Daudex Writing small one-off checks gets you on the Cap Table & exposes you to startup's network of supporters. 99.5% of time, the lessons & opportunities from joining this network will be more valuable in the long-run than the likely returns from your soon-to-be-diluted shares.

@Daudex Writing small one-off checks gets you on the Cap Table & exposes you to startup's network of supporters. 99.5% of time, the lessons & opportunities from joining this network will be more valuable in the long-run than the likely returns from your soon-to-be-diluted shares.Although people will invest as low as $1000 in a business, they have the incentive to bring many other angels or VCs who are willing to put in a lot more.

The only downside I see is that we do not have a great solution out there which can help you manage all the paperwork and the process of raising many small checks.

AngelList is the best solution at the moment (to my knowledge), as they have introduced Rollup Vehicles and Syndicates, which makes the process a lot simpler.

Unfortunately, both solutions require you to be an accredited investor with a net worth of at least $1,000,000. Last time I checked, most people do not have a net worth of $1M.

There are ways to go around some of such rules; after all, the world is a lot more connected than ever before, and some geographies have better requirements. The moment someone figures out a solution to this problem, a lot more wealth will be unlocked.