Welcome to another edition of the Struggle.

The Struggle is a bi-weekly newsletter where I share my thoughts and learnings from running a startup in Southeast Asia.

A week ago, I was having a conversation with one of my friends who works in the public sector on how some countries/cities are punching way above their weight.

Think of places like Taiwan, Singapore, Hong Kong, Dubai, and Silicon Valley. Most of those places are relatively small, yet they have managed to attract incredible talent and develop some of the world’s best financial and tech ecosystems.

I like to think of the above-mentioned locations as startup cities because their size is disproportionate to their value. As far as I know, the term “startup city” was coined by Balaji in a recent tweet talking about major trends during the past 20 years.

Given the global pandemic, there is strong momentum behind the development of such startup cities. For the first time, pretty much everyone was forced to work remotely and realized how that’s not such a crazy idea.

Knowledge workers can now prioritize a better lifestyle and vote with their feet when the governance of a city does not live up to their expectations.

After all, if you could work from anywhere, why stay in a location that does not provide a great lifestyle?

Jakarta to Bali

I spent the past four years in Jakarta, Indonesia. Only when COVID hit, I started thinking about relocating to a different place.

Before that, I did not see a reason to experiment with working from elsewhere. The city brought a lot of business opportunities, leading to meetings with many interesting people. Top it all with a strong relationship-focused culture, and you can see why it’s not an easy choice to move elsewhere and do business remotely.

Yet, once COVID took place and all kinds of businesses were forced to shift to remote work, I started entertaining the idea of relocating to Bali or Singapore.

My thought process ran through the following questions:

What would be the cost of living in a new location?

What’s the quality of life there? Is it fun, how is the weather, can I do a lot of activities?

Would I fit into the local culture?

Is the culture nationalist or globalist?

What kind of growth opportunities would I have access to?

In turn, I decided to give both locations a shot, starting with Bali and eventually to move to Singapore.

When I moved to Bali, my first impression was that the same amount of money that got me one small bedroom flat in Jakarta’s city center allowed me to stay in spacious villas and 5-star resorts.

Even with all COVID precautions, I was having a much more active lifestyle while keeping my costs at the very same level as in Jakarta.

Assuming that your job allows you to work remotely, the timezone is not too different, and the quality of your life can actually increase while the costs remain the same (or lower), it’s a no-brainer choice.

“Like a teenager, society is going through an awkward transition from purely physical reality, to a digitally enhanced existence. Work that has required traditionally present labor can now be done digitally. Remote work now enables this emergent social class to reprioritize their wants and needs.”

The sovereign individual weekly

Bali to Singapore

While Bali lived up to my expectations regarding great quality of life, outdoor activities, healthy food, and interesting people, it failed on one important criterion - growth opportunities. That’s why I did not consider it as a permanent stop and eventually moved to Singapore.

Most digital nomads based in Bali rely on jobs secured in their home countries/abroad. Should you lose a great job while in Bali, it might be difficult to get an equally good one (or better) via your network there.

That chain of thoughts led me to reflect on what else needs to occur for a destination to grow into a true “startup city” where lifestyle and opportunities are world-class.

For example, what makes Singapore such a progressive and attractive place despite its size?

To answer that question, I mapped several global studies to see how Singapore compares to other parts of the world.

Competitiveness, Innovation, and Ease of Doing Business

Annually KPMG runs a survey addressing global tech leaders to determine which cities outside Silicon Valley/ San Francisco will be leading technology innovation hubs over the next four years. In 2020, Singapore ranked #1 as per the table below.

“Singapore, ranked seventh last year, took the top spot this year in the global rankings and offers and advanced IT infrastructure, strong government support and IP protection laws, and a deep pool of talent. As a start to economic transformation, the govrnment-sponsored Smart Nation program has been progressing since 2014, and the National Artificial Intelligence Strategy was announced in November 2019.”

KPMG Technology Innovation Hubs

To drive the point home, I looked at four more global studies mapping all markets around the entire world in terms of competitiveness, innovation, and change readiness. All studies have ranked Singapore in the top 10, while three out of four positioned the wealthy city-state in the top five. The outcome being a robust external validation for Singapore's:

Modern infrastructure, including high-speed bandwidth

An urban locale that attracts young professionals

Available investment funding

A pipeline of skilled talent

Favorable regulatory environment

Positive demographic growth rate

Supporting eco-system (banks, accounting and law firms, etc.)

Generous tax and other government incentives

Here you go the reviewed studies:

The Global Competitiveness Report 2019 - Singapore ranked #1.

Bloomberg Innovation Index 2019 - Singapore ranked #6 and #3 in 2020.

Global Innovation Index 2019 & 2020 - Singapore ranked #8.

KPMG Change Readiness Index 2019 & 2020 - Singapore ranked #2.

Next, I looked at the ease of doing business. The World Bank runs an annual study where different countries are compared on criteria like starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading across borders, enforcing contracts, and resolving insolvency.

As the graph below illustrates, you can see how Singapore compares to other countries nearby. As a result, that creates a pull effect, attracting great talent from each nearby market.

Digital economy

If you visit Singapore’s government agency IMDA’s website, you will find the following words:

“Our goal as a nation is to be the leading digital economy.”

IMDA’s framework to get there consists of four enablers:

1. Manpower Development: Continued upskilling and reskilling to train and groom ICM professionals as well as raise the digital literacy of the workforce to take on the challenges of the digital economy.

2. Research & Innovation: Giving companies the competitive edge to keep abreast of the latest trends in technology through roadmaps which aim to inform and anticipate new developments.

3. Physical & Digital Infrastructure: Continued investment to boost Singapore’s infrastructure and enhance digital connectivity as technology evolves.

4. Governance, Policies, and Standards: Robust data privacy laws, cybersecurity and data protection, as well as continued efforts to calibrate governance of data policy and related activities like AI.

As a result, the country has accelerated its startup ecosystem, giving birth to unicorns like Grab, SEA Group, Carousell, One Championship, PropertyGuru, ShopBack, and Zilingo.

The investment landscape is developing, too; since 2016, tech startups in Singapore have raised more than US$27B.

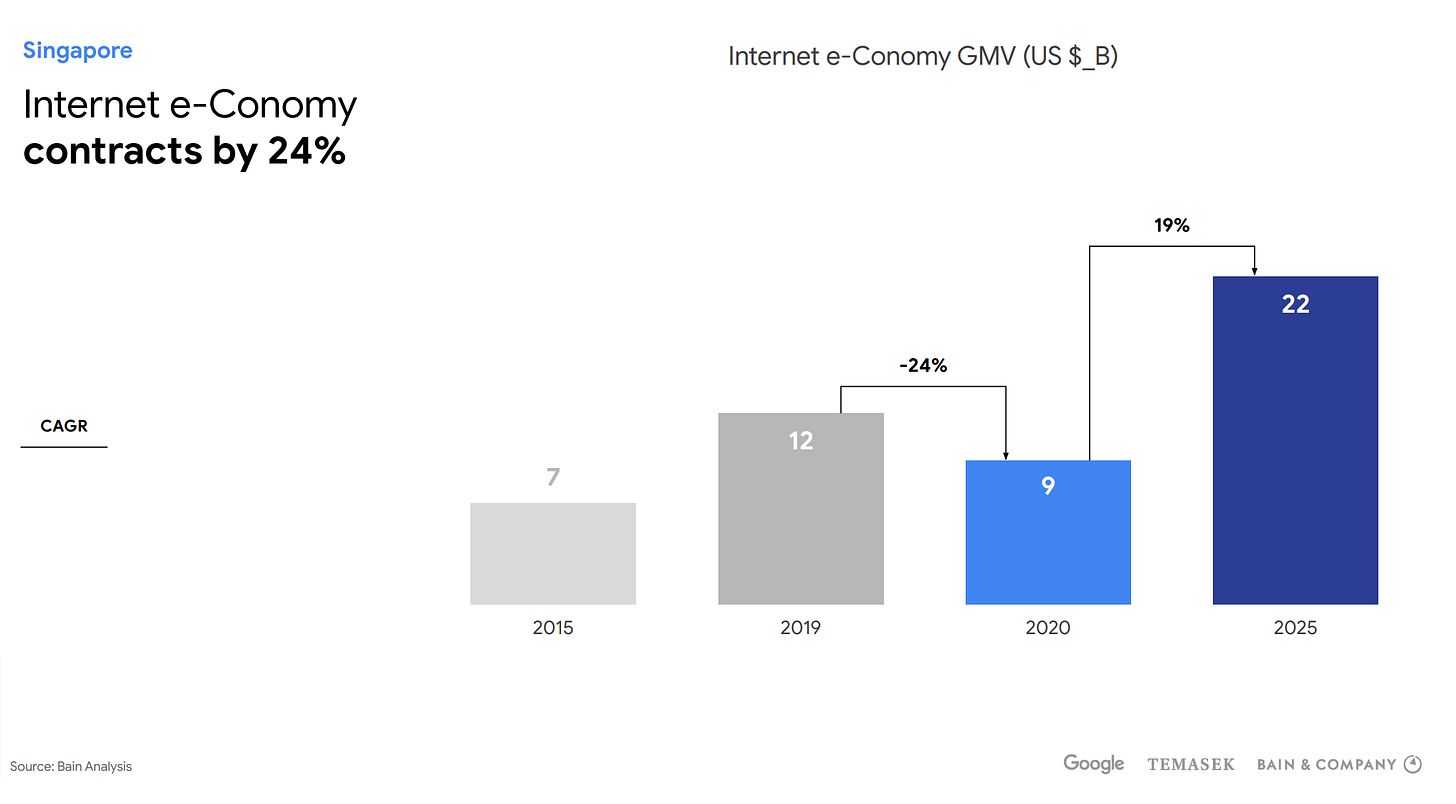

Because of the high income per capita, Singapore is often ahead on most metrics compared to other SEA markets. For example, average order values in Singapore's e-Commerce sector are three to four times higher than those in the rest of the region. Although the population of Singapore is much lower than that of most countries in Southeast Asia, the internet economy was worth US$12B in 2019, which is comparable to many much larger neighboring markets and is expected to reach $22B by 2025.

Government support for startups

Once Covid took place, the most vulnerable companies were startups and SMEs. Overnight it got much harder to raise capital even if your business was somehow coping with the crisis. In turn, the Singaporean government took a very proactive approach. It launched many grants to support SMEs and startups with all kinds of support ranging from financial, HR, digitalization, education all the way to financial incentives for companies planning to expand.

We at Greenhouse mapped 31 grants that are available in a post-covid world, just reach out to me and I will be happy to share the database.

Startup visa

“The Economic Development Board (EDB) today announced plans to launch Tech.Pass, a targeted programme to attract founders, leaders and technical experts with experience in established or fast-growing tech companies, so as to contribute to the development of Singapore’s tech ecosystem.”

Tech.Pass allows seasoned tech entrepreneurs, leaders, or technical experts worldwide to move to Singapore and focus on disruptive innovations.

The program is targeted at people who have a proven track record of at least five cumulative years of experience in a leading role in a tech company with considerable valuation ($500M) or at least $30M in funding.

Closing thoughts

All data points out that Singapore has positioned itself as one of the top hubs for doing business worldwide, despite its small size.

While proximity to promising growth markets does play a role in Singapore’s growth, it seems like the government’s proactive approach to research and innovation, workforce development, physical and digital infrastructure, as well as governance and policies is equally important.

In a post-pandemic world where governments consistently disappoint their citizens, Singapore seems to be coping fairly well.

“Over the course of 2020, public health failed, public schools failed, fire departments failed, and police departments failed. National, state, and local governments failed. Media corporations failed and even the US military failed.”

Founding vs Inheriting

In light of all those examples, Singapore’s approach to building a “startup city” is a rather fresh breeze. After all, a lot of what makes the Lion City attractive as a tech ecosystem could be credited to a consistent track record of great government initiatives throughout the past few decades.

“Singapore and Silicon Valley share a unique quality, they are magnets for talent across the globe. Magic is sparked when people from different backgrounds come together to solve a problem.”

Vinnie Lauria - Managing Partner at Golden Gate Ventures