Welcome to another edition of the Struggle.

The Struggle is a bi-weekly newsletter where I share my thoughts and learnings from running a startup in Southeast Asia.

In continuation of the last article, I am writing a series of essays to describe what steps I would take to build a startup in 2021. The series is designed to help a few friends who are currently starting new businesses and want to leverage technology to build scalable solutions.

A few weeks back, I teamed up with the Managing Partner of Indogen Capital Chandra Firmanto and the Founder of Ensydr Sam Kamani to run a Clubhouse room on “Fundraising secrets 🤫 . “ We ended up engaging about 80 people and had a lot of great discussions around fundraising and the startup ecosystem of Southeast Asia.

One of the most discussed topics ended up being the importance of large TAMs (total addressable markets) when starting an internet business and fundraising from VCs.

It turns out, it’s common for VCs to pass on investments simply because the market does not seem to be big enough. After all, for a VC to generate a great return for their limited partners (LPs), the startup must have at least a billion dollars of enterprise value.

Meaning, the startup must have the potential to exit at or above $1B.

That’s because many of the investments VCs make, are risky and may not work out.

The nature of VC investments is asymmetric. Hence why VCs consider how big the outcome can be if a startup succeeds rather than all the ways it can fail.

Check this out, 6% of deals produce 60% of returns, and half lose money.

In turn, VCs are looking for opportunities that can be so big that even if most of their portfolio fails, they would still get sufficient returns that will compensate for all the losses.

Check out this example of a $100M fund, and 10 companies invested at $10M for 20% ownership:

If we break down the distribution from above and apply it to our companies, we can expect these exits.

5 companies exit at 0x

2 companies exit 2x

1 company exits at 3x

1 company exits at 7x

1 company exits at 10x

Here is how much they will worth at those exit metrics

5 companies are worth $0

2 companies are worth $20M each

1 company is worth $30M

1 company is worth $70M

1 company is worth $100M

If you combine those figures, our original investment of $100M is now worth $240M gives this fund a 2.4x return. Not too shabby. Ideally, you would want to diversify broadly with hopes of getting a few more 10x investments.

The Math behind Venture Capital by Bryan Sanders

It’s clear that large markets are the only way to make the math work, as the startup needs to have the ability to grow considerably.

But then, how do you determine the size of your market?

Reinventing VS Creating new markets

There are two schools of thought concerning market sizing. Some founders work hard towards capturing market share by reinventing existing markets.

Others come up with novel solutions that create entirely new markets.

It’s not always clear which category fits your business as some companies start with reinventing but later end up creating an entirely new market, i.e. Tesla.

It usually takes time to see how things will shape up truly. Some entrepreneurs have deep domain experience and know exactly how to articulate the opportunity they are going after. But in other cases, the founders are encountering unique opportunities serendipitously and adapt their vision accordingly.

And there are those cases where the founder starts by reinventing a market and later on creates an entirely new one.

Let’s take a few examples from Uber and Amazon to demonstrate how the two concepts can overlap:

“Amazon began by reinventing the bookstore online. Using that as a beachhead, they have now created whole new market categories from e-readers (Kindle) to smart speakers (Alexa), while simultaneously reinventing cloud services (AWS) as well as shipping and logistics.”

Take Uber. Which category does it fit into? The answer is not as simple as it may first appear. In the short term, they’ve reinvented an existing market (taxi-hailing). But their bigger vision in the long term is creating an alternative to car ownership.”

Pete Flint, General Partner at NFX

Reinventing existing markets

COVID19 demonstrated what’s truly possible for reinventing existing markets. Many industries were forced to digitize, while others accelerated their digital transformation considerably, i.e., e-commerce, food deliveries, telemedicine, etc.

Basically, reinventing markets is all about digitalization and moving offline behavior to online. In turn, the most obvious opportunities lie here. Whenever you look at a traditional industry that does not leverage technology and automation, there will probably be many opportunities to capture existing market share.

Challenges

Timing - how do you know that the industry will embrace the new tech right now? Most probably, you are not the first one attempting to reinvent it? Why has no one else succeeded?

“What’s important isn’t whether you’re earlier or later than your competitors on an absolute basis – rather, it’s all about who enters the market closest to the critical mass point. It’s at this point when technology, economic and cultural forces can combine to enable explosive growth for founders.”

Pete Flint, General Partner at NFX

Deep understanding of the industry - you must have a great understanding of the industry, it may sound obvious, but it’s tough to reinvent an industry you do not know inside out.

Team - are you able to recruit world-class people to help you execute your vision?

Opportunities:

Advertisement

“If you see a lot of advertising in a market category, that’s a good signpost that there’s significant product atrophy. Usually, advertising signals that existing players are competing for significant revenue, but they can’t rely on product differentiation and therefore they compete on ad spend.”

Pete Flint, General Partner at NFX

Funding activity

Once you notice multiple startups receiving funding in a given industry, most probably the right timing seems to have arrived. A word of caution though, by the time you see all the activity, you might be late to the party.

Creating new markets

Creating a new market is hard. A few founders can envision how one day their companies would be able to create new markets. Having said that, there are ways to spot such opportunities; think of the following:

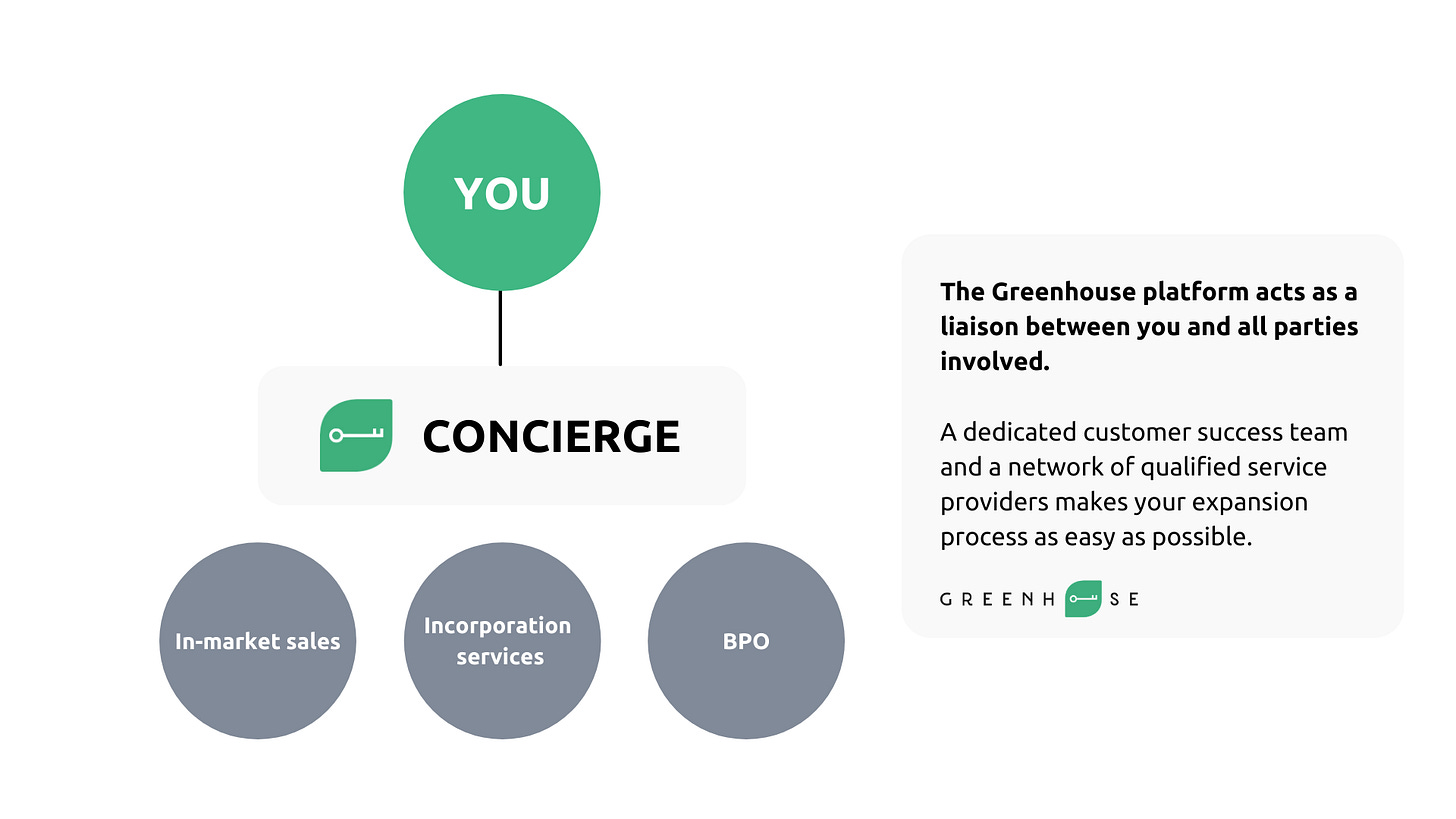

Fragmented industries - here, I can give an example from Greenhouse. If you are not familiar with our model, we help foreign companies to expand to fast-growth markets in Asia. We do that by connecting those companies with qualified service providers across 16 markets in APAC. Our model is a B2B marketplace for professional services.

Initially, we took on reinventing an existing market by onboarding service providers offering corporate services such as company formation, accounting, and tax. The corporate service industry demonstrates all signs of offline behavior and product atrophy I mentioned earlier. With a few notable exceptions, the industry is not terribly digitalized, hence why a digital solution like Greenhouse was helping reinvent the market-entry sector and thus captured value from an existing market. Over time, we discovered other verticals that are more fragmented, less known, yet still related to the market expansion process. Think of business development services designed to help foreign companies get quick traction in new markets or business process outsourcing services designed to outsource services that are not crucial to your core business, e.g., customer service, link building, software development, etc.Today, our solution combines all three approaches, reinventing an existing market (corporate services) and consolidating fragmented verticals that are harder to find but provide alternative ways to expand to new markets. The combination of the three approaches expands the size of the market considerably, resulting in market creation.

Early adopters - As Pete Flint argues in his essay on the topic, identifying early adopters' behavior and paying attention to interesting solutions like Clubhouse and Snapchat could point out at new markets.

Think of Clubhouse; now that the platform got very popular and reached critical mass, I expect to see many more solutions designed to create value in audio format, e.g., Twitter Spaces.

Challenges:

Legal risk - think of Uber and Airbnb; both created entirely new markets but faced fierce regulatory battles worldwide.

Timing - similar to my previous point on the topic, how do you know that right now, tech, economic and cultural forces can combine to enable your solution?

Scale risk - when you are working on something novel, it’s hard to predict how large the market size can actually be.

Product - since you are working on something novel, there is no way to know if people will actually want it. Reaching product-market fit can be incredibly difficult.

“The longer it takes you to get to product-market fit, the harder everything else with your startup will become.”

Pete Flint, General Partner at NFX

Why it’s good to know where you are on this spectrum?

Clarity - understanding your market size helps you articulate a compelling vision about where the business is heading. In the process, it helps you attract the right investors and employees.

It gives you a sense of how big the opportunity is - creating new markets often results in huge opportunities. Still, you face a lot of uncertainty, whereas reinventing markets is all about speed of quality execution.

It helps you understand who your competitors are early on.

Creating new markets can produce much higher returns as you face less competition. That’s because concepts that create new markets tend to be contrarian and less obvious than reinventing existing markets.

At the same time, it’s riskier because it’s hard to predict if you will get the timing right, reach product-market fit, navigate legal regulations, and figure out the size of the market, aka can you really scale?

On the other hand, if you are reinventing an existing market, the risk boils down to execution. Most founders taking on such challenges must understand the space well, but their ability to attract top talent, fundraise and build a great product is what can break the business.

Communicating your market size

Having an understanding of whether you are reinventing or creating a new market is important. Yet, if you cannot clearly pitch the opportunity, you will have a hard time attracting investors to your project.

Perhaps the most popular framework to communicate the size of your market is by breaking it down into three categories:

Total Addressable Market (TAM)

Serviceable Addressable Market (SAM)

Serviceable Obtainable Market (SOM)

While TAM shows how big the market is, it’s nearly impossible to capture the entire market. Hence why you need to estimate your SAM and SOM. In my experience, most entrepreneurs break down the market size in:

TAM - the entire world’s market related to your product/service.

SAM - the region within reach where you would expand first (if you are operating in Singapore, that would be Southeast Asia or a few relevant markets in the region).

SOM - the country/city where you start in the very beginning.

How do you estimate the size of your market?

Rely on secondary/third-party research

That’s the easiest way to discover what’s the size of your market. You can google industry+market size. If you are reinventing an existing market, you will probably discover platforms like Gartner and IDC that consolidate studies that approximate the size of popular industries.

Top-down approach

In this case, you start with the population and try to apply logic and some third-party studies to derive the market's size.

When I speak of third-party studies here, I refer to statistics from sources like the World Bank, OECD, and UN.

Here you go an example by Alex Graham from an article he wrote on Toptal’s blog:

“For example, if the recommended intake of water is 1.9 liters per day and there are 7.5 billion people in the world. Using an average cost of $1.22 per gallon ($0.32 per liter) and a desired margin of 20%, the TAM for bottled water could theoretically be:

7.5 billion people * 1.9 liters * $0.32 price per liter * 120% margin * 365 days = $2.01 trillion TAM”

Bottom-up approach

As the name suggests, here, you will need to start from the bottom, pick a specific case and extrapolate up to the wider population.

You can run a survey or find third-party research investigating a particular business or customer behavior in a small area. That will give you a sense of how big the opportunity is in your immediate environment, and from there, you can extrapolate it nation-wide and globally.

Value theory approach

Value theory is most relevant when you are creating a new market. For example, if you start building flying cars, you would not know the market size. Naturally, you may study the current transportation industry and focus on the airline and automotive sectors. That will give you a sense of how big the opportunity is, but most probably, flying cars will expand the market further as people will be willing to pay more for faster transportation and convenience. Therefore, when you are using value theory, you must identify how much a customer would be willing to pay for the improvement you are creating.

What approach works best for your case?

Typically, I would use a mix of approaches to ensure third-party data and my math are more or less similar. If you are independently arriving on a similar TAM through:

bottom-up

top-down

third-party studies

Most probably, you are as close as possible to the objective reality.

Examples of market size slides

As you can see, some startups emphasize the size of the market and focus on the TAM. Others break down the math to show the investors their thought process and why the market size excites them.

I personally prefer to break down our market size into TAM, SAM, and SOM, as it illustrates a good understanding of how we will approach our growth, what we are targeting now, and what we will be targeting in five years.

Having said that, it all boils down to your storytelling. If your TAM must be emphasized to deliver an impactful pitch, then add a breakdown of TAM, SAM, SOM in the appendix. In that way, you can be prepared for questions on the topic without altering your storytelling.

The market size is often miscalculated; many founders exaggerate, while others are too conservative. Yet, working through your TAM, SAM and SOM will allow you to see more objectively what the business is trying to do, articulate its vision, and better understand who you are competing with.

Key takeaways

Walking away, I hope you remember to:

Your startup must have the potential to exit at or above $1B to attract venture capital.

Consider if you are creating new or reinventing an existing market.

Estimate what is your TAM, SAM, and SOM using one of the following approaches:

Rely on third-party data

Bottom-up

Top-down

Value-based

Verify the size of the market by using a combination of the above-mentioned approaches.

Ensure the size of the market is illustrated through a simple yet informative slide in your fundraising deck.