Newsletter #45: SEA Internet Economy 2020

8 minutes reading time. Thoughts on startups, growth, and technology 🚀

Welcome to another edition of the Struggle.

The Struggle is a weekly newsletter where I share my thoughts and learnings from running a fast-growing startup in Southeast Asia.

Recently, Google, Temasek, and Bain released the 5th edition of e-Conomy Southeast Asia (SEA), a regional effort to map Southeast Asia's digital eco-system. The report is exhaustive, covering 128 pages of topics like the flight to digital, tech's role in a post-COVID19 world, the growth of SEA, new frontline verticals, investment landscape, and what’s ahead.

I like this report quite a bit because it’s regional, industry agnostic, credible, and covers the startup ecosystem's growth in some of the most exciting markets around the world. Hence, I wanted to take a moment and share my notes from “e-Conomy SEA 2020” in an attempt to provide you with a concise summary.

Quick adoption, lasting growth

It seems like the COVID pandemic has brought a massive digital adoption, with more than 1 in 3 digital services consumers being new to the service.

According to the report, digital acceleration is here to stay as 94% of new digital service consumers plan to continue with the service in a post-pandemic world.

The helpful role of technology

In times of a crisis, the internet provided access to essential goods, healthcare, education, entertainment, supporting not only consumers but also many businesses. The overall view of Southeast Asians is that technology is a force of good.

Essential goods - even during lockdowns, e-Commerce remained uninterrupted, giving access to necessities. Digital infrastructure around food deliveries (e.g., GoFood, GrabFoot), cashless solutions (e-wallets, e.g., GoPay, OVO), and grocery deliveries (e.g., GrabMart) helped consumers to get access to pretty much everything they need.

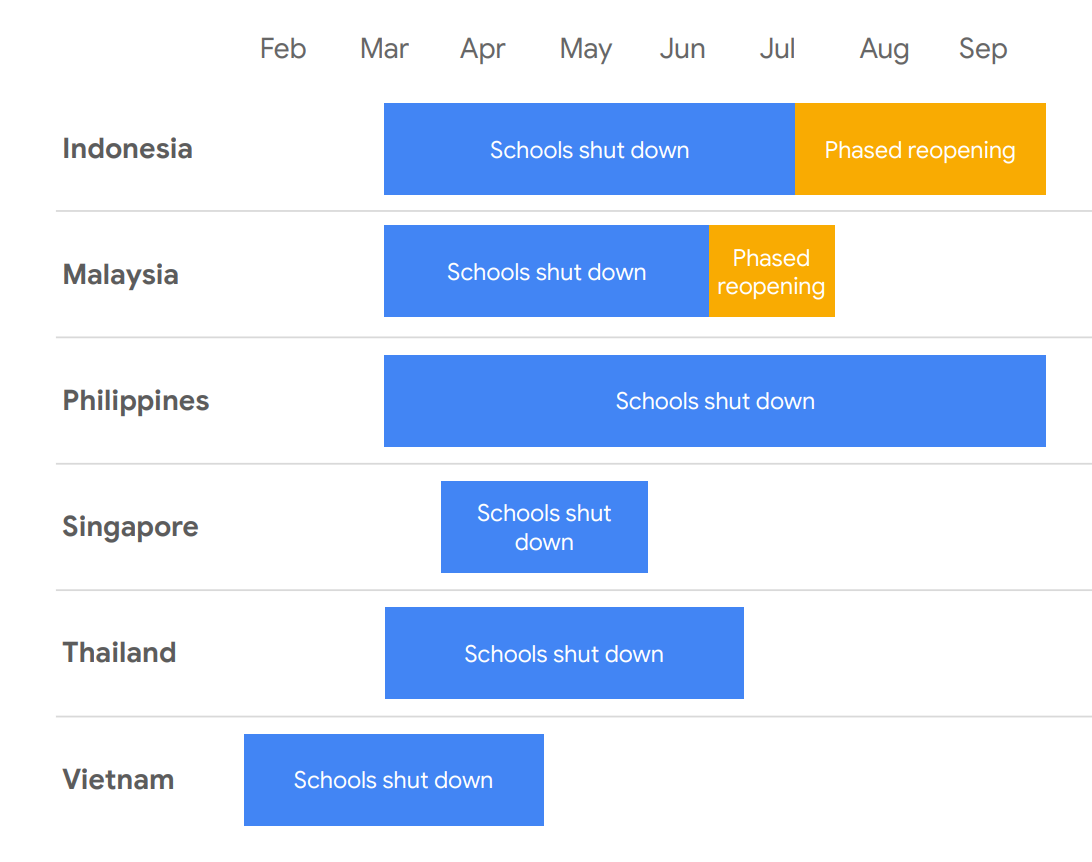

Education - thanks to e-learning platforms, roughly 135M school children had access to education. Moreover, many adults took the opportunity to upskill via online courses as well. Telecoms provided complementarity data, and companies like Ruangguru and Zenius Education thrived in this environment.

Entertainment - music, video streaming platforms, and general communication platforms were instrumental in staying in touch with friends and helping people ease the monotony of lockdowns. Notable examples include streaming platforms Astro, Singtel, iFlix, and even DisneyPlus as they used to opportunity to expand to SEA.

Healthcare - companies like MyDoc and Halodoc, were instrumental in providing information and access to physicians, reducing the healthcare system's pressure.

Work-from-home - tools like Zoom, Google Meet, and Hadirr enabled many people to work from home without investing a lot in digital infrastructure.

Resilience in times of crisis

Although many countries in the region will take a major hit economically due to the pandemic, some, like Vietnam, is expected to finish off 2020 with positive GDP growth.

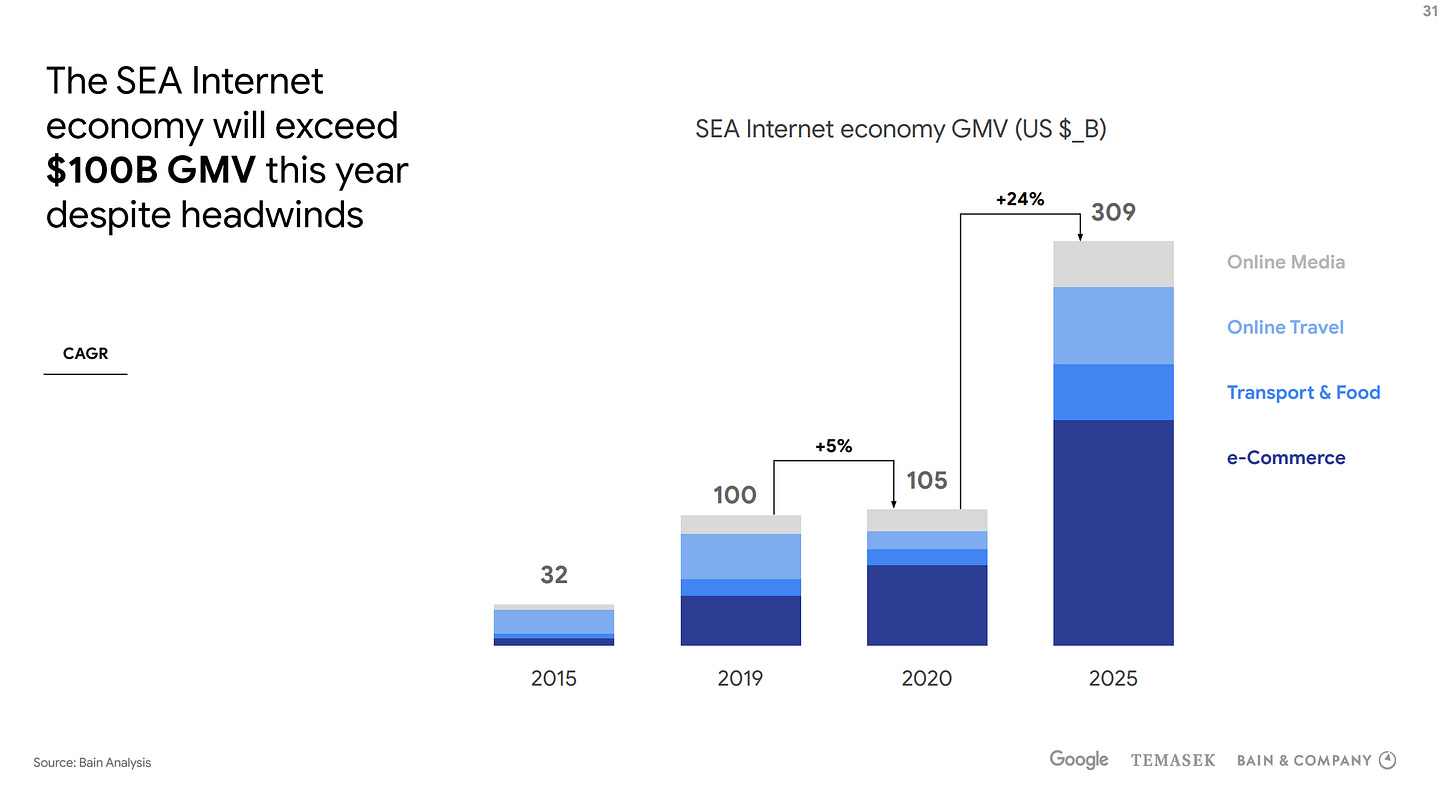

The internet sector remains resilient at US $100B GMV by year-end 2020 and is expected to grow to over US $300B GMV by 2025.

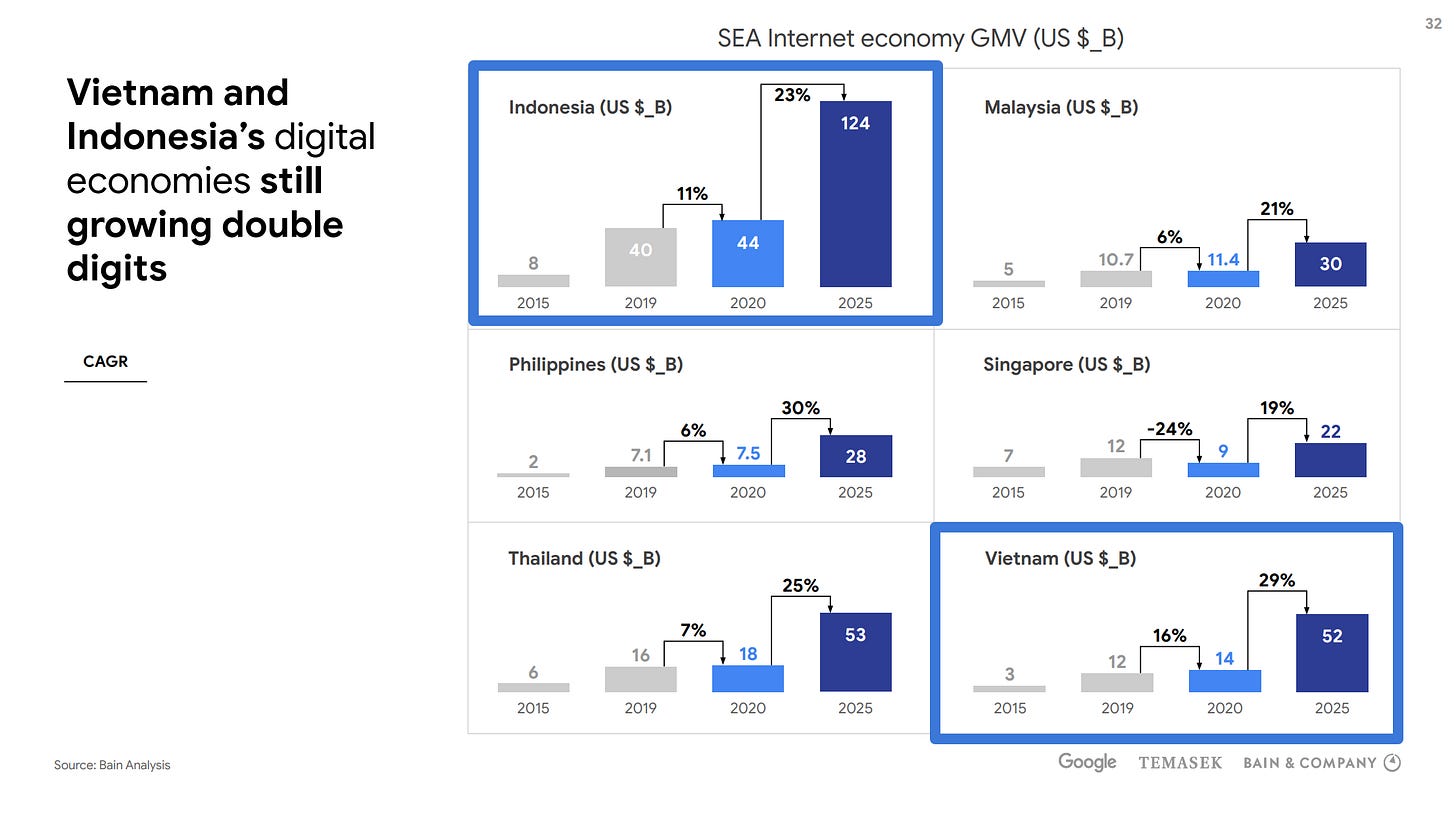

Indonesia and Vietnam are experiencing the highest growth of their Internet economy GMVs. When it comes to verticals, e-Commerce and Online media are experiencing the highest growth with 63% and 22%, respectively.

Pivoting to sustainable growth

Naturally, funding in tech startups has slowed during the pandemic period. Most companies are focusing on their core business and improving unit economics to reach profitability.

Southeast Asia is home to 12 unicorns (companies with valuation over US $1B): Bigo, Bukalapak, Gojek, Grab, Lazada, Razer, OVO, SEA Group, Traveloka, Tokopedia and VNG, and VNPay.

The ecosystem remains vibrant with a lot of success cases but not that many exits.

New frontier verticals

HealthTech and EdTech are some of the most important verticals coming out of the pandemic as winners since they demonstrated impressive adoption rates.

HealthTech

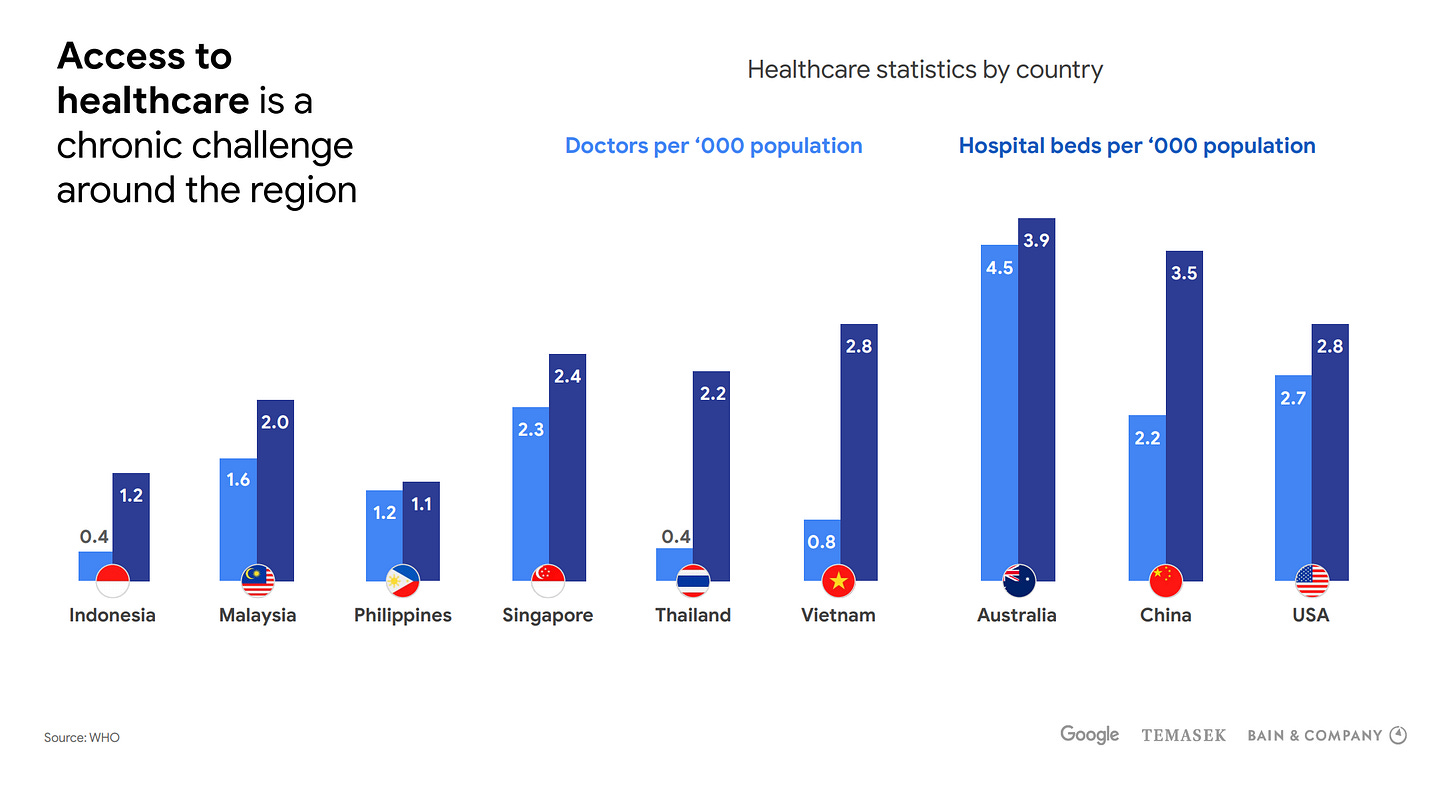

COVID19 emphasized a lot of problems and a path to addressing those opportunities through telemedicine platforms.

A few examples of opportunities coming out of the crisis are:

Aggregation of smaller hospital/clinics

Partnerships between telemedicine startups and ride-hailing platforms to support COVID19 testing and screening

Partnerships with insurance companies to increase healthcare access and coverage

Partnerships with large hospital groups to provide healthcare access and advisory

EdTech

COVID19 created a lot of opportunities for online education platforms to step in and deliver value.

Which led to a spike in the funding of EdTech companies. A few notable examples include Indonesian startup, Ruangguru which raised US $150M in Dec 2019, and Emeritus raising US $40M in Jan 2019.

Cautiously optimistic

Despite everything going on, SEA remains strong, and investors are cautiously optimistic. The number of transactions grew by 7% between 2018 and 2019 and 17% year-over-year between H1 2019 and H1 2020.

Early-stage funding covering Seed, Series A, and B is pretty much more than 95% of all annual deals. The average deal size for early-stage funding continues to grow:

Between 2016 and 2020, Seed and Series A deal sizes nearly tripled

2016 - 2020 Series deal size B doubled

Later stage funding plateaued

There is plenty of capital to deploy, though. Dry powder reached record heights in 2019. Notable players include Sequoia Capital, and Wavemaker Partners announced the close of SEA funds.

What’s ahead

The good

Unprecedented move towards digital services

The Internet economy hits US $100 billion and is on track towards >US $300B in 2025

Investments in technology remain strong

Adoption, acceptance, and usage hyper-accelerated for both consumers and SMEs

Market competition remains healthy, with more opportunities in an open ecosystem

The bad

Internet access - there are 400M Internet users in SEA, of which 70% are online. 40M new users were added in 2020

Payments - cash as payment method fell from 48% of transactions to 37% in 2020. In comparison, e-wallets rose from 18% to 25%

Consumer trust - 1 in 3 of all digital services users were new due to COVID-19; 94% intend to stay. 80% of users also find tech helpful and indispensable

Funding - deal activity is growing, but the pace of activity has slowed. Ample dry powder still available for proven sustainable and profitable ventures

The ugly

Talent - shortage of workers with relevant skills remains a challenge

Logistics - while the growth of e-Commerce indicates better logistics, “Issues with delivery” remains the single biggest barrier to e-Commerce cited by consumers in 5 out of the 6 countries

You can find the complete report here.