Newsletter #43: Fundraising in Southeast Asia 🌏 💰

12 minutes reading time. Thoughts on startups, growth, and technology 🚀

Welcome to another edition of the Struggle.

The Struggle is a weekly newsletter where I share my thoughts and learnings from running a fast-growing startup in Southeast Asia.

This month I am helping 10 startups improve their pitch decks as they get ready to hit the fundraising roadshow. All companies have fundraised in the past a seed round in their home markets (Netherlands, Russia, and South Korea) and now want to get strategic investors in Southeast Asia, as the region is an important part of their growth strategy.

The reality is that nobody loves fundraising and most founders have plenty of priorities apart from their next raise. But for most startups, external investment is an important step in their journey as it takes a while to build a valuable product.

As with most things in life, you can study the process of fundraising as much as you want, but building fundraising decks and pitching investors are skills that people develop only by doing.

In my experience, first-time entrepreneurs face most challenges crafting an easy to understand deck and when attempting to tell a compelling story.

To be effective, the story must leave the investor with a sense of confidence. People must see you as an expert in your space, a storyteller who would not struggle to convince other investors, employees, partners, and customers to board the ship and give you their time and money.

This week, I decided to write a guide that summarizes my experience of crafting compelling decks, presentations that blend data, vision, velocity, and passion. It draws from six years of working in the tech sector, researching the topic, and helping several startups fundraise across the region.

Where to start?

Last week, I attended a webinar by 4th & King, a pitch deck agency that has helped startups raise $4.5B capital.

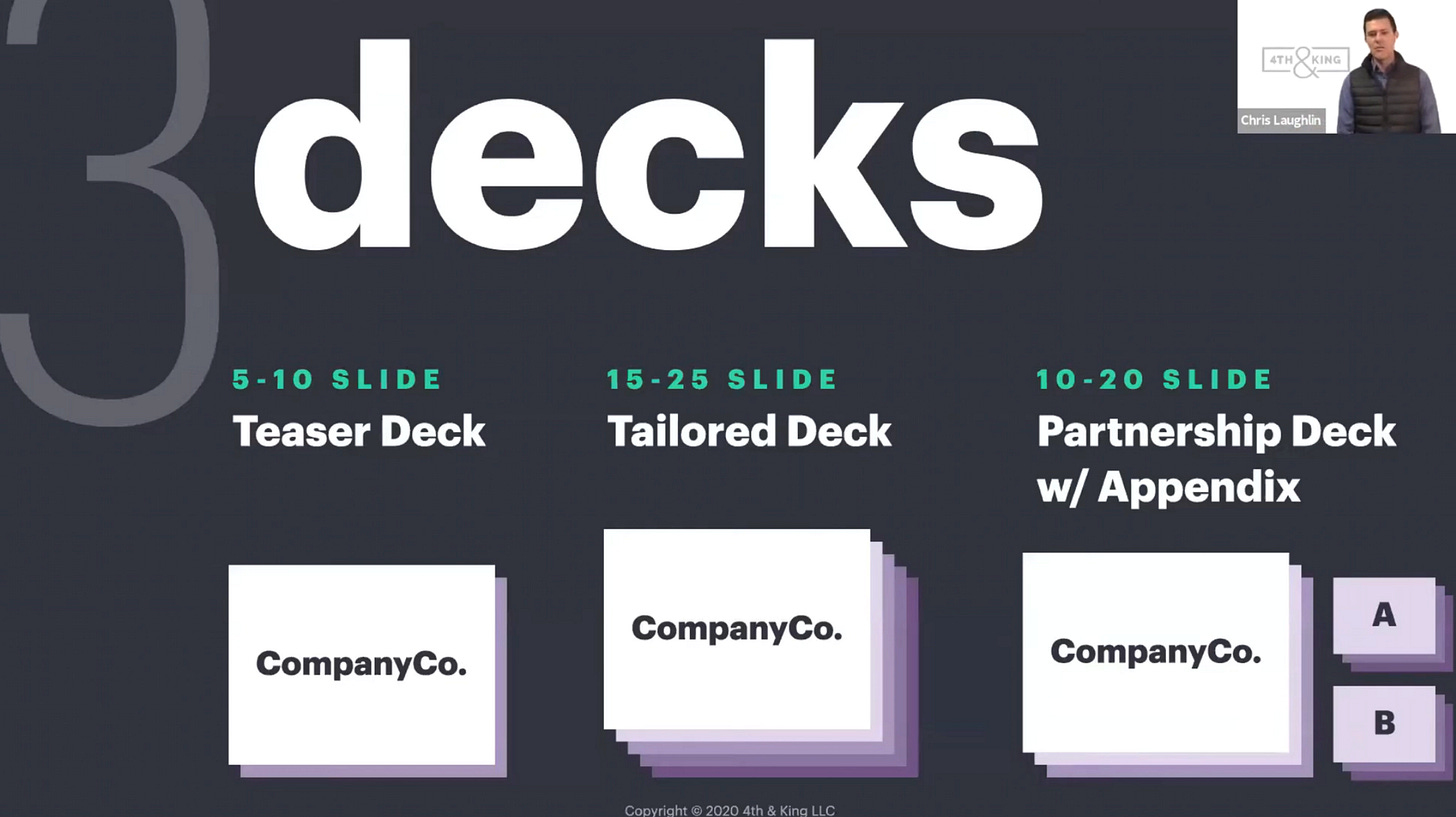

The first piece of advice 4th and King’s team shared was the importance of building three decks.

I would advise you to start with the “Tailored Deck,” which is essentially your pitch deck, and then use it as the base for your teaser and partnership decks.

This entire article will be about the tailored deck, so I won’t spend a too long time talking about it now. Instead, I will focus on the teaser and partnership decks.

Partnership deck - some people call it “sales deck,” which is the presentation that you are happy to attach to any email going out to clients, partners, or people who would like to learn more about what you do. While this deck is not designed strictly for fundraising purposes, it is important to develop it as you are getting ready to hit the roadshow. Assuming that you are successful in your fundraising efforts, most investors would be keen to support you through introductions. Investors are typically very well connected; thus, they will want to introduce potential clients, partners, and employees. For such purposes, you cannot use your “tailored deck” as a lot of the information there is too technical or confidential. Most VCs will ask for a partnership deck to spread around.

Check out this resource to find out how to structure a great partnership deck: Product Marketing for New Products

Teaser deck - is a presentation that’s supposed to be consumed by itself without a presenter. In most cases, the reader will spend just a couple of minutes on this deck, so your goal is to create enough interest in a follow-up. Here you go a few tips:

Make it short; 5 to 10 slides are sufficient.

Reduce the fat. Just look at your “Tailored Deck” and strip down as much as you can.

Send it to a few people in your network without presenting it to them and asking what they understood by reading it independently.

Consider what is your business’s biggest strength and emphasize it. If your team is kickass, make sure a team slide is included; if your traction is through the roof, include that; if your market is huge and relatively untapped, include that. You know your business best; make sure you include the most exciting aspects of your startup journey.

Take into account that each deck serves a different purpose. Creating a single deck for multiple use cases rarely works.

Seed VS Series A VS later rounds

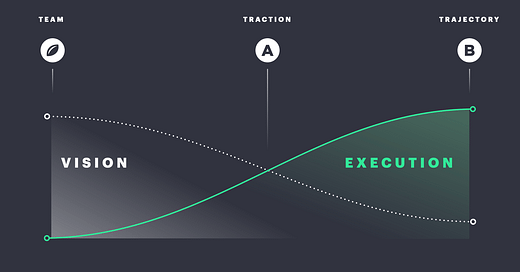

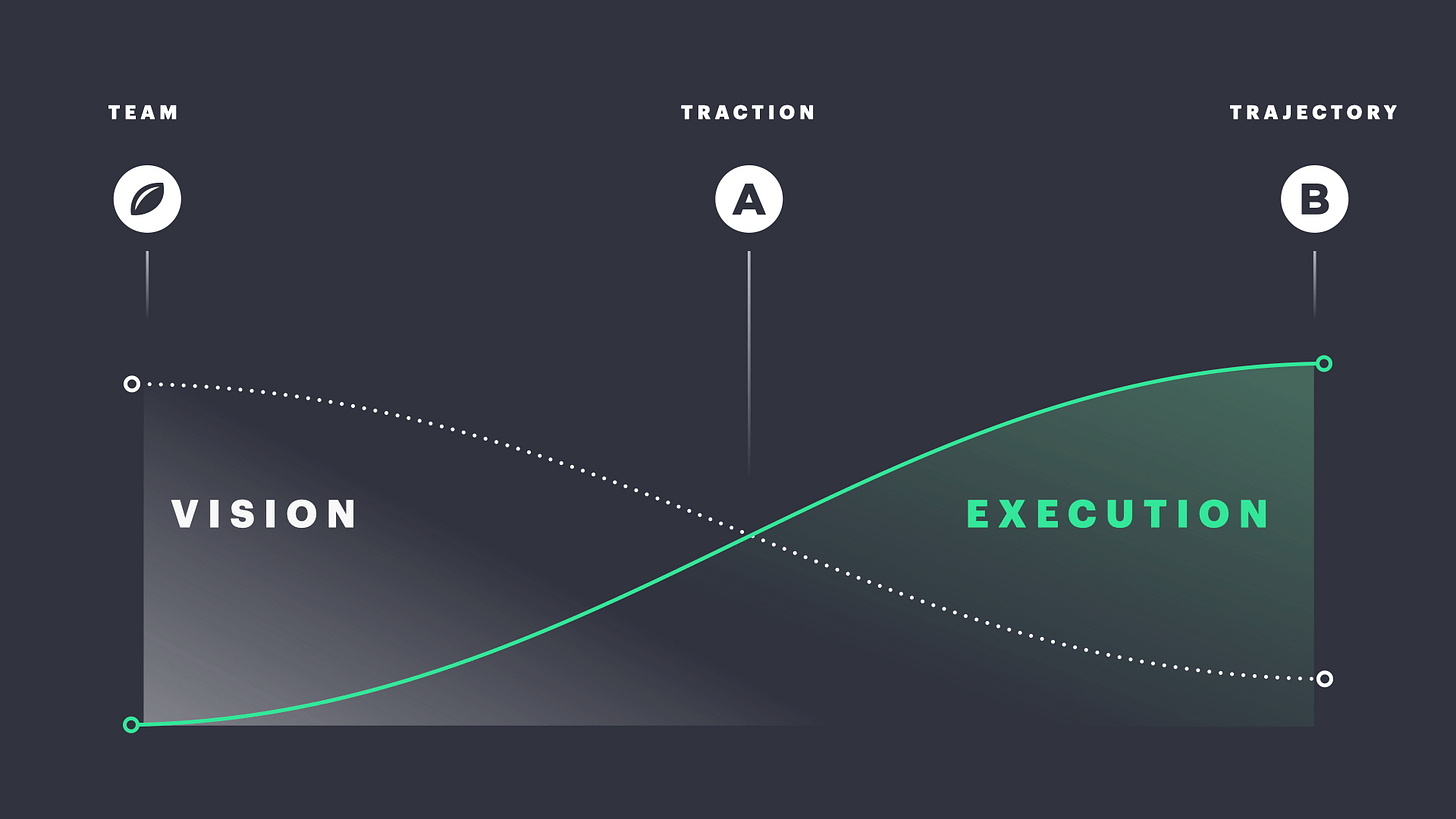

Source: Starting your fundraising pitch by Stripe and 4th & King

In the early days, the product is not great, the team is small, the business model is questionable, and there aren’t many customers. Hence, your ability to articulate the company’s vision is much more important than anything else.

As the company grows, the focus must gradually shift towards your ability to translate the vision into a reality. This is especially true in emerging markets where running a business is quite hard. Investors in Southeast Asia have a bias for traction and healthy unit economics, so the earlier you can demonstrate how your execution results in traction, the better.

You can break down your company’s history into three major acts that guide your flow and storytelling.

Act I: Make your case. What are you building? What can it become? Why now? Why you?

Act II: De-risk your approach. What have you done to increase your odds of success?

Act III: Broaden your case. What does success mean to you, your investors, and the world?

Source: Starting your fundraising pitch by Stripe and 4th & King

I typically work with startups going through “act 1,” and because of that, I won’t be sharing tips for late-stage startups.

When it comes to building decks, there are two schools of thought:

Follow a well-established template.

Arrange the flow to match your story, carefully crafting the first two-three slides so that you hook investors early on.

If you are fundraising for the first time, use the first approach. If you have fundraised before, you will know what would make the most sense to come first, second, and third.

If it’s your first time fundraising, check out the following templates I highly recommend:

For the rest of you, make sure you communicate clearly your unique understanding of the market, why now, strong indicators that the product is working, and your velocity (fast execution equals traction).

Deck structure

“Act 1” is perhaps the hardest one as you dont have much to show, yet you ask for support and capital. Therefore, you need to do your best in crafting the right framework and structure to guide your storytelling.

In a recent article, 4th & King outlined several frameworks that can help you tell your story. To keep this message short, I have chosen one of their frameworks it is often applied in emerging markets.

All the kids are doing it

This approach works best when your company is at the forefront of a new trend. Rocket Internet is really good at this one; they observe what’s happening worldwide and then act fast to bring that innovation to emerging markets.

Be mindful, though, that investors are looking for long-term trends. COVID-19 does not qualify as a long-term trend because, at some point, it will be over.

Here you go, a fictionary example following this framework.

⬆️ Here the founder starts with a large problem that is relatable while demonstrating unique insights.

⬆️ Next, the deck is showing how not only we have a large problem, but the consumers’ demands are changing to address that problem.

⬆️ The incumbents aren’t ready for all that. They either do not see it or cannot move fast enough to respond to it. The deck must showcase the clash between consumer expectations and what incumbents offer.

⬆️ Showcasing other well-funded startups can act in your favor because it shows validation. But you need to be able to explain how you are different.

⬆️ If you are entering a space where you will face well-funded startups and incumbents as competitors, it’s important to demonstrate your ability to execute.

⬆️ Leverage your personal story to demonstrate founder-market fit. Then provide evidence that your solution is getting early signs of traction and positive customer feedback.

“Give investors a sense that you’ve discovered the inevitable.”

Once you figure out what approach would work best for your case, focus on practicing and collecting feedback.

Ensure that investors understand what you do and why it’s an exciting opportunity. Your ability to verbally and visually communicate a compelling story must be your priority. Most companies I meet struggle to explain clearly what problem they are solving, why their product is the right solution, and why now.

If you enjoyed this post, you may also like:

First-Time Founder Guide to Fundraising Amid COVID by Lolita Taub

How to Read a Term Sheet by Hyde Park Angels

Startup Documents by Y Combinator

All the Public Startup Pitch Decks in One Place by Startup Grind

Startup Pitch Deck Templates by Nextview VC

VC Cold Email Template by High Output

Model Legal Documents by NVCA

Investor Update Template by High Output