Newsletter #35: VC landscape in SEA 🌏

11 minutes reading time. Thoughts on startups, growth, and technology 🚀

Welcome to another edition of the Struggle.

The Struggle is a weekly newsletter where I share my thoughts and learnings from running a fast-growing startup in Southeast Asia.

In a continuation of my previous newsletter, this month I am speaking at several events where I will talk on the topic of what it takes to be successful in fast-growth markets across Southeast Asia. Hence why, my essays are centered around that topic. As usual, any feedback is appreciated.

Invention and investment drive the digital economy of Southeast Asia (SEA). Judging by how that segment of the economy grew with 40% between 2018 and 2019, exceeding US$100B in gross merchandise value (GMV) in 2019, and how it seems that the total GMV will reach US$300B by 2025, I wanted to take a moment and assess the venture capital (VC) activity across the region.

In my opinion, such an exercise can come handy to startup founders eyeing the region as by understanding venture capital's development in Southeast Asia, foreign companies can mitigate risks while increasing potential rewards when expanding.

Source: economy SEA 2019: Swipe up and to the right: Southeast Asia's $100 billion internet economy

Taking into account all sectors, the GMV of SEA's internet economy amounts to about 3.7% of the region's gross domestic product (GDP) in 2019, up from 1.3% in 2015. If the growth continues at a similar rate, it is projected to exceed 8% by 2025, thus, decreasing the gap with developed markets.

Venture capital plays a vital role in the early period of a company's life when the entrepreneur begins to commercialize its innovation, thus becoming an engine for economic growth.

Startup funding in Southeast Asia

The connectivity of SEA allows VCs to invest in multiple markets no matter where their headquarters are based. Hence, it's common to see VC firms that invest across various countries, even though there are some focused entirely on the country where they operate.

Despite everything going on around the world, SEA remains a bright spot for funding. The main reasons being: a young population, growing internet connectivity, and rising income levels.

e-Commerce and Ride-Hailing - have dominated the funding scene in Southeast Asia, attracting two in every three dollars raised since 2016. The reasons being: both sectors are growing at a record pace as consumers embrace both types of services, marking a permanent shift in the way people view such conveniences.

Online Travel - in 2018 the sector attracted over US$600M, a big chunk of that was towards Indonesia's unicorn Traveloka.

Online Media - had a record high year in 2019, bringing in many new deals. Most of these deals are smaller in quantum, but the number of investments remains strong.

The pandemic's impact of funding in SEA

When it comes to funding in 2020, we need to consider the impact of COVID19. But that's hard to asseess because investments take time, meaning, deals executed in H1 2020 may well have been originated before COVID19 struck. Therefore, there is a chance that the real impact of the pandemic will be experienced only in Q3 and Q4, as the lockdowns took place in April, March, and May of 2020.

The outcome that we have seen so far is that the total number of deals decreased by about 15% compared to the same period in 2019 and the amount of capital invested fell by 13%. While not reaching new records, the deal flow is reasonably healthy.

Perhaps a better way to consider the impact of COVID is to benchmark how SEA performed in comparison to other regions around the world.

Source: Cento VC report "Southeast Asia Tech Investment - H1 2020."

We see less decline in the # of deals in Southeast Asia than in North America and Europe, which suggests a resilience of the startup eco-system in the region.

Investment in the region by deal size

A good indicator of investor confidence is the size of the early-stage deals, which has doubled over the last three years. In 2016, the average size was at about US$500,000, but this has increased to an average of US$800,000 in 2019. The same growth followed at the Series A stage, from US$2M in 2016 to US$4M in 2019.

In 2020, Series A rounds average US$5,4M, thus, continuing the trend of growing ticket sizes. Most probably, startups are fundraising larger rounds to ensure they have an additional cash buffer during uncertain times.

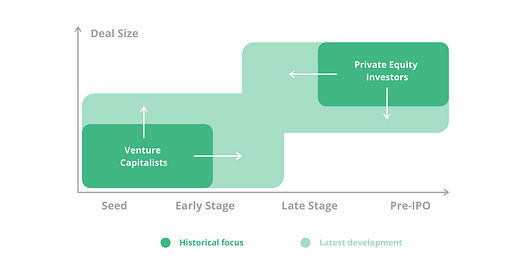

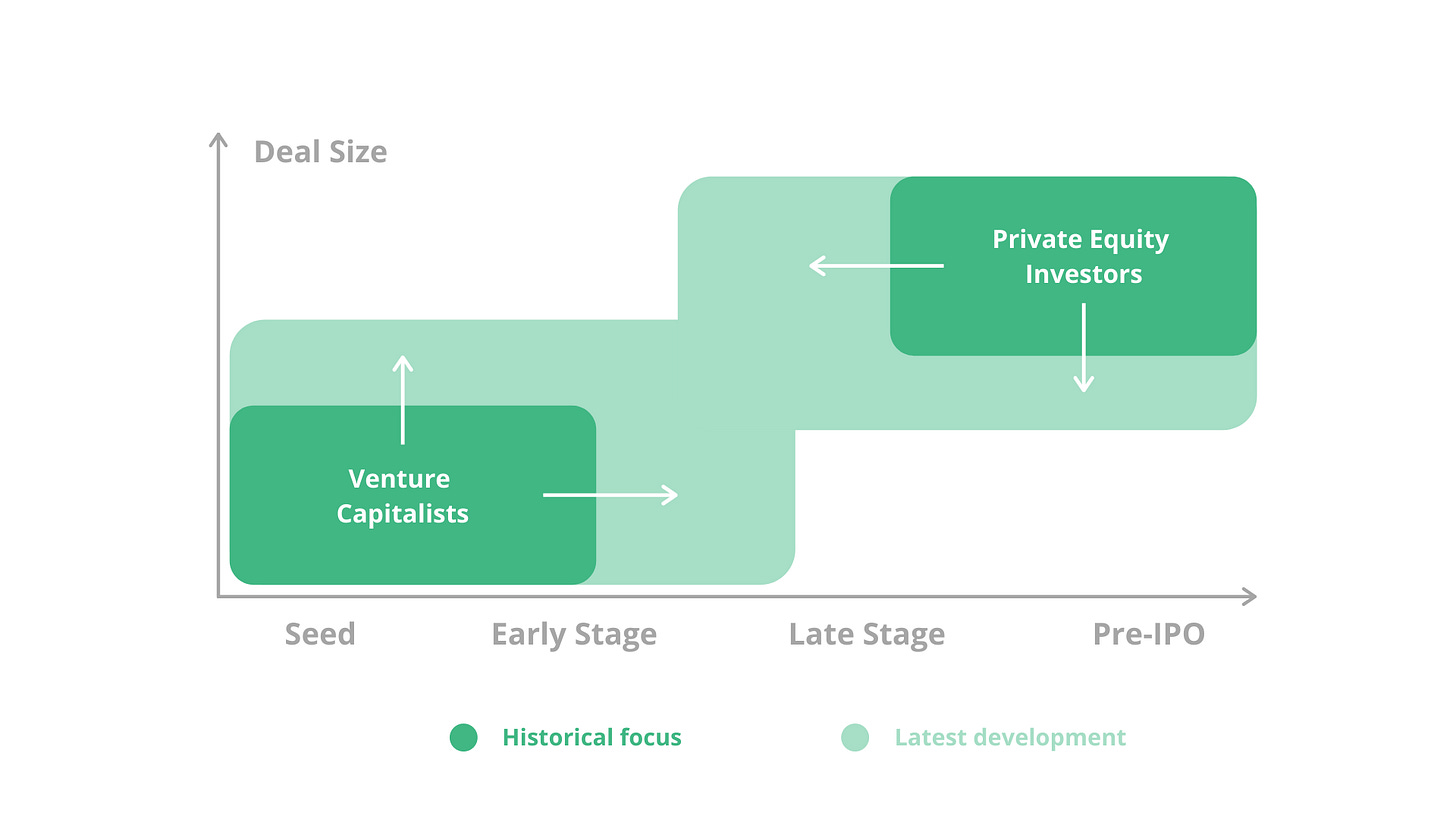

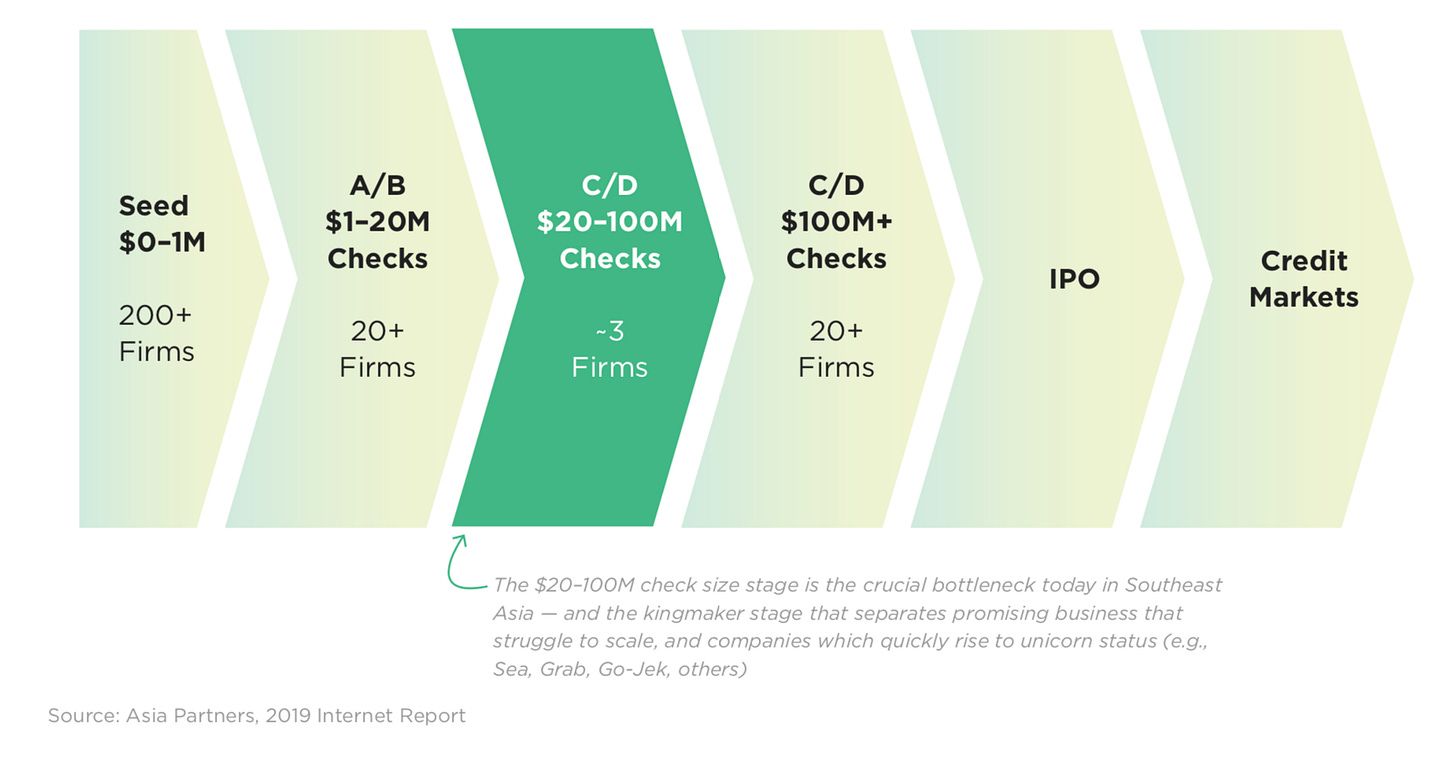

Additionally, more and more VCs are launching larger funds to keep up with the more massive investments and opportunities across the region; a few notable examples are EV Growth, Golden Gate Growth, Asia Partners, Vertex Growth as each firm has launched a "growth fund" with over $200 million in capital.

Source: economy SEA 2019: Swipe up and to the right: Southeast Asia's $100 billion internet economy

What verticals receive most capital?

Since the startup eco-system is still maturing, most VCs are industry agnostic, and it's common to see a lot of funding going towards "multi-vertical" sectors or also known as "super-app" companies.

In H1 of 2020, Payments and Logistics exceeded funding received in 2019 in similar verticals. Fintech startups, in general, are the talk of the region and generate a lot of interest. Other promising sectors include Real Estate, Advertising, and Business automation. At the same time, verticals like education, travel, and non-gaming entertaining have received less investment.

It is interesting to note that the healthcare sector has seen a lot of new investment in 2019, but less so in H1 2020.

Source: Cento VC report "Southeast Asia Tech Investment - H1 2020."

What markets receive the most capital?

Vietnam used to attract a lot of venture capital in 2019, but in H1 2020, VCs are back to the most typical markets, with 75% of the total money invested in Indonesian startups. Singapore and Indonesia together account for 67% of the total number of deals in 2020 so far.

We do need to consider that this year there have been some mega-rounds in Go-Jek, which may represent why so much capital is deployed in Indonesia. Another potential explanation is that limitations on traveling might have focused VCs on domestic deals as most VCs are based in Singapore and Indonesia.

Source: Cento VC report "Southeast Asia Tech Investment - H1 2020."

NB. the data here excludes companies with a truly regional presence like Grab, SEA Group, and Lazada as that would bias the data quite a bit due to their size.

Singapore has pretty diverse sector allocation across multiple verticals like Real estate and Infrastructure, Financial Services, Healthcare Retail, Business Automation, Payments, Advertising, and Marketing. In contrast, funding in Indonesia is predominantly focused on multi-vertical startups, aka super-apps (68% of all funding in 2020 has gone into such companies), followed by 13% in Payments.

Challenges

Although venture capital has grown dramatically over the past several years, it is still relatively new and constitutes only a tiny part of the SEA economy.

Lack of capital for late-stage startups, e.g., Series C and D - A key challenge in the region is "missing the middle" of money between early-stage capital and public markets.

Exit events are few - liquidity events remain more or less consistent with 2019, but the generated proceeds fell by nearly 50%.

Source: Cento VC report "Southeast Asia Tech Investment - H1 2020."

Once again, Indonesia and Singapore consistently account for >50% on liquidity proceeds and exit events. Whereas, if we consider top acquires' countries of origin by proceeds between 2013 and 2020, we can see that China ranks as number one, followed by 2) Singapore, 3) Australia, 4) Indonesia, 5) the USA, 6) Japan, 7) Malaysia, 8) Norway, 9) the UK and 10) the Philippines.

Conclusions

It is clear that the internet economy has reached the inflection point and surpassed earlier projections. That has attracted more investors, creating a steady flow of funding, which in turn attracts entrepreneurs. With the digital economy expected to reach US$300M by 2025, it is reasonable to expect even more VC activity across Southeast Asia.

The number of investments and capital allocated per deal is consistently growing, but the pandemic may pull the breaks on that growth.

It is too early to say how the region's startup ecosystem will be impacted as we may experience the impact of COVID19 only now, in Q3 and Q4 of 2020. Not to mention that Indonesia is going into another lockdown in September, and as a result, we may see other markets like Vietnam and Thailand experiencing an increase of deal flow as those markets have done a pretty good job in overcoming the pandemic. Or perhaps, the challenges Indonesia is facing will drive more creativity and innovation, propelling entrepreneurs to pivot existing businesses or come up with novel ways to address old problems in a pandemic-proof way.