I am writing this article as the stock market suffers its worst week in about two years. S&P 500 is off to its worst start since 2016! Tech stocks are hit hard. Bitcoin and Ethereum are not doing great, causing a ripple effect throughout the entire crypto space. All that happens as the central bank of the US pulls back its massive stimulus programs. Programs launched in the early days of the pandemic to address the massive uncertainty but resulted in a bull market.

Yet here I am, writing an essay on investing, but I could not help it. Writing down my reflections on wealth creation has been on my mind for a long time. But I took it a step forward and dug deeper. The end product covers why I started to invest so late, my investment strategy, portfolio, and tools.

While all markets are taking a beating, things will get better; they always do. Enjoy!

We all have regrets in life. One of my biggest ones is not investing earlier.

Coming from a humble, working-class Bulgarian family, wealth creation was not the kind of topic we talked about.

Wealth preservation, on the other hand, was a different story. In fact, we still talk about it. It has been 11 years since I left Bulgaria, yet, my mom does not miss an opportunity to ask if I am saving enough money. Not to mention how up until today, my grandma asks if I have enough money to buy food.

Naturally, I started reflecting on why that is? I looked back at my family’s life and figured the following. My grandparents’ generation was caught in a transition from a rural lifestyle to industrialism. Moving from the countryside to the capital must have been a stressful and uncertain experience. In turn, my grandparents barely participated in any formal education.

Employment must have had a higher priority than education. But, without education, it’s kind of tough to understand the complexities of creating wealth.

Sometime later, my mom and dad entered the labor market at a time when the best possible job was to work in a government-owned factory. Factory because it had low barriers to entry as it did not require an expensive education. Government-owned because that translated to great perks like holidays and pension. Back then, such perks were unseen in the private sector.

It goes without saying that my parents did exactly that and got a job at the largest gov. owned factory in the country. They felt so at home that both of them stayed with the organization until the company bankrupted many years later.

You can see how my family’s experiences shaped their reality. We did not have extra money to invest. Moreover, we did not have access to people or resources to guide us. So we did what we could to build the necessary habits to preserve wealth.

To be honest, I am grateful for those lessons. My parents taught me to work hard and live below my means, which has served me well so far. On the other hand, an unfortunate outcome of that upbringing was how we never talked about wealth creation. Topics like: “Why do people invest? Where can you learn the basics? What’s the best way to grow your wealth?” were never raised.

In a way, my family looked down on people who invest and have money. In their eyes, it was not fair how some folks made insane amounts of money while others did not. My parents took a lot of pride in our work ethic and integrity. But, on the other hand, rich people were seen as dishonest and ruthless.

Looking back, that was a silly generalization. A view of the world rooted in a series of bad experiences. A perspective caused by a lifetime of lost jobs, low salaries, and zero appreciation for the hard work my parents were doing. Having said that, that view of the world was by no means objective.

It took me many years to realize how I think like that too. Even today, I have a strong bias to judge the wealthy. Luckily, I have been fortunate enough to know wonderful people representing both spectrums of wealth—great people who taught me the importance of leaving prejudices behind.

But that was not always the case. Early on, I was judgmental, confused, and had no idea how to handle my financial situation. Luckily, when I turned 18, I realized how my current education was not good enough. That led to moving abroad for studies and changing my life a fair bit. Fast-forward several years, and I graduated with two degrees from Danish universities. Unfortunately, while the experience of studying abroad was invaluable, obtaining a few degrees did not help me understand wealth creation.

My studies taught me many new skills, but my net worth did not change much. Quite the opposite, I graduated having debt. Which led to the question, what am I missing?

Ethical wealth creation

Living as an ex-pat in Denmark offered a new perspective. Suddenly, my trips to Bulgaria resulted in new insights. For example, I figured that many young people in my home country optimize for status rather than wealth. Status in the form of fancy cars, being seen in expensive clubs, branded clothes, and overall having a higher place in the social hierarchy.

The more I noticed how people optimize for status, the more I realized how I did not want any of it. My thought process was material possessions should not determine one’s worth.

On the other hand, my life in Denmark offered a completely different lifestyle. The Danish culture is as flat as it gets. For example, consider the following. Irrespective of how much money someone makes, you will likely see them cycling to work. That’s especially impressive when you take into account the terrible weather conditions in Denmark (it’s often cold, windy, and rainy). Such a level of humility resonated with me. The Danish approach felt appropriate, especially after a lifetime of status flexing.

I started questioning whether making money was a worthy goal. Shall I focus on what I like doing and not worry about money? Is it possible to have ethical wealth creation? Or will earning more turn me into the status-driven persona I disliked so much? Even worse, would I become one of the ruthless rich folks my parents despised so much?

Why get rich?

When I turned 26, I moved to Asia. Living in Indonesia showed me an incredible contrast of what it means to have money. So naturally, I revisited the topic and seriously considered my relationship with money. After a lot of reading and carefully curating my content feed, I started realizing the importance of making money. So by the age of 29, I started investing. Better late than never.

My primary motivation to grow wealth was twofold:

Take care of family and friends

Earn the freedom to pursue my interests

The first one is pretty straightforward. But the second one requires some context.

Financial independence gives us the means to pursue interests. Pursuing interests, in turn, helps us to thrive without worrying about day-to-day challenges.

My career so far has taught me that working on big, significant problems truly makes me happy. In that line of thinking, mathematician Richard Hamming liked to ask:

“What’s the most important problem in your field? Why aren’t you working on it?”

Those questions resonate with me a fair bit. So I started reflecting on how having capital would allow me to channel my efforts into activities I consider worthy.

Luckily, a few years back, I discovered Naval’s podcast on how to get rich (without getting lucky), which was transformational for me.

Ever since I built the following framework as a way to grow my wealth:

Work hard, but be selective on what you are working on

Take accountability

Invest efforts in activities that compound, e.g., content creation, investing, relationships.

In today’s essay, I want to take a moment to talk about the third pillar - investing.

Compounding is such a powerful concept. Mainly because it does not apply only to investing. Relationships compound too. I think that’s one of the reasons why people are still getting married. If you are fortunate enough to meet the right person, the time spent together will improve the relationship as you accumulate knowledge and understanding about each other.

Anyway, back to the topic of investments. In the last couple of years, I have met so many people who had a similar, confusing relationship with money. As a result, they did not start investing early or had no clue where to start. That’s how I came up with the idea of writing this article—starting with my story, then diving into my learnings so far.

Investment strategy

My objective here is to be as transparent as possible. I hope that by sharing my thoughts, I will be helpful to others in their investing journey. Yet, please take into consideration how this is not investment advice.

When deciding where to invest, I loosely follow the seven powers framework by Hamilton Helmer:

Does the business demonstrate economies of scale? Companies where the unit cost declines as production volume increases. Think of Netflix.

What about network effects? A network effect occurs when a product or service becomes more valuable to its users as more people use it. Think of Uber and Airbnb.

Is there a counter positioning play? This occurs when a newcomer adopts a new, superior business model to what incumbents are offering. At the same time, the legacy company refuses to mimic the model due to anticipated damage to their existing business. Think of personal (Disruptor) VS mainframe computers (Disrupted).

Are there any switching costs? A dynamic where transitioning from one tool to another result in considerable costs for the user. So competitors will need to compensate consumers for the switching costs. Examples include SAP and Oracle.

How strong is the brand power? Apple is perhaps the most famous example here. Anything carrying the apple logo can be sold at a higher rate than alternatives.

Are there any cornered resources? Of course, the most common cornered resource is intellectual property like patents. But it could be extraordinary founders like Elon Musk and Steve Jobs. That’s why I am a believer in founder-led organizations.

What about process powers? The best example in this category is Toyota's production system. Their process required many years to be developed, and the company let competitors study it. Many books have been written on Toyota’s lean manufacturing process. Yet, the company remains the second most valuable car automaker globally (after Tesla).

Having one of the seven powers is sufficient. The more powers a business has, the higher the probability of consistent growth in the years to come. Therefore, the more powers a company can demonstrate, the higher my conviction to invest.

But above all that, I ask myself, am I using this product, and how does it make me feel?

If the answer is positive, I understand the value proposition and how the product works. That naturally results in an even higher conviction to invest. So you can argue that my philosophy boils down to investing in things you use and understand.

Investment portfolio

Today, my investment portfolio is diversified in the following way:

This year, I plan to add my first investments into startups and real estate.

Anyway, given how much I have to learn, I plan to take my time when writing big checks.

Stocks

I started with investments in individual stocks of companies I know, use, and understand. Then I drifted into taking small positions in companies I do not use but have read a lot about them. In such scenarios, I consider the seven power framework. Over time, and as I started managing some of my girlfriend's money, I have added ETFs to reduce the risk.

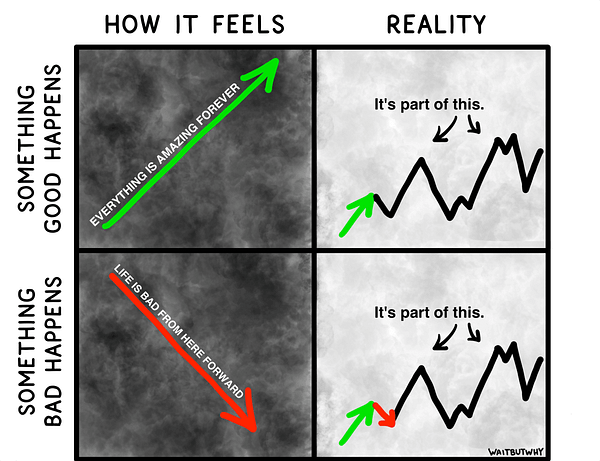

I have tried a lot of things and made a ton of mistakes. But, perhaps the most significant mistakes were: a) not having a clear reason why I am investing in a company, b) selling during the market crashes 🤦♂️, and c) using the wrong investment platform.

Thanks to those mistakes, I have learned to control myself better. As a result, while I expect more mistakes to follow, I feel more comfortable with my portfolio.

Crypto

Once I felt confident enough with my stock investments, I added crypto.

As you might have noticed, I have been spending a lot of time lately learning about and investing in crypto. That led to joining one of the world’s largest finance communities to support their crypto arm with resource curation. Moreover, recently I got invited to speak at Bulgaria's largest crypto show about my web3 2022 projections.

While that may sound great, it’s been a bumpy ride. Only now, I start feeling a little bit more confident with my crypto strategy.

BTC and ETH make up most of the global crypto market cap, representing 51% of my crypto portfolio.

Additionally, I am bullish on Solana, so 21% of my budget is in SOL. Next, I have invested in other layer-one blockchains like MATIC and AVAX. The remaining has been allocated to stablecoins (so that I can readily invest) and a few other experiments. Last but not least, I have started playing with NFTs too.

Overall, I stay away from meme coins that follow the sentiment on Twitter and Reddit (e.g., SHIBA and DOGE). My schedule does not leave me with any time to stay on top of such hype. I prefer to put money into projects with high utility.

Next, I plan to allocate a bit of money into more layer one blockchains. Think of the likes of Polkadot and Polygon, plus some DeFi protocols like AAVE, Chia, and a few others.

In general, I prefer to have fewer positions with more conviction than a messy portfolio.

Tools

When assessing what platform to use, I pay attention to two things 1) UI/UX and 2) fees. When I am new to a field, I prefer to have intuitive UI and UX over fees. In my mind, the high fees are an investment in education. A better UX/UI gives me the confidence to invest without being confused half the time…

That was precisely the case with crypto. First, I started with Coinbase because it was the easiest platform I tried out, despite its high fees. Then, as I got more confident, I started using Binance, Crypto.com, FTX, and a few others.

Next, as I started investing more and more, I started thinking of security. That led me to move my assets in what the industry calls hot wallet, aka software wallet. To begin with, I got Coinbase Wallet. Over time, I have added Metamask and Phantom (the latter precisely for SOL). The wallet acts as your “bank account” and identity on the blockchain where you can store your assets. In addition, it gives you self custody. But with great power comes great responsibility. Since no third party manages your wallet, you need to avoid losing your keys. Otherwise, your funds will be lost forever.

A few months ago, I started shifting my crypto investments to what is often referred to as cold storage, aka a hardware wallet. I use Ledger Nano X as it’s one of the most popular wallets out there (plus I received it as a birthday gift). In the same way, your hot wallet requires you to be very cautious with your keys; you need to be very careful with the cold storage.

For analytics purposes, I use Cointracker, the free version is not perfect, but it’s good enough. Under the paid version, the platform helps you estimate your crypto taxes, too (if any).

When it comes to stocks, I have tested several platforms and narrowed down my choices to:

To summarize, I hope this essay comes in handy when planning your investment strategy. As discussed above, I am new to wealth creation, and there is much to learn. However, writing all that down has helped me better understand my process and what I need to improve.

At the same time, if more people would share their investment journey transparently, that could be a fantastic educational asset.

Unfortunately, there is plenty of generic advice on the web that pisses me off. I prefer tactical over vague advice, but it’s hard to find credible, transparent, and well-intended content. Having said that, nothing beats having skin in the game, so the earlier one starts, the better. That’s why my brother’s gift for his graduation was me coaching him to invest while providing the necessary resources. That definitely taught him a few valuable lessons. Nowadays, he is texting me weekly to ask for guidance on how to invest, and he is only 23. I wish someone had helped me the same way when I was his age.

Lastly, I want to thank all the people who have been writing great content and guiding me over the last few years.

Disclaimer:

None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.

This article does not take into account your personal investment objectives, specific investment goals, specific needs or financial situation and makes no representation and assumes no liability to the accuracy or completeness of the information provided here.

The information and publications are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort offered or endorsed by the author.

The author also does not warrant that such information and publications are accurate, up to date or applicable to the circumstances of any particular case.

Any expression of opinion (which may be subject to change without notice) is personal to the author and the author makes no guarantee of any sort regarding accuracy or completeness of any information or analysis supplied.

The author is not responsible for any loss arising from any investment based on any perceived recommendation, forecast or any other information contained here. The contents of these publications should not be construed as an express or implied promise, guarantee or implication by the author that readers will profit or that losses in connection therewith can or will be limited, from reliance on any information set out here.